CEEPR Working Paper

2022-018, November 2022

Aaron Schwartz, Jack Morris, and Dharik Mallapragada

An increasing number of public and private actors have announced “net-zero” emissions targets by mid-century. In the electricity sector, the United States’ second largest source of carbon emissions as of 2020,1 achieving net-zero goals will require transitioning from today’s fossil-dominated resource mix to one with substantially fewer emissions while providing reliable power for an increasing number of electrified end-uses, such as electric vehicles and heat pumps. Although the transition from coal to natural gas has driven 65% of the decline of U.S. power sector emissions from 2005 to 2019,2 it is unclear what role natural gas generation may play in the future generation mix, when achieving power-sector net-zero goals require rapid and sustained declines in emissions.

This study focuses on the American Southeast (which, for the purposes of this study, includes Tennessee, Mississippi, North Carolina, South Carolina, Alabama, Georgia, and Florida) which is responsible for about 20% of the nation’s electric power sector emissions3 and hosts several utilities which have announced plans to operate at net-zero by mid-century.4 Unlike much of the United States, the Southeast is dominated by vertically-integrated utilities, which perform centralized grid planning and make their own decisions about which generation resources they aim to procure through integrated grid planning processes. We use a capacity expansion model that mimics this central planner perspective, along with perfect foresight, to estimate least-cost resource portfolios over five-year increments spanning 2020 through 2045 across several technology cost, emissions, and policy scenarios. To reflect the increase in load anticipated to accompany increased electrification of end-uses over the coming decades, load forecasts across all scenarios are derived from the “High” electrification scenario from NREL’s Electrification Futures Study.5 Under this scenario, the system’s peak load increased from 151 to 263 GW in 2020 to 2045.

All scenarios included some deployment of new natural gas, with totals across all planning periods ranging from 43 GW when using a low-end cost forecast for variable renewable energy and storage resources, to 81 GW when we assume that all existing nuclear plants (33 GW in 2020) in the region fail to receive second-lifetime extensions and retire at the end of their current license. However, this is dwarfed by the deployment of new VRE capacity; across scenarios, combined new wind and solar capacity range from 345-489 GW, and new storage capacity ranges from 72-118 GW. The deployment of natural gas with CCS (with 90% flue gas CO2 capture) is sensitive to the emissions reduction pathway being modeled; natural gas with CCS doesn’t appear in any scenarios under the least restrictive emissions constraints, but appears in all but one scenario featuring the most restrictive. The exception – a scenario where upstream methane emissions are counted towards the emissions budget – suggests that the scope of emissions encompassed by net-zero goals may have meaningful implications for the types of technologies needed to meet those goals.

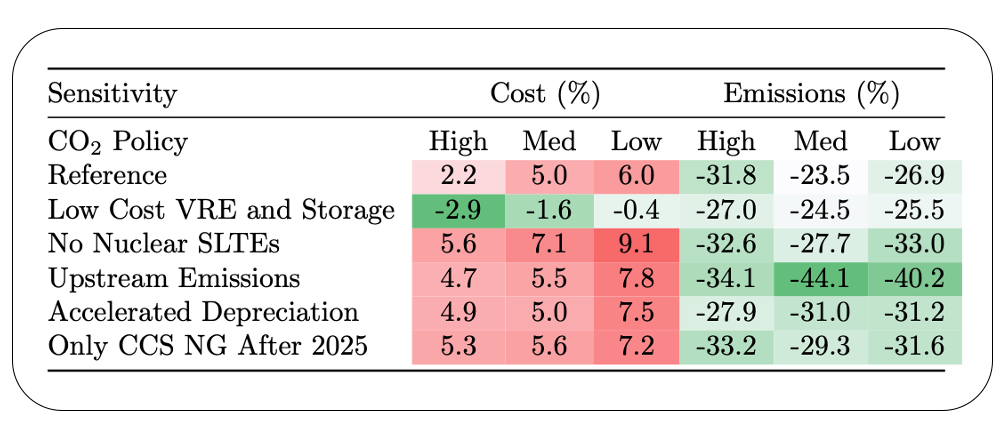

A surprising result of our analysis was that increasing the stringency of the emissions limits did not necessarily result in a decrease in total, cumulative emissions over the planning horizon. In four of the six scenarios considered in our analysis (rows in Table 1), systems costs and cumulative CO2 emissions are lower for the least restrictive (“High”) emissions policy compared to the most restrictive (“Low”) policy. This is attributed to greater utilization of existing coal generation in early model periods under the Low emissions policy, since it is uneconomic to replace existing coal with new gas capacity that would see little future use given the tight emissions budget. This result suggests that a balanced view of near-term and long-term emissions reduction would be prudent in regions with significant existing coal generation.

Finally, all else remaining equal, we find that policies discouraging new natural gas deployment, such as accelerated depreciation timelines and disallowing new gas without CCS after 2025, generally lead to greater cumulative emissions reduction compared to the corresponding scenarios without these policies, along with a marginal increase in systems costs (see the bottom two rows in Table 1). Such policies make it attractive to support early build out of natural gas generation to displace coal generation in the near term, while at the same time limiting cumulative new natural gas deployment in a way that minimizes asset stranding in future years with increasingly stringent emissions constraints. At the same time, it should also be noted that natural gas resources will likely operate differently in a low-carbon power system. We observe steep declines in natural gas capacity factors over time across scenarios, indicating a changing role for natural gas plant operation focused primarily on system reliability.

Table 1. Changes in net present cost and cumulative emissions with respect to a reference case without any emissions limits.

References

1) https://www.epa.gov/ghgemissions/sources-greenhouse-gas-emissions

2) https://www.eia.gov/todayinenergy/detail.php?id=48296

3) https://www.eia.gov/environment/emissions/state/

4) For example, see https://www.southerncompany.com/content/dam/southerncompany/pdfs/clean-energy/Net-zero-report.pdf and

https://www.duke-energy.com/_/media/pdfs/our-company/climate-report-2020.pdf

5) https://www.nrel.gov/analysis/electrification-futures.html