CEEPR Working Paper

2023-06, March 2023

Santiago Andrade Aparicio

and John E. Parsons

A nuclear battery is a stand-alone, plug-and-play energy platform combining a micro-reactor of 1-20 megawatts electric and a turbine to supply electricity and heat from a very small footprint. The development of nuclear batteries opens up new opportunities for the utilization of nuclear power. Its small size and portability enable delivery of energy off-grid, for example to remote communities or mines. Its inherent safety combined with its energy density make it an ideal low carbon replacement for on-grid fossil fuel-fired combined heat-and-power plants and other distributed generation co-located at industrial and commercial facilities. It can be sited downstream of transmission congestion, expanding capacity for data centers, EV charging stations and other large load sources. Nuclear batteries can also be used as emergency energy sources where the grid has been temporarily disabled (Black et al. 2022).

Alongside the technological innovation required to realize the nuclear battery, innovation in the business model may also be required to drive deployment in these new use cases. The nuclear industry’s existing business model evolved around the installation and operation of very large, light water reactors supplying on-grid electricity in bulk. This paper explores how a business model for nuclear batteries may differ from the legacy nuclear model. For inspiration, we look to the business model currently used for the deployment of fossil fuel-fired distributed generators, which the nuclear battery may supplant. Some elements of that business model can be ported over to a business model for nuclear batteries. However, there are differences in the technologies that will force innovation in that model, too.

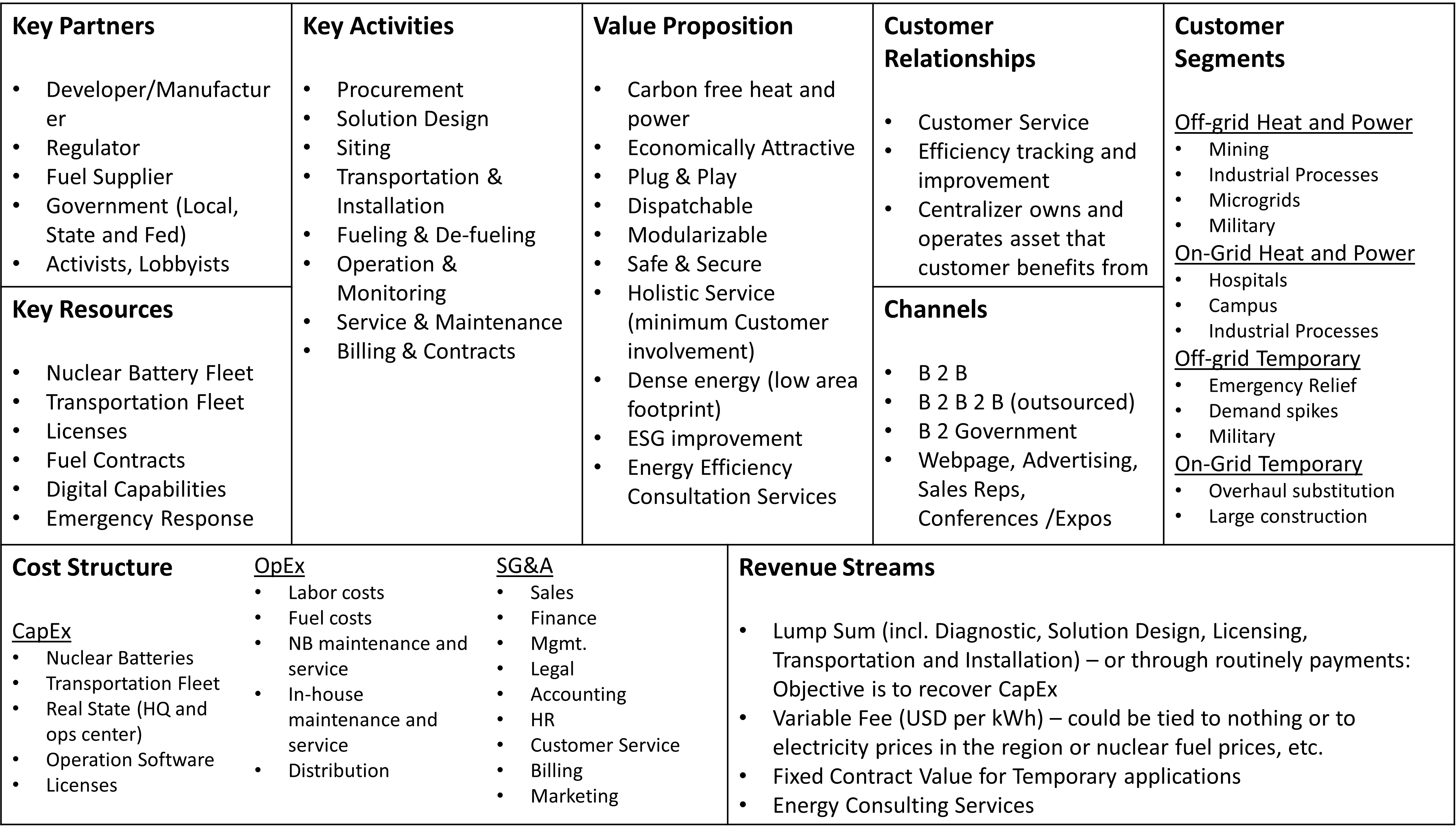

We organize our discussion of business models using the Business Model Canvas of Osterwalder and Pigneur 2010. The Canvas is composed of nine different building blocks: Key Activities, Key Partners, Key Resources, Cost Structure, Value Proposition, Customer Segments, Customer Relationships, Channels, and Revenue Streams. Together, these describe “how an organization creates, delivers and captures value.”

