CEEPR Working Paper 2022-008, April 2022

Alexander MacKay and Ignacia Mercadal

In the late 1990s, several states in the United States started to restructure the electricity sector, replacing regulated and vertically integrated utilities by wholesale and retail markets open to many competitors. Over 20 years later, we have yet to fully understand the consequences of these efforts (Bushnell et al., 2017). The existing evidence has primarily focused on the impacts on costs, and has shown modest reductions in generation costs as a result of restructuring (Fabrizio et al., 2007; Davis and Wolfram, 2012; Cicala, 2015, 2022). The price effects of restructuring have not been extensively studied (Borenstein and Bushnell, 2015; Bushnell et al., 2017).

Importantly, the impact of deregulation on prices is theoretically ambiguous. Market-based prices provide incentives for profit-maximizing firms to reduce costs, but firms that have market power also have an incentive to increase markups but choosing prices above marginal costs. When cost efficiencies from deregulation are outweighed by an increase in markups, market-based prices can be higher than regulated rates. Thus, without efforts to protect and strengthen competition, such as regulatory oversight and antitrust enforcement, markets may be worse for consumers. Regulators must consider the tradeoff between production efficiencies and higher markups when deciding whether to transition from regulated monopolies.

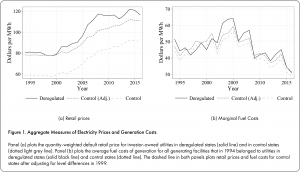

We study this tradeoff in the context of the deregulation of the U.S. electricity sector. Deregulation efforts included the introduction of market-based prices and restructuring measures to introduce competition into the upstream generation market and the downstream retail market. Contrary to the objectives of deregulation, we show that prices increased in deregulated markets, despite a modest reduction in marginal and average variable costs (See Figure 1 below). Thus, the increase in markups dominated the efficiency gains, indicating the widespread exercise of market power. Our findings show that deregulation does not necessarily lead to lower prices to consumers.

We construct a unique dataset that covers the annual electricity flows from generation to final consumption for each electric utility territory from 1994 through 2016. This dataset offers a novel perspective of the evolution of the U.S. electricity market after deregulation. Importantly, our dataset includes purchases through bilateral contracts in addition to purchases in the centralized wholesale markets run by independent system operators (ISOs), which have been the focus of the previous academic literature. From 2000 through 2016, the vast majority—over 85 percent—of wholesale electricity was sold with such contracts, outside of centralized markets. Thus, our data allows for a broader analysis of prices and the interactions between upstream and downstream market participants.

Using this data, we compare utilities that were subject to state-specific deregulation policies to similar utilities in other states that remained tightly regulated with a difference-in-differences matching approach (Deryugina et al., 2019). We find substantial price increases for consumers in deregulated states relative to consumers in regulated states. On the other hand, marginal costs declined in deregulated states, indicating that higher prices are driven by higher markups. Overall, we estimate that gross markups—retail prices minus the marginal cost of generation—increased by 15 dollars per MWh from 2000 to 2016. Relative to 1999 price levels, this change in markups corresponds to a 19 percent increase in prices over the period.

Crucially, our data allow us to examine the impacts in wholesale markets, providing greater insight into the underlying mechanisms that explain this increase. We find that wholesale markups increased by more than the decline in generation costs, leading to higher wholesale prices. Retail markups also increased modestly. Wholesale markups increased by roughly 9 dollars per MWh, representing over 60 percent of the overall increase in gross markups. Thus, we find market power in the generation market to be the primary driver of price increases.

It is important to note that we measure market power using markups, the difference between price and marginal cost. Market power can exist even with competitive market mechanisms, such as auctions, when there are a limited number of potential suppliers. Thus, deregulation can lead to higher prices due to entry barriers and other market features that lead firms to charge markups in equilibrium.

To distinguish market power from competitive rents, which could arise in a competitive market in the presence of cost heterogeneity, we consider the costs of the most expensive plants in the market. In a perfectly competitive market, prices should equal the costs of the most expensive plants. Consistent with market power, we find substantial increases in markups over the highest-cost plants. We additionally present several indirect tests of market power that point to market power at the wholesale level as the main driver of price increases.

We also show that the market restructuring intended by deregulation was delayed for several years. Despite the divestiture of generation assets, utilities maintained a high degree of vertical integration through contracts and umbrella ownership, where different companies are subsidiaries of the same parent/holding company. Thus, we distinguish between apparent deregulation—the share of a market supplied by companies other than the incumbent utility—and effective deregulation-the share of a market supplied by companies unaffiliated with the incumbent. In wholesale markets, we find that the use of contracts with affiliated companies delayed the onset of effective deregulation by many years, compared to apparent deregulation. In retail markets, caps on retail rates and other factors slowed the introduction of competitive supply. Consistent with these delays, we observe a much larger impact on prices once restructuring measures are fully in effect. Thus, distinguishing between apparent deregulation and effective deregulation can be important to accurately measure policy impacts.

We believe we are the first to show that electric deregulation in the U.S. has resulted in increased prices from market power, and that this effect has dominated cost efficiencies. Though there was early awareness of the potential for market power in deregulated markets, the fact that the effects of market power could considerably exceed the savings from increased cost efficiency is surprising. Our findings point to the importance of careful market design and market monitoring in electricity markets to guarantee that consumers benefit from the cost savings that resulted from deregulation.

References

MacKay, A.,and I. Mercadal (2022), “Deregulation, Market Power, and Prices: Evidence from the Electricity Sector,” MIT CEEPR Working Paper 2022-008, April 2022.