3 Questions: The Future of Nuclear Energy

Jacopo Buongiorno and John Parsons, co-directors of the MITEI LCEC for Advanced Nuclear Energy Systems, discuss how to overcome the challenges and realize the benefits of expanding nuclear power.

SEE FULL ARTICLE

Reforming Electricity Markets for the Transition: Emerging Lessons from the UK’s Bold Experiment

In 2013, the UK introduced radical market reform to meet the new challenges – a change which some critics denounced as a return to central planning, whilst others feared the costs. The results to date suggest that EMR is a step forwards, not backwards; but it is not the end of the story.

SEE FULL ARTICLE

3 Questions: Transforming our Electric Power System

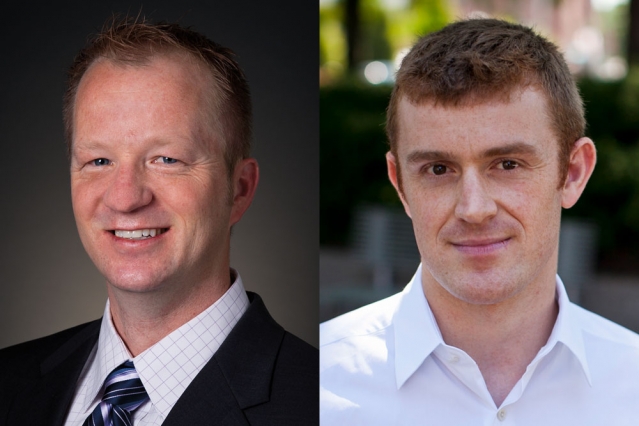

Christopher Knittel and Francis O’Sullivan, co-directors of the MITEI LCEC for Electric Power Systems Research, are exploring cleaner, more reliable, and more cost-effective solutions.

SEE FULL ARTICLE

Is Massachusetts ready for carbon pricing?

On Jan. 25, a panel at MIT explored the benefits, costs, and political challenges involved in translating carbon pricing from concept into law in Massachusetts and beyond.

SEE FULL ARTICLE

Jing Li: Applying economics to energy technology

Soon-to-be assistant professor of applied economics focuses on development and deployment solutions that can help the world move to a low-carbon future.

SEE FULL ARTICLE

Subsidizing Fuel Efficient Cars: Evidence from China’s Automobile Industry

In a new CEEPR Working Paper, the authors examine the response of vehicle purchase behavior to China’s largest national subsidy program for fuel efficient vehicles during 2010 and 2011.

SEE FULL ARTICLE

Subscribe To Our Newsletter

Subscribe now and check outour Past newsletters