CEEPR Working Paper

2024-08, June 2024

Hanna F. Scholta and Maximilian J. Blaschke

With the intensifying global focus on fighting climate change, more consumers are turning to green energy, often verified through energy attribute certificates (EACs). These certificates assure consumers that their energy consumption is backed by renewable sources. However, the predominant mechanism, which matches supply and demand only on an annual volumetric basis, has been criticized for lacking transparency (Brander et al., 2018; Hast et al., 2015; Mulder & Zomer, 2016; Nordenstam et al., 2018; Winther & Ericson, 2013) and for its inefficacy in stimulating investments in renewable energy infrastructure (Bird et al., 2002; Gillenwater et al., 2014; Hamburger, 2019; Herbes et al., 2020; Markard & Truffer, 2006). Recent studies call for a revision of current accounting practices for environmental claims. Bjørn et al. (2022) express concerns about the inflated effectiveness of mitigation efforts due to the widespread use of EACs. Similarly, de Chalendar and Benson (2019) advocate for corporate carbon accounting to reflect the benefits of different types of renewable energy, dependent on the local grid mix at a certain time of day. Xu et al. (2024) suggest that aligning green electricity generation and corporate consumption geographically and temporally, specifically through hourly matching, enhances CO2 emissions reduction per MWh. However, this comes with the drawback of higher system costs.

Our paper investigates the robustness of green electricity claims when subject to shorter measurement intervals and, hence, stricter temporal alignment between green electricity supply and demand. Using real-world European EAC data from 2016 to 2021 alongside European data on electricity demand and renewable supply, we investigate the impact of adjusting the temporal granularity of matching periods – from annual to more frequent intervals such as quarterly, monthly, weekly, daily, and hourly. By considering the implications for renewable energy installations and flexibility measures, we formulate policy recommendations to optimize the effects of these green claims.

We approximate annual green electricity supply and demand using the issuance and cancellation of EACs under annual matching. We interpolate hourly EAC issuance and cancellation based on renewable energy generation and consumption data and test the system for sufficient coverage of green electricity at various hypothetical matching periods, namely quarterly, monthly, weekly, daily, and hourly.

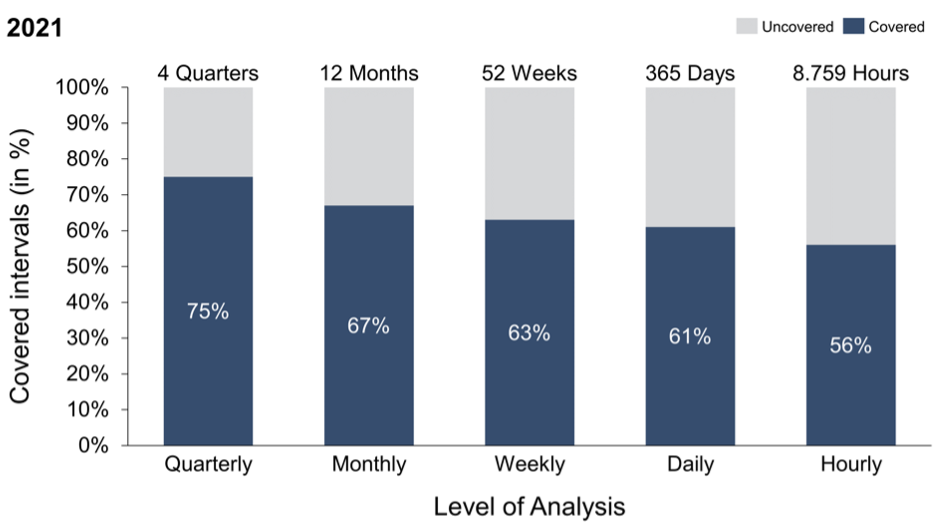

Figure 1. Share of intervals where green electricity demand was covered with green electricity supply in 2021, depending on the imposed matching period (in % of all intervals at the respective level of analysis).

For more granular matching periods, we observe severe discrepancies between green electricity demand and supply, as illustrated in Figure 1 for 2021. The prevailing annual matching conceals significant shortfalls in green electricity supply, especially during periods of high demand. More granular matching periods expose these gaps. Our simulation with quarterly matching shows deficits in supply during the first and fourth quarters, times typically associated with lower renewable energy generation due to seasonal variations in solar and wind energy production. Transitioning to quarterly matching could more accurately reflect seasonal variances in supply and demand, potentially increasing the market value of GOs during periods of shortage. These price differences in GOs may then incentivize further investments in renewables and flexibility measures, e.g. long-duration storage.

We find total shortages in uncovered intervals relative to the yearly green electricity demand to peak at the imposition of hourly matching. At this matching granularity, two major trends stand out: Firstly, there has been an overall increase in the share of intervals with insufficient coverage in recent years. Secondly, the night hours exhibit a higher number of shortages than the day hours, and the disparity has grown more pronounced over the years. Due to the increasing day-night disparity, even quarterly matching may eventually fail to provide adequate transparency and incentives. The introduction of hourly matching, however, could elevate the value of EACs issued during nighttime or early morning hours. These relative price increases may, for instance, trigger increased deployment of west or east-angled photovoltaic units for higher production outside the peak hours. Moreover, on the demand side, hourly matching could support shifting consumption from high-priced EAC hours to periods with abundant green electricity supply (see Blaschke, 2022).

Given the high system costs associated with hourly matching (see Xu et al., 2014), we initially recommend moving to quarterly matching. Nonetheless, our findings stress the long-term necessity of hourly matching when aiming for effective green claims based on EACs. To incentivize not only the expansion of appropriate renewable energy capacities and demand-side measures but also the enhancement of flexibility measures, we recommend integrating energy storage as a dynamic component within the green electricity market — permitting storage systems to both consume and issue certificates.

Our research underscores significant issues with the current structure of EAC markets and suggests that moving to more granular matching could alleviate those. Implementing our recommendations could foster more robust growth in renewable energy capacities and flexibility measures. Hence, our study serves as a call to action for policymakers, market operators, and stakeholders within the renewable energy sector to critically reevaluate and reform green electricity certification practices and regulations. By doing so, they can ensure that EACs fulfill their potential as catalysts for transitioning to a sustainable and resilient energy system.