CEEPR Working Paper

2023-02, January 2022

Gilbert E. Metcalf and James H. Stock

Economists widely agree that putting a price on carbon emissions is a key element of economically efficient policies to reduce greenhouse gas emissions. The two most straightforward ways to apply a price are a carbon tax and a cap-and-trade system. A carbon tax can be levied on fossil fuels and other sources of greenhouse gas emissions based on their emissions. A cap-and-trade system limits emissions to a set overall amount (the cap) and allows polluters to trade the rights to those scarce emission rights. In recent years, members of Congress have filed numerous bills to establish national carbon tax systems and a few cap and trade bills. This reflects the growing consensus that action is needed at the national level to curb our carbon pollution and that a carbon tax is the most straightforward way to do that.

However, despite this consensus, resistance to carbon taxation policies is significant, in part due to concerns about the economic impact on jobs and growth.

In our paper, we assess the economic costs of a carbon tax, particularly relating to GDP growth and employment. With three decades of data since the first carbon taxes were implemented, we now have enough experience with carbon tax systems around the world to carry out statistical analyses of existing systems.

We carry out an analysis of the 31 European countries that are part of the EU wide emissions trading system (EU-ETS). All of these countries price a portion of their emissions through a cap-and-trade system. However, fifteen of these countries also impose a carbon tax, mostly on emissions not covered by the EU-ETS. By leveraging the variation in carbon tax systems within EU-ETS countries, we can identify the incremental impact of carbon taxes on emissions, output, and employment.

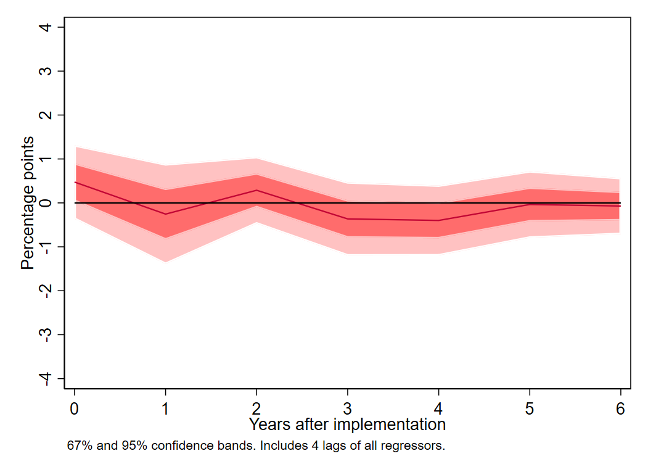

We find the following. For a wide range of specifications, we find no evidence of adverse effects on GDP growth or total employment (see Figure 1). Our results are robust controlling for how carbon tax revenue is used, whether we limit the analysis to countries with large tax rates or to the Scandinavian countries that were early adopters of carbon taxes as part of a Green Tax Reform, allowing for marginal effects to depend on the level of the tax, the covered share, or other cuts of the data.

Figure 1. Effect on GDP growth of a $40 carbon tax covering 30% of emissions: LP Regression – Restricted

We also test and cannot reject the hypothesis that the carbon tax has no long run effect on growth rates of GDP, emissions, and employment. In other words, we find that the tax potentially shifts the long-run path of the log levels of those variables, but those paths are parallel to the no-tax path. This parallel shift finding is consistent with macroeconomic theory that suggests growth rates are driven by fundamentals, such as aggregate technological progress, which are unaffected by changes in relative prices. It is also consistent with most general equilibrium modeling of climate policy.

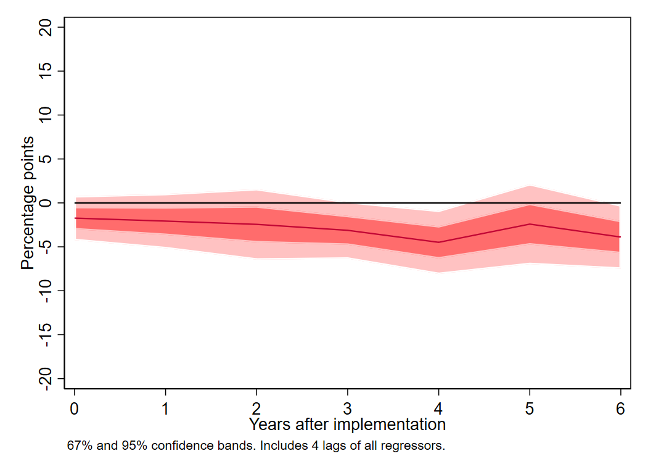

We find cumulative emission reductions on the order of 4 to 6% for a tax of $40 per ton of CO2 covering 30% of emissions (see Figure 2). We argue that this is likely to be a lower bound on reductions for a broad-based carbon tax in the U.S. since European carbon taxes do not include sectors with the lowest marginal costs of carbon pollution abatement (electric generation, energy intensive manufacturing). We show that these estimated emissions reductions are in line with estimated price elasticities of demand in the transportation sector.

Figure 2. Effect on level of emissions in covered sectors: LP Regression – Restricted

Our approach differs from the existing (scant) empirical literature on the macroeconomic impact of carbon taxes by focusing on macroeconomic time-series econometric methods instead of the more typical event study methods used in microeconomic assessments. This macroeconomic approach is designed to respond to policymakers’ concerns that a carbon tax could hurt the economy. Unlike microeconomic analyses focused on individual sectors, our analysis accounts for the fact that the tax’s adverse impacts in one sector can be offset by positive impacts on other sectors. While distributional impacts are certainly relevant, focusing only on the impacts on sectors directly bearing the tax can overstate the adverse macroeconomic impacts of carbon pricing.