Robert Kleinberg and Sergey Paltsev

High oil prices in the first part of this decade provided a boost to U.S. oil production, which increased from about 5.5 million barrels per day (Mb/d) in 2010 to about 9.4 Mb/d in 2015. Most of the increase was due to the growth in production of unconventional (tight) oil. As a result of this rapid increase in oil production, numerous experts declared the United States to be a rival to Saudi Arabia as the world’s most influential oil producer. At a time when oil prices were in the range of $100 per barrel, many analysts suggested that the cost of unconventional oil development in the US would be in the range of $60 to $90 per barrel. It was widely believed that once the oil price fell below $60 per barrel, many investments in unconventional oil projects would cease to move forward. For instance, in its editorial for the December 6, 2014 issue, The Economist stated that “since shale-oil wells are short-lived (output can fall by 60-70% in the first year), any slowdown in investment will quickly translate into falling production.”

The $60-90 range for U.S. unconventional oil was thought to act as a shock absorber, with tight oil projects quickly coming onto production as prices increased, and dropping out of production as prices decreased through this range. With U.S. unconventional oil accounting for roughly 4% of global production, and seemingly able to respond to price signals considerably faster than conventional projects, analysts predicted that this new resource could bring welcome stability and price support to oil markets.

There is no documented evidence that OPEC acted on these assessments, but we can speculate that these considerations might have influenced their decision late in 2014 to pursue a strategy to preserve their share of the international oil market by increasing oil production. If conventional wisdom were to hold true, moderate increases in Middle East oil production, accompanied by a moderate oil price decline, would result in prompt declines of U.S. unconventional oil production, thereby preserving OPEC market share.

Reality, however, proved to be different. As the West Texas Intermediate benchmark oil price fell from $108 per barrel in mid-2014 to $32 per barrel in early 2016, U.S. oil production was sustained even as prices fell below minimum breakeven points calculated by energy economists. According to the latest energy outlook from the U.S. Energy Information Administration, tight oil production was 4.28 Mb/d for 2014 and 4.89 Mb/d for 2015. It is projected to fall to 4.27 Mb/d for 2016.

A recent CEEPR working paper by Robert Kleinberg, Sergey Paltsev, Charles Ebinger, David Hobbs, and Tim Boersma offers an investigation into this phenomenon. They have found that the cost of oil production is often misstated or even misused. In many instances, the lifting cost related to the incremental cost of producing from an existing well is quoted as the cost of oil production. This calculation does not include many components of the full cost, such as exploration and development expenditures, as well as the full cost of financing. The study provides a detailed assessment of these components and proposes a standardized definition of costs with a tiered structure that includes the full cycle, the half cycle, and the lifting cost.

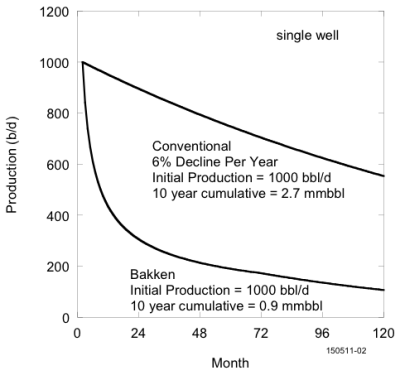

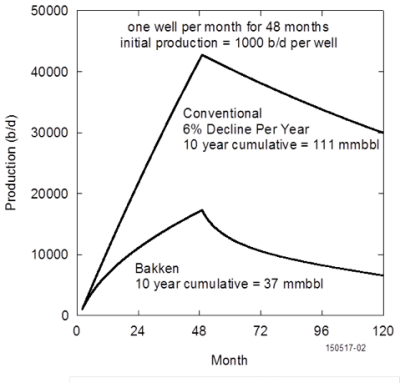

The study also investigates a reduction in well drilling and completion costs. These costs fell by a reported 25-30% from 2012 to 2015 in different unconventional oil basins in the U.S., contributing to the resilience in U.S. oil production. Another factor in the inelastic response of oil production is explained by an illustration from a simple field-level production model developed by the authors. The model shows that while individual well behavior in conventional and unconventional oil basins differs substantially (see the figure below), where unconventional oil wells typically decline by about 60% in the first year and 25% in the second year of production, the field-level production profiles show a similar decline once drilling is stopped.

|

|

The dynamics at the field-level is driven by a larger number of older wells that are declining more slowly. Thus, the unconventional oil fields with large legacy inventories of wells will produce substantial quantities of oil for many years even after drilling has ceased. A decision by the traditional oil producers to increase production and reduce global prices might have been driven by misunderstanding the economics of unconventional oil development, where aggregate production from unconventional sources declines more slowly than suggested by an individual well analysis, where the companies continue to produce to cover their lifting costs rather than the full-cycle costs, and where the substantial improvements in well drilling and completion help to maintain the production activities.

As the majority of U.S. unconventional oil companies continue to provide negative cash and their levels of debt service as a share of operating cash flow are increasing, it remains to be seen if the financial sector will continue to keep lending money to unconventional oil companies. In a rapidly evolving industry such as unconventional oil production, many crucial drivers remain uncertain. While our study provides a close examination of certain aspects related to the dynamics of the response, many other components related to infrastructure, capital and labor markets might affect the prospects of this industry and influence global oil prices.