Fernando J. de Sisternes and John E. Parsons

Future decarbonization pathways in the U.S. and in Europe rely heavily on a large-scale deployment of intermittent energy resources —including wind and solar power. Intermittent energy resources increase the volatility of energy supply as well as the associated market clearing prices, creating uncertainty around when the system will experience “scarcity”— the very few hours of the year when capacity is strained exhibiting prices high-enough to cover a large portion of the capital and fixed operation and maintenance costs incurred by all types of installed generation capacity. Additional uncertainty is introduced by uncertain growth in demand and uncertain growth in renewable capacity—primarily driven by uncertain energy policies—which together lead to uncertain growth in net demand.

The combined volatility of demand and renewable generation has been identified as one possible cause for underinvestment in thermal generation capacity. However, a rational investor with perfect information about how the net demand and its growth are distributed—and therefore perfect information on its volatility—would have little trouble estimating its expected earnings over the life of the asset as it occurs in many other markets. In reality, it takes time to fully understand the underlying process characterizing net load uncertainty, and it is the limited knowledge about this process, based on historical experience, that informs investment decisions. Therefore, it is not the volatility per se that is problematic, but the uncertainty on the underlying parameters and processes characterizing that volatility—one learns faster about the average of the underlying distribution than about the tails of that distribution.

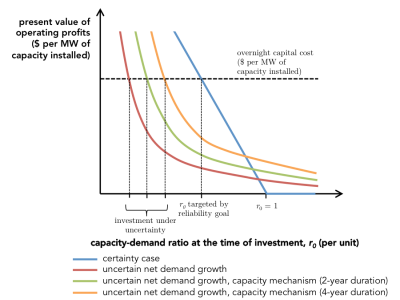

A recent CEEPR working paper by John Parsons and Fernando de Sisternes highlights the central role that uncertainty around the distribution and growth of the net load plays in the case for introducing capacity remuneration mechanisms (CRMs, or capacity mechanisms) and in determining their optimal design. Capacity mechanisms are a tool that shifts the structure of profits from one where all revenues are earned exclusively through the marginal cost of energy supplied to another in which the same total revenue is paid for capacity across a broader number of hours. A capacity mechanism can be a useful element of market design, as it can offer a way for society to provide ex ante a rational signal about its short-and long-term demand for security of supply and to commit to paying for that supply on reasonable terms, which would partially resolve the uncertainty about the future net load.

Using a stylized example, this working paper describes how uncertainty increases the risk investors take financing new generation so that a higher likelihood of near term profits is required for new investments to take place. The paper reviews existing forms of capacity mechanisms and discusses how each of them addresses the uncertainty component of the security of supply problem, highlighting the role that contract durations play in increasing the optimal capacity in equilibrium, enhancing the system’s security of supply.

The paper also stresses the importance that capacity mechanisms be technology neutral to guarantee access to all generation technologies—conventional and renewable—as well as energy storage, and that they introduce penalties for non-performance to ensure that resources are only compensated for the capacity they actually provide when it is needed the most. Failing to do so would imply a hidden subsidy to the limited set of technologies qualifying for the capacity mechanism, and produce an inefficient generation mix.

Most zero emissions technologies—e.g., wind, solar PV, nuclear, energy storage—are capital intensive assets with zero or almost-zero variable costs. As power systems embark in the process of deep decarbonization and the focus on competition in generation shifts from variable costs to capital costs, the design of market-based capacity mechanisms will become a critical element to guarantee the optimal deployment of capacity and operation of resources.

Illustration of the effect of introducing a price-based capacity mechanism with different contract durations, shifting the capacity-demand ratio towards the targeted reliability goal.