CEEPR Working Paper

2023-015, September 2023

James Donegan

What makes a sustainable company a sustainable company? More and more companies are setting seemingly ambitious net-zero targets for their greenhouse gas emissions, with the dirty secret being that the path to achieving these targets is largely met with little to no actual emissions reductions from the company itself. These targets are being met through financial instruments, where renewable energy credits are purchased from a renewable energy plant in a different corner of the world and applied against a company’s operational emissions to counteract them on paper. So what can be done differently?

We built a prescriptive optimization framework, looking at how a major telecommunications company consumes energy, and output specific and actionable upgrade decisions that have been optimized to both save money and reduce emissions. Applying this framework resulted in a >10% reduction in operational emissions and energy spend. Furthermore, we look beyond operational emissions, and instead at embedded emissions of how a telecommunication network has been designed, and ask questions on what can be done to optimize this architecture. This included investigating the financial and environmental implications of reducing the real estate footprint of the company’s telecommunications network, finding billions of dollars of savings in energy spend just in the baseline location of New York City for the company.

There are five main stages of results from this project. Firstly, we examine the output of a baseline optimization model using only the information available from the building energy audits Verizon conducted in its NYC Central Offices which highlights a 12% reduction in energy costs and a 14% reduction in emissions through use of this optimization model.

The second stage of results, examined the effect of bundling network transformation inside-plant work with building upgrades in the optimization model. This highlighted a 14% reduction in energy costs and a 18% reduction in emissions through use of this optimization model.

Thirdly, our final piece of results from the optimization model is to examine the price of carbon set by the city of New York for their incoming environmental compliance laws. Is this the best price to reduce the most amount of emissions? Is this the best price holistically from a sustainability standpoint? In this section, we find the energy gap of Verizon’s operations where a 24% reduction in energy costs and a 17% reduction in emissions would be possible and recommended with no carbon tax introduction.

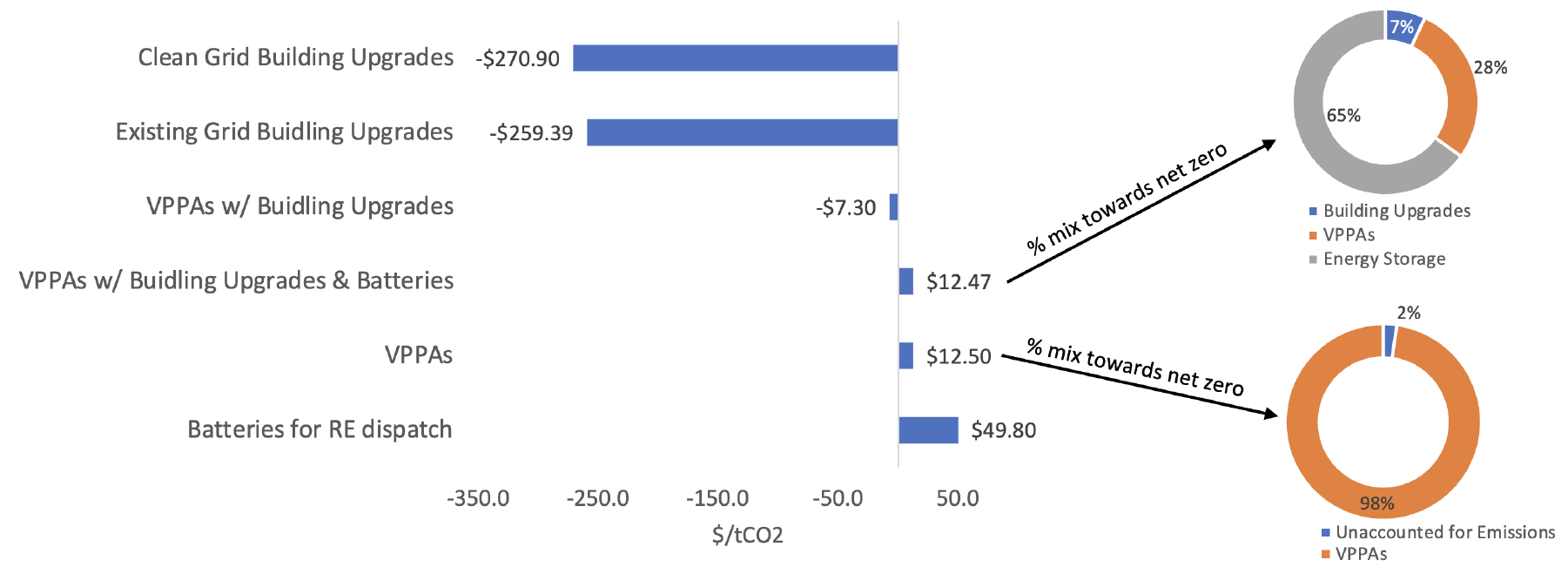

Figure 1: Dollars spent per ton of CO2 accounted for on Verizon’s net zero goal for different solutions or combinations of solutions, including pie charts showing contribution mix towards net zero contribution for identically priced solutions of existing green bond funded VPPAs, or a mixture of building upgrades, on-site energy storage, and green bond funded VPPAs.

The fourth batch of results is from an investigation into the most sustainable way to achieve net zero. This looks at how scalable the building upgrades are nationally, and how much of a dent they would put into the company’s total scope 1 & 2 emissions. This section also looks at alternative solutions to meet Verizon’s net-zero goals that have a reduction in emissions, to complement both building upgrades and the existing method of financing VPPAs. This section finds that if Verizon’s sustainability budget was restructured and distributed to a variety of emissions reductions projects, a 60% reduction in emissions is possible for the same cost per ton of CO2 that Verizon is currently spending (see Figure above). This solution features a large investment in energy storage which at this point is purely theoretical. As a follow on to this work we would recommend further investigating the opportunity cost of widespread energy storage installations for Verizon. This analysis is intended to show rough possibilities on the energy storage point.

Our final set of results highlighted the financial and sustainability opportunities available from the consolidation of Central Offices in high-population-density metropolitan areas. These opportunities sum to billions of dollars of savings for Verizon, albeit with significant challenges in implementation.

The project produced significant amounts of results which can be condensed to the below major takeaways and recommendations:

Creating a prescriptive optimization model to recommend building upgrades can not only reduce emissions but can significantly reduce energy expenditure, up to 24%.

Alternatives to renewable energy credits can be utilized by companies to achieve sustainability goals at the same price, while also reducing operational emissions by up to 60%. This should be the gold standard for sustainability and energy teams at organizations. These are sometimes considered to have high barriers to entry given the operational time and expense associated with building upgrades compared to financial instruments such as VPPAs.

Analyzing the requirements of modern network architecture can point to significant opportunities in real estate consolidation which not only saves money, but also reduces emissions, and creates a more robust network overall. The barrier for entry to any type of consolidation project however is huge, as the projects would take many years to complete at great upfront cost.

The most important learning from this work is to never stop working towards reducing your carbon footprint; continue to evolve and use the most state-of-the art tools at your disposal to determine the best paths forwards. True corporate sustainability is possible if companies are willing to dive in head first.