CEEPR Working Paper

2025-05, March 2025

Diego S. Cardoso, Stephen W. Salant, and Julien Daubanes

In response to Russia’s invasion of Ukraine in February 2022, the EU, the US, and other G-7 countries (hereafter the West) ceased their imports of Russian oil, leading Russia to export more to India, Turkey, and China instead. In addition, the West imposed sanctions on oil exports from Russia, whose profits are instrumental in supporting its war.

Since more than 80% of Russia’s seaborne oil exports relied on the provision of Western services (CREA, 2023)—financial, operational, and commercial—the EU suggested banning the use of these Western services on all Russian seaborne exports. Yet governments feared that this would have caused a spike in the world oil price. As an alternative, the US suggested a price cap, which the West ultimately imposed in December 2022, limiting Russian revenues from oil shipped using Western services to $60 per barrel.

Oil transported without Western services is exempt from the cap. Therefore, Russia gradually assembled a “shadow” fleet that uses non-Western services in order to sell oil at prices above the cap.

The price cap on Russian oil is a new, untested economic sanction, currently a subject of active discussion. In their pioneering contribution to this literature, Johnson, Rachel, and Wolfram (2025) provide a rich analysis of the effects of the price cap, albeit under the assumption that the shadow fleet has a fixed capacity.

In this MIT CEEPR working paper, Cardoso, Salant, and Daubanes (2025) present a new dynamic equilibrium model that accounts for the expansion of the Russian shadow fleet. The model is calibrated to reproduce observed facts and used to simulate the effects of (1) various levels of the price cap, including the extreme case of a complete ban, of (2) enforcement stringency, and of (3) policies targeting the shadow fleet.

Perhaps surprisingly, our research shows that lowering the cap below $60 would not hurt Russia further unless a robust expansion in non-Russian oil supply occurred in response; in fact, lowering the cap could even moderately increase Russian profits. More generally, the model reveals that a lower cap would have two opposite static effects on Russia: On the one hand, it would reduce its profit (i.e. revenues net of production costs) from sales at the cap. On the other hand, since a lower cap would reduce Russia’s oil exports, it would increase the oil price and, therefore, Russia’s profit from sales through its shadow fleet. The paper’s model links shadow fleet capacity to sales at the ceiling price. When sanctions were imposed, Russia’s relative shadow fleet capacity was already sufficiently high for Russia to benefit from higher oil prices. Moreover, dynamic simulations indicate that these higher oil prices would have prompted Russia to rapidly further expand this fleet. As a result, Russia’s discounted profits would have been slightly larger if a service ban or a lower-than-$60 cap were imposed.

