CEEPR Working Paper 2020-005, March 2020

Magnus Korpås and Audun Botterud

Variable Renewable Energy (VRE) technologies are now deployed at an accelerated phase in electricity markets all over the world. Up to now, investments in these resources have been driven, to a large extent, by different subsidy schemes. However, in the last few years, the cost for field-ready VRE installations has declined so fast that in more and more areas, onshore wind and utility-scale solar have become competitive with conventional generation without any form of subsidy. In a future where VRE is the cheapest technology, calculated in terms of lifetime costs of kWh delivered, current electricity markets are challenged if no changes to their design take place. First and foremost, this is due to the well-known merit-order effect which expresses that conventional generators with higher marginal costs are dispatched less and potentially pushed out of the market as more low or zero marginal cost VRE enters the system and reduce the average short-term price in the electricity market. Moreover, the merit-order effect will also impact the deployment of VRE as long as they receive no subsidies and must rely on short-term electricity prices in the electricity market to cover their expenses.

In this research, we derive simple but generally valid cost recovery conditions for VRE and thermal generators in energy-only markets with scarcity pricing. Under a set of assumptions, we show that all generators, including VRE, recover their costs by traditional marginal cost pricing and that this results in an optimal generation capacity portfolio for the system. This implies that the merit-order effect of VRE may not be a problem for efficient development and operation of the power market as such, but it will have an impact on the amount of thermal generation capacity that is needed in the system. We further investigate the implications of introducing energy storage systems (ESS) in the market since in particular batteries have experienced tremendous cost reductions in the last years and are expected to be cost-competitive for different grid applications in the near future.

We take an analytical approach to study market equilibrium in competitive low-carbon electricity markets. We first derive analytical expressions for the optimality conditions for thermal generators, VRE and EES where the objective is to minimize the total cost of meeting a hourly demands over a year. We then show how profit maximization of each generation and storage resource in a market based on marginal cost pricing and administrative scarcity pricing can give the same results as the optimal investment portfolio under system cost minimization. This result also applies to cases where surplus VRE gives periods with zero prices, and cases where EES sets the price either based on the marginal cost of charging or the marginal value of discharge, depending on the instantaneous power balance.

Our analytical results show that when EES is used for charging excess VRE that otherwise would have been curtailed, it triggers more VRE capacity in the long run. This is because the EES creates a new price segment based on the marginal value of storage, where the VRE gains additional profits. This result has important implications for the electricity market: 1) EES pushes more thermal capacity out of the market, both because of its balancing ability and because it triggers more investments in VRE, 2) EES leads to lower total amounts of curtailed VRE in equilibrium, although it triggers more VRE investments.

We verify the analytical findings through a numerical example, which shows that the analytic model gives identical results to a standard capacity expansion model with sequential operation of the generation and ESS units. The numerical example is based on data and scenarios for the European power system in 2050. Our case study results indicate that EES can trigger substantial new VRE investments, and thus have an important role in lowering the CO2-emissions from power systems operated under a competitive market regime. The results also indicate that the impact of EES on average system costs are much less prominent than on CO2-emissions, even with high carbon prices in line with low-carbon scenarios for Europe in 2050. How a marginal economic benefit will impact the willingness to invest in merchant EES in electricity markets is an important topic for further analyses.

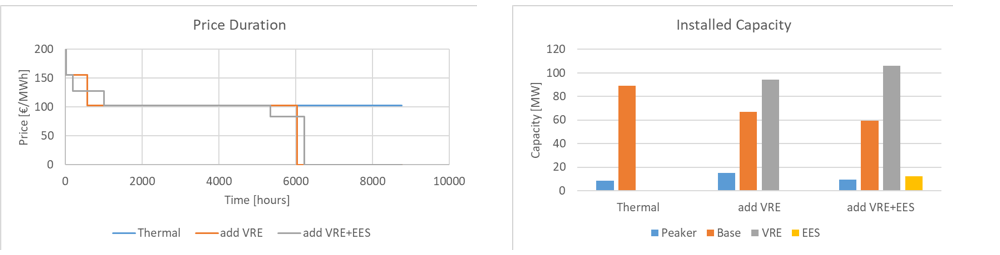

Figure: Example of price segments and optimal plant capacities derived from the analytical model.

Optimal investment in VRE gives many hours with zero price and pushes thermal baseload capacity out of the market. Adding competitive EES creates new price segments based on the value of stored energy, and therefore triggers more VRE capacity in optimum. All technologies recover their costs in all three cases, with average costs of 115 €/MWh (Thermal), 81.6 €/MWh (add VRE), and 81.4 €/MWh (add VRE+EES).

References

Korpås M. and A. Botterud, 2020, “ Optimality Conditions and Cost Recovery in Electricity Markets with Variable Renewable Energy and Energy Storage.” MIT CEEPR Working Paper 2020-05.

Further Reading: CEEPR WP 2020-005