Matti Liski and Iivo Vehviläinen

Exit from a declining market is among the prime economic illustrations of a war of attrition. Exit by one firm increases the profits of the remaining firms, so all firms have incentives to free-ride on the other firms’ exit decisions and thereby delay their own exit. This working paper makes a simple but yet unnoticed observation: cross-ownership arrangements can eliminate the free-riding incentives and, effectively, achieve collusive exit decisions from the market.

The observation is relevant in the electricity sector. Climate and energy policies give rise to a rapidly growing market for renewable energy technologies, putting the demand remaining for old technologies on a downward trend and forcing incumbents to adjust their capacity utilization and, ultimately, exit the market. However, renewable energy expansion has led to adverse impacts, not just for the intended targets of the policies, but for all incumbent technologies. Such impacts can follow from flaws in policy design, but they can follow from voluntary choices as well. When there are a few large players in the market, there is no reason for them to take the policy-driven decline in their residual demand as given: Through early closures, the industry can influence the demand left for remaining capacity, thereby implementing a noncompetitive capacity phase-out. The possibility of market power in the capacity phase-out has gone largely unnoticed in the literature on energy transition.

To provide an illustrative quantification, we look at the dynamic exit decisions of the nuclear power plants in the Nordic electricity market, where the demand for nuclear power generation is declining due to increased wind power generation, which has grown to around 10% of the supply in 2017. Wind power reduces market prices as it replaces higher marginal cost thermal units. In contrast, nuclear power closures can offset the price decline and, temporarily, even increase the price level. The exit distortions that we illustrate in the Nordic nuclear industry seem relevant more generally. In the U.S., several plants have been closed and yet more may soon be decommissioned, although the reason is often different: it is the low cost of gas generation that is creating the downward pressure.

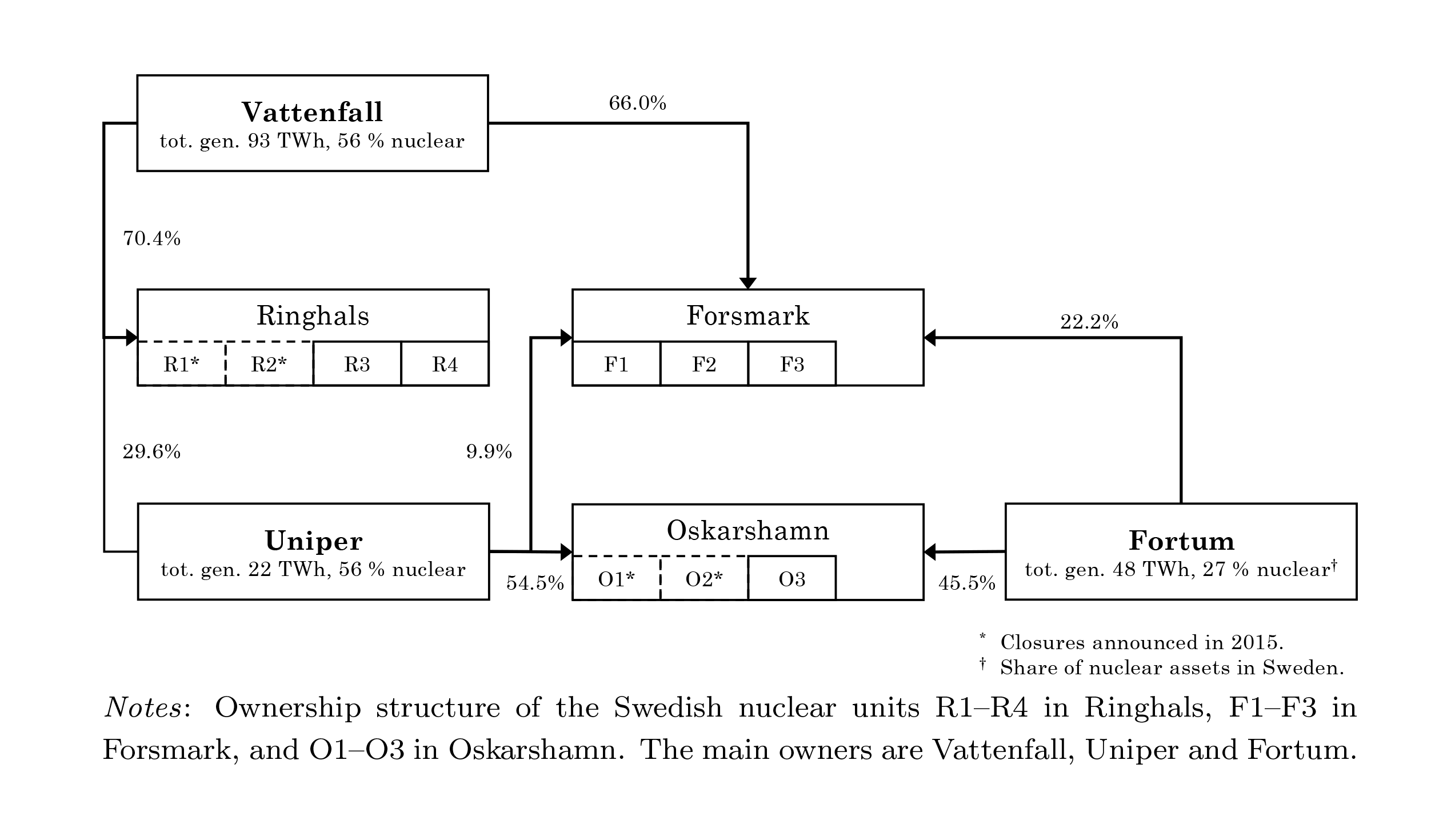

There is an intricate structure of cross-ownership between the main players in the Nordic nuclear industry (see figure below). We compute the exit game outcomes for the existing ownership structure and for several counterfactual situations. The annual cost of procuring wholesale electricity from this market for the consumers will be ca. 13 billion euros per year in the coming decade. Removing the cross-ownership entirely forces the nuclear units to play a war of attrition game where almost all units remain running, which reduces the annual procurement cost to 8 billion euros. We find that the inefficient phase-out increases annual emissions by 37 MtCO2, corresponding to roughly 40% of the current industrial emissions in the Nordic region.

This quantification is just an illustration – it is not an empirical assessment – but the quantitative importance of the theory observation seems robust. Understanding why the industry is currently undergoing a period of activity in rearranging ownership should be of importance to the competition and environmental policy authorities. The results add the exit distortion to the complex short-term distortions caused by renewable energy policies. The findings also point out the need to pay attention to market power in the transition towards clean energy in deregulated electricity markets.

It is important to interpret the precise quantitative results with caution but we still believe the analysis delivers a strong policy conclusion. First, cross-ownership should be dissolved, or closures should be regulated. Second, once the incentives for early closures are removed, there is a case for running some units even when they run a deficit: The consumer surplus covers the losses.

In general, our results contribute to the literature addressing the question “Why do firms have an interest in each others’ equity?” This working paper submits exit dynamics as a potential explanation, and also illustrates the potential quantitative meaning of the mechanism.

References

Liski, M., and I. Vehviläinen, 2018. “Ownership and Collusive Exit: Theory and a Case of Nuclear Phase-out”, MIT CEEPR Working Paper 2018-010.

Further Reading: CEEPR WP 2018-010