CEEPR Working Paper

2022-001, January 2022

Julien Xavier Daubanes, Shema Frédéric Mitali and Jean-Charles Rochet

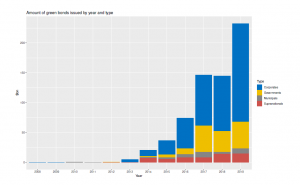

Green finance certification allows investors to link their decisions to firms’ commitments toward the environment. Green bonds are the most emblematic and prominent green finance instrument: Their issuers commit to use the bond proceeds to a certified climate-friendly project. For example, Unilever announced on March 19, 2014, one of the now most famous certified green bond issues, earmarking more than $400m to new climate-friendly production capacities. This commitment confirmed the success of years-long plans to develop new green detergents and refrigerants. It was received enthusiastically by investors, generating stock returns of more than 5%. In the past few years, a rapidly increasing number of firms have made similar commitments, leading to a boom in the global green bond market (now around 3.5% of total corporate bond issuance in 2020).

|

| Figure 1. Green bonds issuance In the past few years, a rapidly increasing number of firms have issued green bonds, leading to a boom in the global green bond market, whose volume has nearly doubled every year since 2013. |

Economists have long recommended to price carbon. In practice, however, this direct approach is less successful than hoped; even in developed countries, the effective price of most CO2 emissions is far below the social cost of carbon. The urgency of the climate challenge calls for examining all instruments that are feasible and potentially effective.

Firms’ issuance of green bonds is voluntary. Nevertheless, recent empirical evidence rules out the possibility of greenwashing (Flammer, 2021). Now more than ever, governments and financial institutions are paying a lot of attention to the rapid growth of green finance markets, hoping that it could play an effective role in climate policy. Yet economists know very little about the mechanisms that make green bonds work.

Recent empirical analyses of the green bond boom further establish the following stylized facts. First, firms’ stock price increases when they announce the issue of certified green bonds and financed projects, unlike conventional bonds. Second, firms’ certified green bonds do not allow them to obtain less costly financing; green and conventional bonds pay the same to investors. Third, certification of green bonds is critical. So-called “self-labeled” green bonds are associated with neither CO2 reduction, nor stock market reaction (e.g., Flammer, 2021).

How to account for stock market reactions at green bond announcements? In the absence of green bond yield spread, one can reasonably rule out that concerned investors play a significant role. Positive stock market reactions, therefore, indicate that green bond certification of firms’ projects conveys positive information about these projects’ expected profitability.

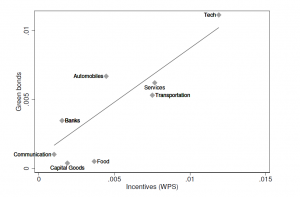

Our theory points to the crucial role of managers’ interest in the stock price of their firm. For example, managers’ actual compensation schemes feature stock components. Edmans, Gabaix, and Landier (2009) measure managers’ incentives as the sensitivity of their compensation to their firms’ stock price, an incentive measure that is comparable across sectors and over time. Figure 2 shows, for example, the unconditional relationship between the proportion of issued green bonds and Edmans et al.’s managerial incentive measure: Sectors in which managers’ pay is more stock-price sensitive issue more green bonds.

|

| Figure 2. Green bond issuance and managerial incentives (2007-2019) This figure shows the unconditional relationship between the proportion of green bonds and the stock-price sensitivity of managers’ compensation in sectors that issue green bonds. It illustrates that sectors in which managers’ pay is the most stock-price sensitive issue more green bonds. |

Our analysis unveils that it is existing carbon penalties that explain this relationship! Besides green bonds, effective carbon prices in most countries already provide firms with some, although insufficient, incentives to undertake CO2 reducing projects. Our model highlights that with green bonds, the effect of carbon prices is twofold: It induces firms to undertake more certified green projects not only because carbon prices penalize conventional technologies, but also because, all else unchanged, these penalties amplify the stock market reaction to green bonds and, therefore, managers’ interest in certified green projects.

We obtain a testable positive relationship between, on the one hand, the proportion of green bonds issued in an industry, and, on the other hand, the interaction between the carbon price that this industry is applied and managers’ concern for their firms’ stock price.

To verify this prediction, we use data that relate public firms’ certified green bonds to the stock-price sensitivity of managers’ compensation in their industry and to the effective carbon price that prevails where they are based. We find that the total role of managerial incentives is positive on average, and statistically different from zero as carbon prices are sufficiently high, e.g., around the average effective carbon price in the EU, where the green bond market is the most developed.

We draw the following conclusions. First, certified green bonds can induce firms to commit to effective CO2 reductions even though green bond issuance is voluntary. Second, perhaps surprisingly, firms’ incentives to issue green bonds is likely a matter of short-term financial interest. Third, green bonds are complementary to carbon pricing, with important practical implications. With green bonds, governments cannot dispense with carbon penalties; on the contrary, the latter are instrumental in the effectiveness of the latter. At the same time, if carbon prices are sufficiently high, green bonds are likely to make them more effective.

References

Edmans, A., X. Gabaix, and A. Landier (2009), A Multiplicative Model of Optimal CEO Incentives in Market Equilibrium, Review of Financial Studies, 22: 4881-4917.

Flammer, C. (2021), Corporate Green Bonds, Journal of Financial Economics, 142: 499-516.

OECD (2018), Effective Carbon Rates 2018 – Pricing Carbon Emissions Through Taxes and Emissions Trading.