Christiane Baumeister and Lutz Kilian

Between June 2014 and March 2016, the inflation-adjusted price of oil dropped by 66%, yet average U.S. economic growth accelerated only slightly from 1.8% at annual rates before the oil price decline to 2.2% thereafter. The fact that this decline in the price of oil failed to translate into faster U.S. economic growth has puzzled many observers who expected lower oil prices to create a boom in the U.S. economy. In a recent CEEPR Working Paper, Christiane Baumeister of the University of Notre Dame and Lutz Kilian of the University of Michigan explain why this result is not a puzzle, but is in fact consistent with the predictions of conventional models of the transmission of oil price shocks.

As Baumeister and Kilian show, the traditional view in undergraduate textbooks that lower oil prices stimulate the economy by lowering the cost of producing domestic goods and services is at odds with the data. Not only are there few industries that heavily depend on oil as a factor of production (such as the transportation sector or rubber and plastics producers), but the stock returns for those industries increased only slightly more than the overall stock market after June 2014, if at all.

In contrast, the stock returns of industries whose demand depends on the price of oil (such as tourism and retail sales) have been far above average stock returns. This evidence is supportive of the view that that the primary channel through which unexpected oil price declines are transmitted has been higher demand for domestic goods and services. For example, consumers faced with a windfall gain in income caused by unexpectedly low gasoline prices will spend most of this extra income, stimulating economic growth via a Keynesian multiplier effect.

Recently, there has been much debate about whether lower gasoline prices may have failed to stimulate domestic spending this time. One concern has been that the decline in the price of oil may not have been passed on to retail motor fuel prices, but it can be shown that these cost savings were fully passed on by refiners and gasoline distributors. Another conjecture has been that consumers chose to pay back credit card debt or to increase their savings rather than spending their extra income, but this hypothesis is not supported by the data either. Nor is there support for the notion that increased uncertainty about gasoline prices has depressed automobile demand, slowing overall consumption growth.

As Baumeister and Kilian show, this debate ignores that there actually has been a remarkable increase in private consumption since June 2014. Average real consumption growth accelerated from an average annual rate of 1.9% to 2.9% between the third quester of 2014 and the first quarter of 2016. The authors demonstrate that U.S. consumer spending increased about as much as predicted by conventional models of the effect of lower gasoline prices on U.S. consumption.

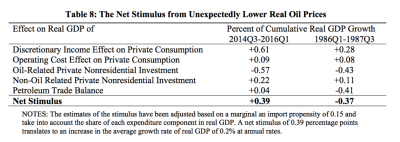

Why then did U.S. real GDP growth remain so sluggish? Given that the U.S. produces about half of the crude oil that it consumes, Baumeister and Kilian stress that in assessing the overall stimulus to spending we also must take into account the response of domestic oil producers to lower oil prices. They demonstrate that there has been a dramatic drop in U.S. oil-related nonresidential investment in response to the decline in the price of oil, which largely offset the consumption stimulus, resulting in a net stimulus for the U.S. economy close to zero.

This type of response is by no means unprecedented. The authors make a point of comparing the most recent oil price drop with events in late 1985, when a shift in Saudi policies caused a large and sustained decline in the global price of oil in 1986, resulting in an increase in private consumption and a decline in oil-related nonresidential investment – much like today. The main difference between now and then is that the decline in oil-related investment after June 2014 was about twice as large. The magnitude of this decline is not surprising upon reflection, Baumeister and Kilian argue, because the cumulative decline in the price of oil after June 2014 was also twice as large as that after December 1985, while the share of oil and gas extraction in GDP was about the same in 2014 as in 1985 (see table below).

Much has been made of the increased importance of shale oil for the effects of the recent oil price decline on the U.S. economy. For example, it has been suggested that bad oil loans may have caused fears of contagion in the banking sector undermining financial intermediation not unlike bad mortgages during the housing crisis. Baumeister and Kilian show that there is no empirical support for this view. It has also been argued that declines in investments by the oil sector may have spilled over to other investment expenditures. There is no empirical support for this view either. More generally, the case has been made that lower growth in the oil-producing states (Alaska, Montana, New Mexico, North Dakota, Oklahoma, Texas and Wyoming) has dragged down overall U.S. economic growth. These effects can be shown to be too small to matter, however. Yet another argument has been that frictions in reallocating workers from the oil sector to other sectors may have caused higher U.S. unemployment. This view is not only hard to reconcile with the continued rapid decline in the overall U.S. unemployment rate, but there is evidence that even in most oil-producing states the unemployment rate has been declining, and that these declines cannot be explained simply by migration away from oil-producing states.

This does not mean that the U.S. shale oil boom did not matter for the response of the U.S. economy. Clearly, without this boom, the share of oil and gas extraction in GDP, which in 2014 was almost the same as in 1985, would have been much lower and the sharp decline in oil-related investment would have mattered less for U.S. real GDP growth. There is also evidence that the recent oil price decline was not met by increased oil imports, as occurred in 1986, given the ready availability of shale oil, which allowed real GDP to remain higher.

This is not the only difference, however. The authors point out that the oil price drop in 1986 was caused by developments in the global oil market alone, whereas in 2014-15, it was in part associated with a global economic slowdown which is reflected in a lower average growth in U.S. real exports (see, e.g., Baumeister and Kilian 20162). Had U.S. real exports continued to grow at the same average annual rate of 3.2 percent as between the first quarter of 2012 and the second quarter of 2014, Baumeister and Kilian note, average U.S. real GDP growth after mid-2014 would have – all else equal – increased by 0.3 percentage points to 2.5 percent (up from 1.8 percent on average between 2012 and mid-2014).