We draft a proposal of a business model for a nuclear battery Solution Provider company. This business model is displayed through the Business Model Canvas and is intended as a thought-generating tool for readers to reflect, critique and edit.

Key Partners: describes the network of suppliers and partners that make the business model work.

The Solution Provider and its operating model will rely heavily on partnerships with private and public entities. The Developer/Manufacturer of the nuclear battery is the single most crucial supplier. Additionally, the fuel supplier is also a critical link to the functionality of the nuclear battery. Moreover, public entities like regulators (NRC in the US), and local, state, and, federal governments, are crucial non-technical partners that will license and permit the use of nuclear batteries. Finally, the Solution Provider will also have to prioritize its relationships with activists and lobbyists to address the hurdle for nuclear energy to achieve social capital.

Key Activities: describes the most important things a company must do to make its business model work.

The Solution Provider will oversee purchasing all the equipment, diagnosing, and providing a solution to the Customer, siting the equipment, fueling the nuclear battery, and transporting it to the site. After this, the company still needs to install the nuclear battery, operate it for the duration of the agreed-upon timelines, with an incredibly high level of reliability and safety and provide monitoring of the asset.

Key Resources: describes the most important assets required to make a business model work.

Many physical assets are needed for this business to run smoothly, including a fleet of Nuclear Batteries, a transportation fleet, and fuel contracts. However, in addition to Human Capital, there are also significant non-physical resources that are crucial for the company to produce value, such as nuclear licenses and software.

Cost Structure: describes all costs incurred to operate a business model.

The costs incurred in this business fall within three categories. (1) Capital Expenditures including the purchase of the nuclear battery fleet, transportation equipment, software licenses, nuclear licenses, and real state. (2) Operational Expenditures including labor costs, fuel costs, service, and maintenance. (3) Sales, General & Administrative.

Value Proposition: describes how a company communicates with and reaches its Customer Segments to deliver a Value Proposition.

The key differentiator of this technology will be the carbon-free heat and power on-site. Its additional value propositions include an economically attractive solution that is readily deployed (plug-and-play) and that can be modularized to serve the specific Customer need. Furthermore, it poses a safe and secure holistic solution to the Customer with an incredibly small land footprint that can improve the overall Environmental, Social, and Governance metrics of the user. Finally, it can be imagined that the Solution Provider might be able to generate energy efficiency insights than can be offered to the Customer to create additional value.

Customer Relationships: describes the types of relationships a company establishes with specific Customer Segments.

This building block shares several aspects with nuclear power plants and fossil fuel-fired distributed generators. However, because in the nuclear battery enterprise assets are not owned or operated by the Customer but rather by the Solution Provider, some differences in the relationship they have are bound to happen.

Customer Segments: defines the different groups of people or organizations an enterprise aims to reach and serve.

This technology can service a variety of customers across industries and locations. We propose a four-category approach to understand better what markets are being served and which are the expected players in each segment. (1) Off-grid Heat and Power: Industries such as mining, industrial processing, military bases, and microgrids require both electricity and heat to operate. They can leverage the nuclear battery as a carbon-free source of both inputs. (2) On-grid Heat and Power: Clients such as some industrial processes, educational or corporate campuses, and hospitals require a primary system to provide clean electricity. Once they have the electricity provided by a nuclear battery, it will be more economically attractive to leverage the heating power instead of getting that resource from a different provider. (3) Off-Grid Temporary: This segment will leverage the mobility and dispatchability of the nuclear battery only for a limited amount of time. Instances of this may include emergency relief, energy demand spikes in remote areas, or military applications. (4) On-Grid Temporary: this customer base is expected to be the smallest, with applications imagined substituting power for significant overhauls of other generation sources or large construction projects.

Channels: describes how a company communicates with and reaches its Customer Segments to deliver a Value Proposition.

Business-to-business, business-to-business-to-business (out-sourced), and government partnerships are imagined to be the most prominent communication channels. Additionally, web services, sales representatives, advertising, and conference/expos attendance can be relevant to secure new partnerships and clients.

Revenue Streams: represents the cash a company generates from each Customer Segment.

The Solution Provider will generate cash in different ways depending on the type of service they provide. For example, suppose they service a mine for ten years. In that case, we can expect there to be an initial Lump Sum charged to the Customer to cover the fixed costs, plus a variable rate for the energy produced, which may or may not be tied to other variables such as nuclear fuel prices or electricity prices. On the other hand, for temporary purposes, the enterprise may simply charge a contract value to the customer. The Solution Provider will have the data to draw insights regarding energy efficiency and may sell those to the customer in a consultancy/advising package.

The challenge of decarbonization will require deployment of a variety of new technologies such as nuclear batteries. The technological changes must be accompanied by changes to the business models used to deploy these technologies. The business model discussed here for nuclear batteries needs to be fleshed out in a variety of ways. Significant research and understanding need to happen on the regulation side that focuses on the licensing of serially manufactured reactors, the transportation of the technology, and the usage in urban settings. Additionally, a financial structure and economic analysis need to understand how and if this entity can be profitable in the expected markets.

Figure 1: Proposed business model for nuclear battery Solution Provider