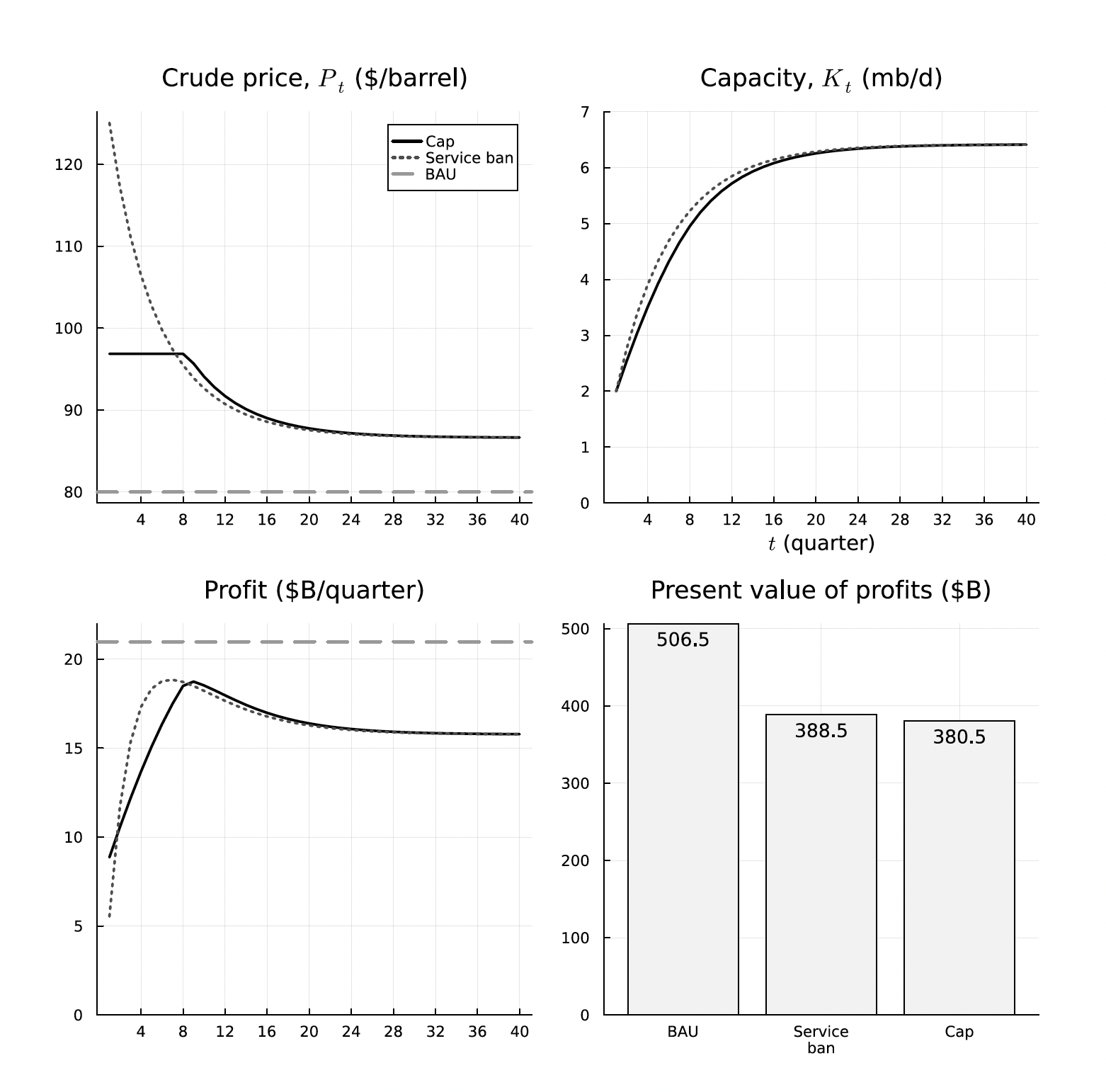

All these sanctions quantitatively impact Russian discounted profits (i.e., export revenues net of production and investment costs) in a similar way. For example, the $60 cap reduces Russian profits by about 25% with respect to the absence of sanctions and the complete ban would have impacted Russia only slightly less.

The figure below shows a comparison of prices, shadow fleet capacity, and profits under a price cap sanction (solid lines), a service ban (dotted lines), and the absence of sanctions (grey dashed lines). The simulations assume no supply response from non- Russian producers (none occurred when the cap was first implemented). A lower cap cuts Russian exports and raises the global oil price, raising Russian profits on its fleet sales. A non-Russian supply response would dampen this oil price spike and would, therefore, diminish the resulting revenue increase in Russian fleet sales.

Figure 1: A comparison of prices, capacity, and profits under a price cap sanction (solid lines) and a service ban (dotted lines).

The line graphs display only the first 40 quarters of the 80-quarter simulation.

Russia sometimes uses Western services to ship oil at a price above the cap, taking the risk that its shipments get sanctioned. Increasing the probability that cheating is punished lowers the expected price for Russia, with consequences formally identical to a reduction in the cap level: Tighter enforcement would increase Russia’s discounted oil profits.

By contrast, policies that sideline part of the shadow fleet may harm Russia, even though they prompt Russia to rebuild its fleet rapidly. This happens, for example, if the neutralization of the fleet occurs while oil is also being sold at the ceiling, so that ceiling sales replace the lost fleet sales.

Overall, these results justify using the price cap instead of the service ban and maintaining the cap at its current level instead of a lower one. They also call for attention to complementary energy policies that would facilitate the response of non-Russian oil production to higher global prices.