John Birge, Ali Hortaçsu, Ignacia Mercadal, and Michael Pavlin

Though financial players in commodity markets are expected to improve market performance, manipulation scandals and higher prices attributed to their trading have made their role controversial and lead to proposals to restrict their activity. This paper studies the case of the Midwest electricity market, which allows the participation of purely financial firms like most North American deregulated markets.

Electricity generation is cheaper when it is planned, because supply needs to continuously meet a stochastic demand and adjusting production levels is costly. For this reason, most electricity markets are organized as sequential markets: There is first a forward market that schedules production a day in advance, and then a spot market to adjust unexpected shocks right before operation. The market is more efficient when the forward and spot prices are on average similar, sending accurate signals for generation planning. Nonetheless, a forward premium has been documented in several markets around the world, i.e. the forward price is on average larger than the spot.

Financial or virtual players have been introduced to arbitrage this forward premium. Firms buy or sell in the forward market, and then their transaction is reversed in the spot, i.e. buying 1MWh in the forward market requires to sell it in the spot. Saravia (2003) and Jha and Wolak (2013) have shown that after financial players were introduced in New York and California, respectively, the forward premium went down, as did production costs and emissions. By contrast, in the Midwest the forward price was consistently larger than the spot price in 2010, despite the presence of financial traders since the market opened in 2005. The first part of this paper investigates whether financial traders have an effect on the premium. Because a larger premium attracts more financial traders, this effect cannot be determined by just looking at the correlation between financial transactions and the premium. Instead, we use two variables that affected the volume of financial transactions, but are unlikely to be related to the premium, in order to isolate the effect. The first is a measure of perceived financial risk that increased during the financial crisis, and the second is a regulatory change that imposed large transaction costs on financial traders.

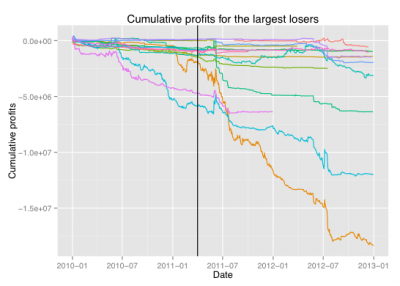

We find that financial traders seem to contribute to lower the forward premium, but the effect is not robust. A deeper exploration of virtual bidders’ behavior indicates that some players were not acting as expected. In spite of the forward premium, there were more virtual purchases than sales in the forward market. As these transactions entail buying at the forward price and selling at the spot, they bet on the wrong direction and we would expect them to yield negative profits. In fact, some traders consistently lost money over time without leaving the market. This can be observed in the figure below, which pictures the profits of the ten largest losers.

The surprising behavior of some traders can be rationalized once we consider the closely related market for financial transmission rights (FTRs), financial instruments that pay based on local price differences in the forward market. Prices differ across locations because limited transmission does not always allow to bring electricity to where it is demanded. FTRs allow firms to bet on local price differences, either to arbitrage or to hedge. Virtual demand bids can be used to increase the value of FTRs: By increasing demand at a given location, price will raise when there is not enough transmission capacity to bring enough energy to cover demand. The difference between local prices will increase, as will the FTR’s payoff, even after considering the losses from virtual purchases in the presence of a forward premium.

Consistently with this hypothesis, we find that virtual bids and FTRs are correlated. Moreover, evidence is consistent with market manipulation only during the period in which the regulator imposed high transaction costs on financial participants. These charges restricted competition between traders, making manipulation possible. Our findings point out to the importance of competition between financial traders, as opposed to restricting their participation, as a mean to avoid manipulation and increase market efficiency.

References

Severin Borenstein, James Bushnell, Christopher R. Knittel, and Catherine Wolfram (2008). “Inefficiencies and Market Power in Financial Arbitrage: A Study of California’s Electricity Markets.” The Journal of Industrial Economics, 56(2): 347–378.

Nicholas Bowden, Su Hu, and James Payne (2009). “Day-ahead Premiums on the Midwest ISO.” The Electricity Journal, 22(2): 64–73.

Koichiro Ito and Mar Reguant (2016). “Sequential Markets, Market Power, and Arbitrage.” American Economic Review, 106(7): 1921-57.

Akshaya Jha and Frank A Wolak (2013). Testing for Market Efficiency with Transactions Costs: An Application to Convergence Bidding in Wholesale Electricity Markets, URL https://arefiles.ucdavis.edu/uploads/filer_public/2014/03/27/caiso_vb_draft_v8.pdf.

John E. Parsons, Cathleen Colbert, Jeremy Larrieu, Taylor Martin, and Erin Mastrangelo (2015). Financial Arbitrage and Efficient Dispatch in Wholesale Electricity Markets. MIT Center for Energy and Environmental Policy Research Working Paper 15-002.

Celeste Saravia (2003). Speculative Trading and Market Performance: The Effect of Arbitrageurs on Efficiency and Market Power in the New York Electricity Market. URL http: //www.escholarship.org/uc/item/0mx44472.

Further Reading: CEEPR WP 2017-003