CEEPR Working Paper

2024-05, March 2024

Ilenia Gaia Romani and Chiara Casoli

The energy transition stands as a cornerstone in fighting climate change and reaching net-zero emissions by 2050. This challenge requires the development and adoption of new technologies for energy generation, which will lead to a substantial increase in demand for critical raw materials (IEA, 2021).

Critical raw materials are becoming rapidly dominant in the development of different technologies and several countries have already studied plans to secure access to them. Many of these resources are concentrated in few geographical areas, often subject to geopolitical tensions and mostly in developing countries. Governments recognize the significance of mineral requirements for the energy transition and are prioritizing the strengthening of domestic supply chains due to the increasing dependence on foreign sources for critical minerals. Two notable policies for boosting access to clean technologies are the U.S. 2022 Inflation Reduction Act (IRA), affecting all of North America with energy and climate subsidies, and the European 2023 Critical Raw Materials Act, aimed at increasing and diversifying the EU’s critical raw materials supply.1 In the U.S., the White House has favored an expansion of domestic mining, production, processing, and recycling of critical minerals and materials.2

This study aims to assess the role of the Inflation Reduction Act and other U.S. policies strategic for boosting the minerals’ domestic production in terms of future price patterns of some critical raw materials. In particular, we focus on a selection of battery minerals, namely cobalt, lithium and nickel. These materials are key ingredients for the energy transition, as they are extensively used in rechargeable lithium-ion batteries, and are strategic for the development of electric vehicles (EVs) and grid-scale energy storage. Given their importance, they are included in the U.S. classification of critical minerals by the U.S. Geological Survey (USGS) and in the Inflation Reduction Act.

We build a Structural VAR model (SVAR) for each mineral market of interest and disentangle the role of different shocks on mineral fundamentals. Specifically, by identifying four separate structural shocks, distinguishing between aggregate supply and demand shocks, concerning the whole U.S. business cycle, and between mineral-specific supply and demand shocks, which are driven solely by the commodities market fundamentals, we are able to model the energy-transition policies as a mix of these shocks.

Additionally, our econometric model is particularly suitable for the evaluation of U.S. policies of the energy transition. In fact, we also conduct a structural forecast exercise to quantify the effects of selected energy transition-related U.S. policies on the evolution of prices in battery minerals markets. To do so, we condition forecasts of the selected minerals prices on different future trajectories of structural shocks up to 2030. The comparison of the different outcomes provides a useful indication of the range of possible future price evolution under different policy mixes.

In order to build the hypothetical sequences of future paths of demand and supply shocks up to 2030, we employ thought experiments, backed as much as possible by empirical evidence. Specifically, we ask ourselves what would happen to mineral prices if mineral demand shocks impacted prices themselves more or less strongly, and supply shocks increased domestic minerals’ production just enough to alleviate import dependency, versus the IRA-induced stronger increase in production.

We build specific scenarios to address those questions, and feed them into our conditional forecast equation as future flow shocks (of supply or demand), while setting all other future structural shocks equal to their zero expected value. The cases we consider are listed below.

a) Historical demand increase: to reconstruct the energy transition dynamics leading to positive mineral-specific demand shocks, we select the sequence of shocks of the years 2010-2015 and suppose that the same path will continue in the following years.

b) Higher demand increase: we assume that the biggest demand increase will happen in the following two years, hence we modify the previous scenario by imposing a higher increase in 2023 and 2024, setting their growth rates equal to the average of the last five years’ price growth.

c) Ambitious supply increase: we compute the expected increase in domestic minerals’ production driven by government funding. In order to map the U.S. extraction and processing projects of cobalt, lithium and nickel that will be developed in the years to come, we review their development studies and releases. We compile a list of these projects, which highlights the target year and the targeted annual production. By cumulating each mineral’s annual exceptional production across projects, we calibrate the expected supply shock matching with the desired production driven by public policies up to 2030.

d) Lower supply increase: we conjecture the expected increase in U.S. production driven by the government’s stated goal of import independency. Official U.S. documents define import reliance as imports (M) being greater than 50 percent of annual consumption (C), for most of the minerals designated as critical, including cobalt, lithium and nickel. Considering this approximation: C = P + (M – X) (consumption equals the sum of domestic production and net imports) and that imports cannot exceed 50 percent of the consumption, we calculate the new production capacity necessary to maintain the same level of consumption P* = C – (M*- X), with M* = C/2. By doing so, we are able to compute an approximation of the production increase which would allow the U.S. to stop being import reliant. We therefore compute a supply shock compatible with this production approximation.

