CEEPR Working Paper

2021-020, December 2021

Ömer Karaduman

Wind energy plays a critical role in reducing greenhouse gas emissions by providing carbon-free and low marginal cost energy. In 2018, a quarter of all additional power capacity in the world was wind energy, and it is expected to become one of the dominant sources of power in the next couple of decades. As wind generators produce clean electricity, it offsets some thermal generators’ production. The substitution patterns of wind generation effectively determine its environmental value.

As more wind energy is deployed, it should be accompanied by the retirement of high carbon emitter thermal power plants to achieve higher decarbonization. In 2018 wind generation only accounts for 5% of world electricity consumption. Nevertheless, increasing wind generation is already affecting generators’ revenue in the wholesale market by lowering the prices due to its low marginal cost. Understanding this revenue impact of renewable generation is essential for determining the path for decarbonization in the future.

In this paper, I ask what the substitution patterns for large-scale wind generation are and how they affect existing firms’ revenues. To answer this question, I use Karaduman (2021)’s framework to quantify the potential effects of large-scale wind generation in the wholesale electricity market. My model uses data from an electricity market to simulate the equilibrium effects of a wind capacity expansion in electricity markets. I account for the price impact of wind generation and find a new market equilibrium in which I allow incumbent firms to respond to wind capacity increases.

To model firms’ decisions, I represent the electricity market as a multi-unit uniform price auction. Each day, before the auction, firms observe a public signal containing information such as publicly available demand and renewable production forecasts. They then bid into the electricity market a day ahead of the actual production. I simulated wind generation and modeled it as a decrease in demand for a given wind generation profile. I estimate incumbent firms’ best responses to this shift in demand by using observed variation in demand and renewable production in a market without wind expansion. In this research, I use South Australia Electricity Market data from 2017 -2018. In the observed period, almost 35% generation comes from wind energy, one of the highest wind energy ratios among electricity markets. The current high penetration level creates a considerable variation in residual demand, which helps my model recover firms’ best responses.

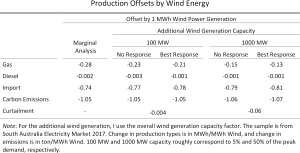

First, I compare offset by wind patterns with reduced form analysis for different wind expansion scenarios. I decompose offsets by the wind into two parts, merit order effect, due to price change, and market power effect, due to market power change. For small-sized wind expansion, my model give similar results to the literature on marginal impact, as market power changes are insignificant. However, as the new wind generator’s capacity increases, marginal units that new wind generation offsets change, and the market power effect amplify the difference between estimates of my model and marginal approach Surprisingly, I find a similar carbon emission decrease with both models, 1.05 tons per MWh.

Next, I evaluate substitution patterns for wind generation at a much larger scale, up to 100% of the market generation capacity. South Australia trades with its neighbor region Victoria, which has a lot of brown coal generation. For a low level of wind generation investment, gas power plants with flexible technologies adjust their strategies and do not get replaced by wind generation much. Most of the renewable generation is exported to Victoria to replace brown coal. However, as the penetration level increases, the transmission between the two regions gets congested, and almost half of the renewable production gets curtailed. On the other hand, all other power plants’ production in South Australia is cut almost half. In terms of emissions, large-scale wind generation cuts South Australia’s carbon emissions by 60% and two times more in terms of tons in Victoria.

The impact of wind generation on different generators’ revenue varies a lot at different expansion scales. For small capacity expansion, generators with flexible technologies lose the least by adjusting their bids. However, as the penetration level increases, wind generation suppresses prices, and flexible but high-cost generators stop producing. Some gas technologies lose up to 90 percent of their revenue. The existing wind generation gets the most considerable reduction in revenue and loses up to 91% of its revenue. These results have some policy implications. In a pathway with an aggressive wind capacity target, low carbon emitting generators may exit due to price reduction. On the other hand, as new renewable generation cannibalizes existing renewable technologies, it can be more costly to incentivize further investment in renewable technologies.

Lastly, I find that wind project production differs from each other based on their capacity factor, and this can affect the potential value of a wind generation investment. I look for potential heterogeneity between 18 existing wind projects in South Australia, and I find a significant dispersion in projects’ price effects, 35%, and revenue effects, 30%. This heterogeneity leads to a policy discussion. If a policymaker has a particular concern about the capacity, price impact, or revenue impact of a project, a policy must differentiate between competing investments to ensure that the socially optimal renewable investments are made.

References

Karaduman, Ömer (2021)“Large Scale Wind Power Investment’s Impact on Wholesale Electricity Markets,” MIT CEEPR Working Paper 2021-020, December 2021.

Karaduman, Ömer (2021)“Economics of Grid-Scale Energy Storage in Wholesale Electricity Markets,” MIT CEEPR Working Paper 2021-005, February 2021.