Michael Grubb and David Newbery

Until 1990, the UK – like many other countries – had an electricity system that was centralised, state-owned, and dominated almost entirely by coal and nuclear power generation. The privatisation of the system that year with the creation of a competitive electricity market attracted global interest, helping to set a path which many have followed.

Two decades later, however, the UK government embarked on a radical reform which some critics described as a return to central planning. The UK’s Electricity Market Reform (EMR), enacted in 2013, has been a topic of intense debate, and global interest in the motivations, components, and consequences.

This report1 summarises the evolution of UK electricity policy since 1990 and explains the EMR in context: its origins, rationales, characteristics, and results to date. We explain why the EMR is a consequence of fundamental and growing problems with the form of liberalisation adopted, particularly after 2000, combined with the growing imperative to maintain system security and cut CO2 emissions, whilst delivering affordable electricity prices.

The fifteen years after privatisation, coinciding with the era of low fossil fuel prices, had seen mostly falling electricity bills; from about 2004 they started to rise sharply, for multiple reasons including increasing fossil fuel prices, the need for new investment in both generation and transmission, and inefficient ways of promoting renewable energy.

The EMR comprises four instruments: fixed-price contracts for zero-carbon sources (defined as contracts-for-difference on the electricity price, lasting 15 years for renewables); a whole-system capacity market (paying a fixed £/kW/yr for firm power); a minimum or top-up price on CO2 emissions; and an emissions performance standard which in effect bans new coal plants. The first two are implemented through competitive auctions, for amounts defined, respectively, by targets for renewable energy (for the CfDs) and the estimated capacity needed to ensure system security (for capacity market volumes).

These four instruments have indeed combined to revolutionise the sector; they have also both drawn on, and helped to spur, a period of unprecedented technological and structural change. Competitive auctions for both firm capacity and renewable energy have seen prices far lower than predicted. The fixed-price contracts for renewables are estimated to have reduced financing costs to little over 3%/yr, which would save over £2bn/yr on the cost of financing the projected renewables investments2, compared to the previous support system; the most recent auction saw contracted prices even for offshore wind tumbling to less than £60/MWh.

Rather than the expected new combined cycle gas plants, smaller scale decentralised generation – and most recently storage – has been the main beneficiary of the Capacity market, though this has highlighted complexities in design and pricing elsewhere in the system.

The minimum carbon price has brought cleaner gas to the fore, displacing coal to the margin. Electricity prices may have peaked from 2015, with energy efficiency helping to lower overall consumer bills.

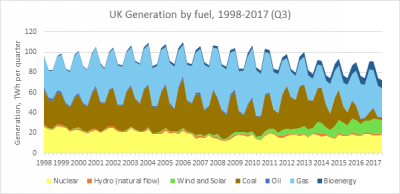

New forms of generation have expanded rapidly at all scales of the system. Renewable electricity in particular has grown from under 5% of generation in 2010, to almost 25% by 2016, and is projected to reach over 30% by 2020 despite a political de-facto ban on the cheapest bulk renewable, of onshore wind energy. The environmental consequences overall have been dramatic: coal generation has shrunk from about 2/3rd of generation in 1990, to 35% in 2000, to 10% in 2016, halving CO2 emissions from power generation over the quarter century.

Neither the technological nor regulatory transitions are complete, and the results to date highlight other challenges. Pushing coal to the price-setting margin cuts emissions but initially exacerbates the impact of carbon prices on electricity prices; revenues are returned to internationally exposed major industrial consumers3, and the impact will declline as coal retreats (and coal is due to be phased out entirely by 2025).The Capacity mechanism has proved ill-suited to encouraging demand-side response, at least initially, and in combination with the growing share of renewables, has underlined problems in transmission pricing. As the share of variable renewables grows further, the associated contracts will require reform to improve siting efficiency and avoid adverse impacts on the wholesale market.

Thus the results to date show that EMR is a step forwards, not backwards; but it is not the end of the story.

Figure 1: UK Quarterly Electricity Generation by Fuel Type, 1998-2017 (Q3)

Source: Energy Trends, various years

References

1 Grubb, M., and D. Newbery, 2018, “UK Electricity Market Reform and the Energy Transition: Emerging Lessons.” MIT CEEPR Working Paper 2018-004.

2 Newbery, D.M., 2016. ‘Towards a green energy economy? The EU Energy Union’s transition to a low-carbon zero subsidy electricity system – lessons from the UK’s Electricity Market Reform.’ Applied Energy, 179, 1321–1330. Available at http://dx.doi.org/10.1016/j.apenergy.2016.01.046.

3 Grubb M. and P.Drummond, 2018. UK Industrial electricity prices: competitiveness in a low carbon world https://www.ucl.ac.uk/bartlett/sustainable/sites/bartlett/files/uk_industrial_electricity_prices_-_competitiveness_in_a_low_carbon_world.pdf

Further Reading: CEEPR WP 2018-004