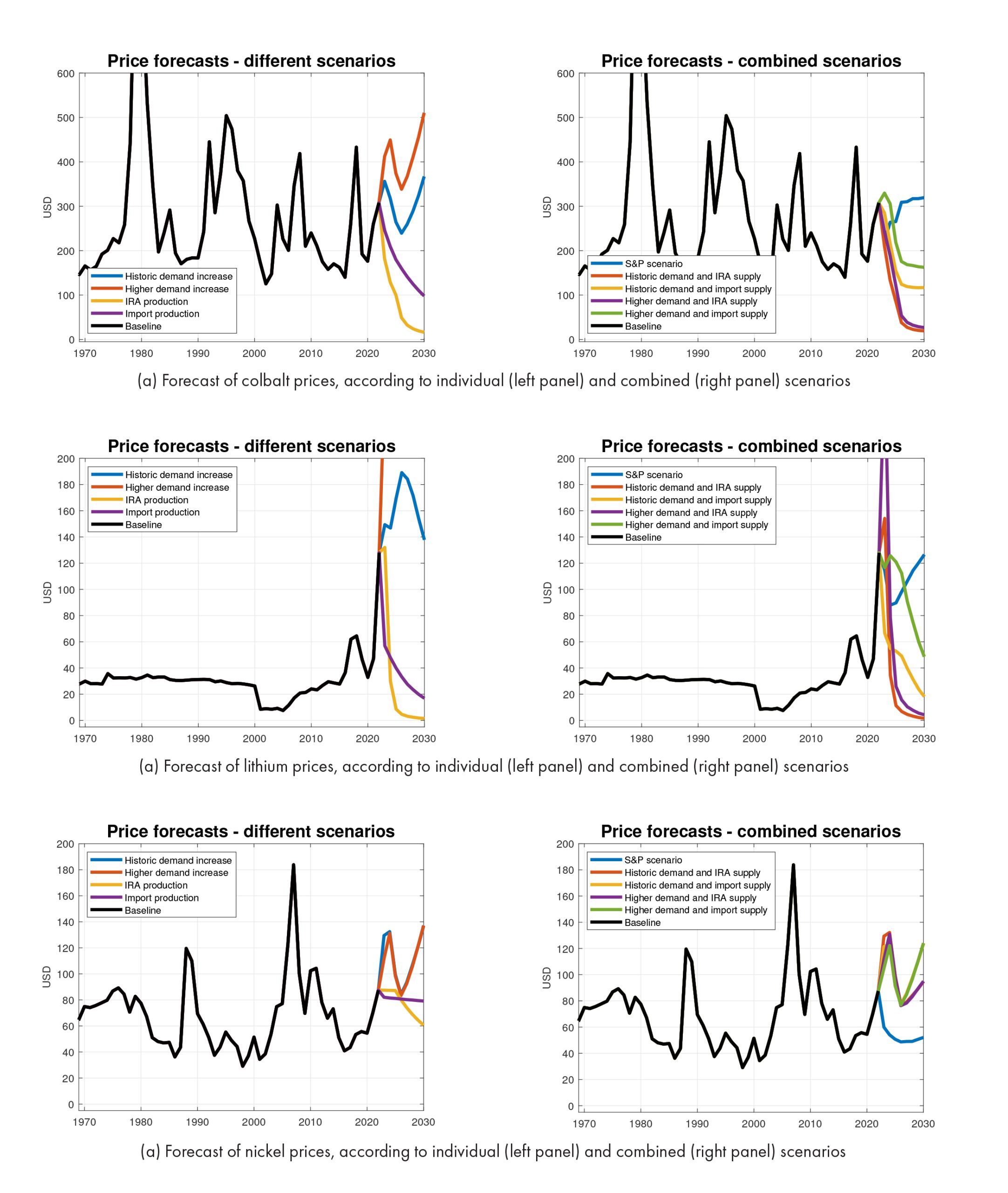

Figure 1. Forecast of minerals’ prices (USD/t) up to 2030 according to different scenarios

