CEEPR Working Paper 2019-007, April 2019

Gunther Glenk

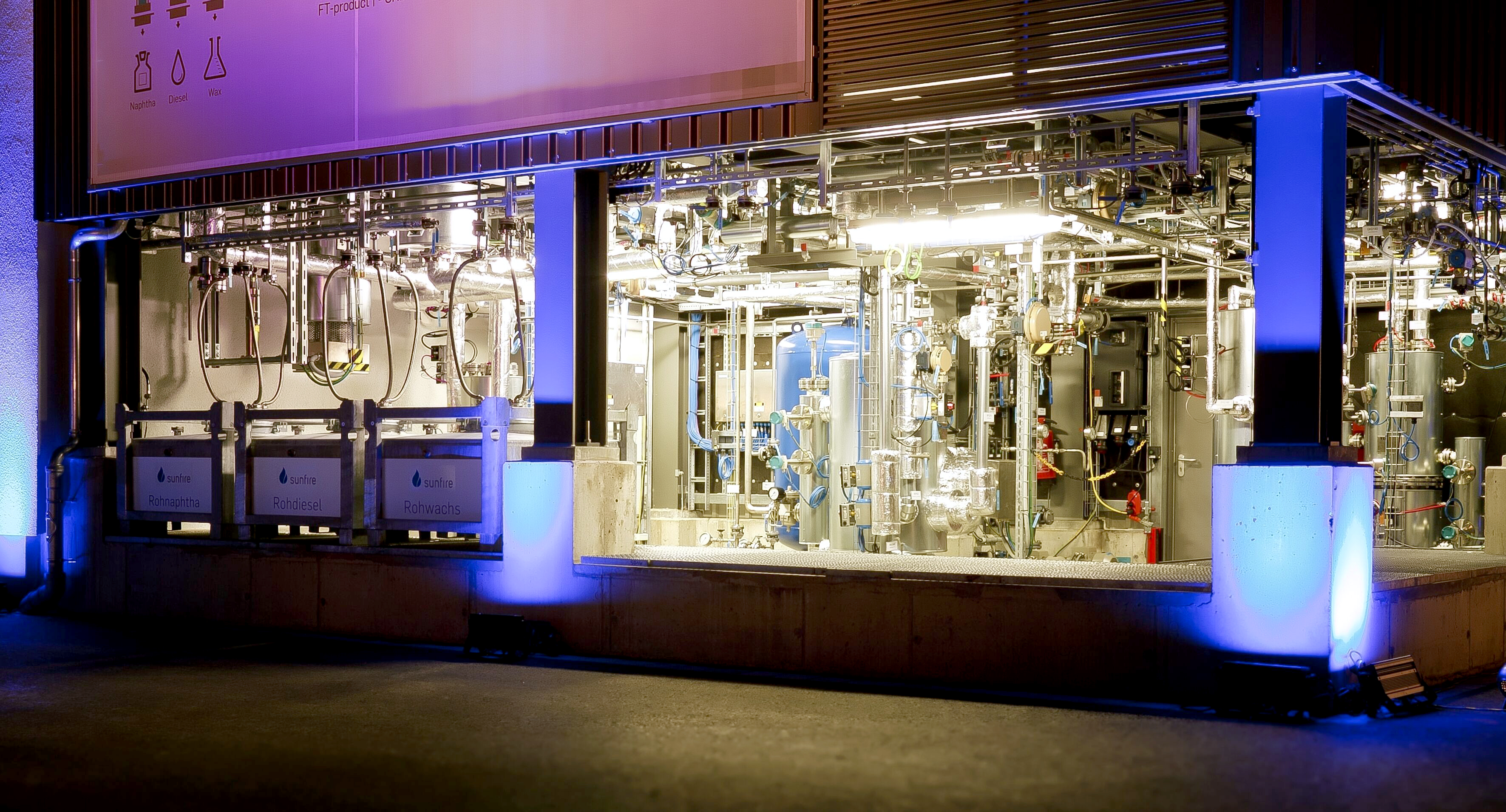

Photo credit: Electrolysis facility: Sunfire GmbH, Dresden / renedeutscher.de

While wind and solar power sources have outpaced early projections in terms of cost reductions and share of power generation (Comello et al., 2018; Kök et al., 2018), two challenges remain unsolved in the transition to a decarbonized economy. First, the production of electricity depends on intermittent weather conditions and, second, decarbonization measures must include other sectors, especially, transportation and industrial processes. A promising solution could be new Power-to-Gas (PtG) technology. By converting and reconverting electricity to hydrogen (Buttler and Spliethoff, 2018), reversible PtG can effectively store electricity at large scale and provide a clean energy carrier (hydrogen) to processes that are otherwise difficult to decarbonize (Davis et al., 2018). One objective of this paper is to assess when a reversible PtG facility would be economically viable and both electricity and hydrogen competitive with fossil-based alternatives in the market.

For its economic viability, I ï¬nd that a reversible PtG facility breaks-even if and only if the average contribution margin of operation exceeds a full cost measure per unit of capacity, which I term the levelized fixed cost (LFC). The measure accounts for the upfront investment, fixed operating expenses and any tax-related cashflows. As a technology that can store electricity over time, the break-even point of reversible PtG is widely thought to rely on the volatility in power prices and the continuous switch between conversion and reconversion. While my analysis conï¬rms this tie, it shows that the ability to trade the storage medium (hydrogen) is even more important. Through access to the market, reversible PtG receives a price for hydrogen and the possibility to generate value from its conversion without the need to reconvert after prices have changed sufficiently. As a consequence, I ï¬nd that for conditions frequently observed in current markets, reversible PtG will break-even when it largely produces the one output that has the higher average price.

For the facility’s competitiveness, an investor would make use of the concept of levelized product cost, which provides a useful metric. Since levelized cost identiï¬es the lowest price required to break-even, the concept is widely used in the energy sector to ï¬nd the cheapest power generation technology to serve a particular load that results from, say, insufficient renewable production (MIT, 2007). Measuring the competitiveness of electricity and hydrogen generated with reversible PtG requires an investor to allocate joint costs cross-sectionally and to find the allocation at the break-even point of the facility. Here my analysis shows that the cost allocation emerges as a main driver of competitiveness as the economics of reversible PtG divide the sizable joint costs into a large and a small share. With the shift to renewable energy, I ï¬nd that the small share will be allocated to electricity which enables a competitive levelized cost despite the high cost for the new technology and using hydrogen as a fuel.

The empirical part of the paper seeks to assess the economic prospects for reversible PtG in Germany and Texas, two jurisdictions that have exhibited a rapid growth of renewables (IEA, 2017). Given the current market environment, the numerical evaluations yield that reversible PtG breaks-even only if the average price of hydrogen is above the price of electricity and the facility largely produces hydrogen. To break-even on largely electricity production, the price of hydrogen would have to be negative to generate a contribution margin at the current electricity price that exceeds the high cost of capacity. With regard to competitiveness, the calculations show that electricity and hydrogen are, in both jurisdictions, only competitive in niche applications. Hydrogen, for instance, is competitive at small- and medium-scale but not with the lower prices paid for large-scale supply of industrial hydrogen produced from fossil fuels.

Incorporating recent market trends, the calculations line out a trajectory for reversible PtG that corroborates its promising potential for solving the challenges of intermittency and decarbonization. These trends include sustained cost reductions, efficiency improvements, and that reversible PtG is integrated vertically with a co-located wind energy source to beneï¬t from operational synergies. Due to these synergies, hydrogen produced with reversible PtG becomes competitive with large-scale industrial hydrogen supply already in the current market. Electricity production remains presently more expensive but is likely to become cheaper than conventional power generators over the coming decade.

References

Comello, Stephen, Stefan Reichelstein, Anshuman Sahoo. 2018. The road ahead for solar PV power. Renewable and Sustainable Energy Reviews 92(April) 744–756. doi:10.1016/j.rser.2018.04.098.

Kök, A Gürhan, Kevin Shang, Safak Yücel. 2018. Impact of Electricity Pricing Policies on Renewable Energy Investments and Carbon Emissions. Management Science 64(1) 131–148.

Buttler, Alexander, Hartmut Spliethoff. 2018. Current status of water electrolysis for energy storage, grid balancing and sector coupling via power-to-gas and power-to-liquids: A review. Renewable and Sustainable Energy Reviews 82(February) 2440–2454. doi:10.1016/j.rser.2017.09.003.

Davis, Steven J, Nathan S Lewis, Matthew Shaner, Sonia Aggarwal, Doug Arent, Inˆes L Azevedo, Sally M Benson, Thomas Bradley, Jack Brouwer, Yet-Ming Chiang, Christopher T M Clack, Armond Cohen, Stephen Doig, Jae Edmonds, Paul Fennell, Christopher B Field, Bryan Hannegan, Bri-Mathias Hodge, Martin I Hoffert, Eric Ingersoll, Paulina Jaramillo, Klaus S Lackner, Katharine J Mach, Michael Mastrandrea, Joan Ogden, F Peterson, Daniel L Sanchez, Daniel Sperling, Joseph Stagner, Jessika E Trancik, Chi-Jen Yang, Ken Caldeira. 2018. Net-zero emissions energy systems. Science 9793(June). doi: 10.1126/science.aas9793.

MIT. 2007. The Future of Coal: Options for a Carbon-Constrained World. Tech. Rep. ISBN 978-0-61514092-6, Massachusetts Institute of Technology, Cambridge, MA.

IEA. 2017. CO2 Emissions from Fuel Combustion 2017 – Highlights. International Energy Agency 1 1–162. doi:10.1787/co2 fuel-2017-en.

Further Reading: CEEPR WP 2019-007