Figure 1 displays the historical price series along with the structural forecasts up to 2030 for the prices of the three minerals. The left panel presents the projections based on individual scenarios, namely (a) historical demand increase, (b) higher demand increase, (c) increasing production driven by U.S. government policies such as the IRA, and (d) increasing production driven by the goal of achieving import independence. Despite considering these scenarios in isolation presents an interesting picture, a more realistic situation would involve a combination of supply and demand forces. For instance, a significant supply increase without a corresponding demand request is unlikely. For this reason, the right panel of Figure 1 displays combinations of demand and supply scenarios together.

In the case of the cobalt market, supply rather than demand scenarios have the most significant effect on price, which, as a consequence, keep decreasing quite steadily, especially with IRA-driven production.

Lithium price, already peaking in 2022, has an extended peak in 2023. This is particularly pronounced in the case of the higher demand and IRA-driven supply scenario, and reverts to more credible levels starting from them subsequent year. This is likely explained by the fact that, according to the funded projects, additional lithium domestic production will not start until 2024.

In contrast, the structural forecast of nickel prices is only moderately influenced by supply scenarios. Given that the additional investment in the domestic production of the mineral is quite restricted in both the IRA- and import-independency-driven production scenarios, the nickel price exhibits a path which follows more the demand-side scenarios.

Our research yields two key takeaways. First, different mineral markets exhibit distinct dynamics, emphasizing the need to treat them as separate entities rather than as a homogeneous group. Second, different policy combinations lead to heterogeneous price patterns over the forthcoming years. Our price forecasts are, by definition, conditional on the chosen scenarios. This follows from the definition of a structural forecast, which can be framed in the form of: “what would happen, if…?” and therefore does not provide the most likely outcome. For example, if the U.S. experiences an increase in demand that follows the historical trends, coupled by the ambitious production boost driven by U.S. public investments, prices of cobalt and lithium will decrease steadily. Conversely, the nickel price is expected to remain high. This reflects the target of the selected U.S. policies, focused on strengthening the domestic production of cobalt and lithium, whereas less effort is devoted to nickel market expansion.

More research effort should be invested around the development of country-specific scenarios. In fact, most of the studies – including IEA technical reports – provide demand (and to a lesser extent, supply) estimations only at the global level (Calvo and Valero, 2022; Hund et al., 2023). Moreover, we acknowledge the importance of focusing on conditional forecasts targeting specific national policies, thus providing a useful tool for the evaluation of government strategies.

As the U.S. navigates the path toward cleaner energy, the insights around price dynamics gained from this study could provide valuable guidance for policymakers and industry stakeholders.

Further Reading: CEEPR WP 2024-05

Footnotes:

1 See H.R.5376 – Inflation Reduction Act of 2022, 117th Congress (2021-2022) for the U.S., while refer to: proposal for a regulation of the European Parliament and of the Council establishing a framework for ensuring a secure and sustainable supply of critical raw materials and amending Regulations (EU) 168/2013, (EU) 2018/858, 2018/1724 and (EU) 2019/102, for the European case.

2 U.S. Department of Energy, “America’s Strategy to Secure the Supply Chain for a Robust Clean Energy Transition” and “Inflation Reduction Act – Energy Security and Climate Change Investments”.

Citations:

Calvo, G. and A. Valero (2022). Strategic mineral resources: Availability and future estimations for the renewable energy sector. Environmental Development 41, 100640.

Hund, K., D. La Porta, T. P. Fabregas, T. Laing, and J. Drexhage (2023). Minerals for climate action: The mineral intensity of the clean energy transition. Technical report, World Bank Group.

IEA (2021), The Role of Critical Minerals in Clean Energy Transitions, IEA, Paris https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions