CEEPR Working Paper 2020-004, March 2020

Ghislaine Lang and Bruno Lanz

In the absence of a global carbon price, individual countries often promote specific emissions abatement measures to reduce fossil fuel use. A prominent example is a widespread adoption of subsidized weatherization and energy efficiency programs in buildings. This approach to regulation implies that investment decisions determine the implicit price of carbon as the cost of reducing CO2 emissions by one tonne (Gillingham and Stock, 2018).

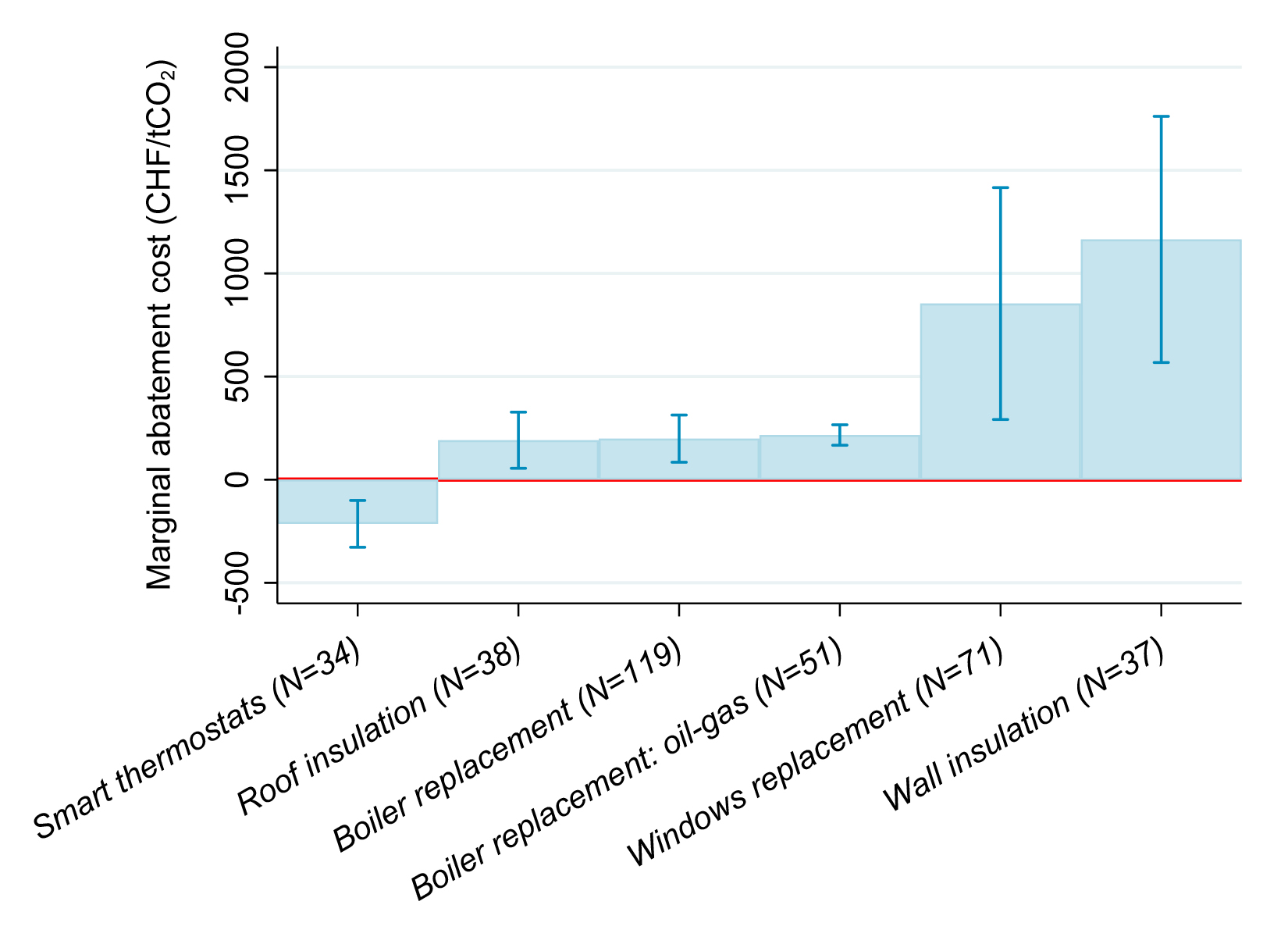

In this paper, we provide empirical evidence on the implicit carbon price of alternative energy efficiency investments, namely insulation of exterior walls, roof or attic, replacement of windows, installation of smart thermostats that optimize heating operations using real-time information (e.g., weather forecasts), and replacement of the boiler, both with and without fuel switching from heating oil to natural gas. Intuitively, we construct a statistical counterpart to the often-cited “McKinsey curve” (McKinsey & Company, 2009), ranking energy efficiency interventions from the least to the most expensive. As current policies (e.g., subsidies for wall insulation or windows replacement) typically target interventions based on expected energy savings, we also document heterogeneous effects of alternative investments on energy use.

Our data comprise a portfolio of 548 apartment buildings (12,820 rental units) observed from 2001 to 2016. During the observation period, 240 buildings benefitted from a total of 402 energy efficiency improvements. We exploit observations for the 308 buildings that experienced no energy-related intervention to form a candidate control group and estimate a counterfactual trajectory for treated buildings in the absence of interventions. In particular, the staggered nature of investments across buidlings allows us to provide evidence that treated and control buildings follow the same trend in the absence of energy efficiency investments.

In order to quantify energy savings associated with individual energy efficiency interventions, we employ a staggered difference-in-differences estimation strategy (Autor, 2003; Stevenson and Wolfers, 2006), controlling for year and buildings fixed effects, local weather shocks and fuel prices, as well as complementarity effects across interventions (Mulder et al., 2003). We then use detailed information about the financial cost of interventions to quantify the effect of a marginal investment in alternative energy efficiency improvements on building-level CO2 emissions and heating expenditures. Together with standard engineering estimates on the lifetime of building elements and a discount rate (0% or 6%), this allows us to carry out inference on the implicit price of carbon associated with alternative investments.

Our results show substantial heterogeneity in energy savings across interventions. Widely subsidized investments such as exterior wall insulation and the replacement of windows are associated with energy savings of 18 and five percent, respectively. Further, point estimates for the implicit price of carbon associated with these interventions is around CHF 1,000 per tonne of CO2, which is well above estimated benefits of avoided emissions (around USD 40/tCO2, see Greenstone et al., 2013). By contrast, evidence suggests that the implicit price of carbon associated with the installation of smart thermostats is negative, and delivers energy savings of around 10 percent. This suggests that such investments are beneficial even in the absence of externalities associated with energy use.

Taken together, heterogeneity across interventions illustrates the difficulty for policy makers to select specific abatement measures instead of relying on a carbon price. In particular, we emphasize the need for transparent information about the cost of carbon abatement associated with different policy interventions. Moreover, while our estimates are consistent with evidence derived in other settings (e.g. Fowlie et al., 2018), evidence on the implicit price of carbon is by construction context-dependent (Gillingham and Stock, 2018), and further work on the impact of specific abatement measures is warranted.

Figure: Ranking for the implicit price of carbon across interventions

The graph displays point estimates and 95% confidence intervals for estimates of the implicit price of carbon.

Prices refer to a 2015 baseline; exchange rate approx. CHF 1 = USD 1

References

Autor, D. (2003) “Outsourcing at will: The contribution of unjust dismissal doctrine to the growth of employment outsourcing,” Journal of Labor Economics, 21 (1), pp. 1–42.

Fowlie, M., M. Greenstone, and C. Wolfram (2018) “Do energy efficiency investments deliver? Evidence from the weatherization assistance program,” The Quarterly Journal of Economics, 133, 3, pp. 1597–1644.

Gillingham, K. and J. Stock (2018) “The cost of reducing greenhouse gas emissions,” Journal of Economic Perspectives, 32 (4), pp. 53–72.

Greenstone, M., E. Kopits, and A. Wolverton (2013) “Developing a social cost of carbon for US regulatory analysis: A methodology and interpretation,” Review of Environmental Economics and Policy, 7, 1, pp. 23–46.

Lang, G. and B. Lanz (2020) “Climate Policy Without a Price Signal: Evidence on the Implicit Carbon Price of Energy Efficiency in Buildings”, MIT CEEPR Working Paper 2020-004.

McKinsey & Company (2009) “Pathways to a low-carbon economy: Version 2 of the global greenhouse gas abatement cost curve.” Report.

Mulder, P., H. L. de Groot, and M. W. Hofkes (2003) “Explaining slow diffusion of energy-saving technologies: A vintage model with returns to diversity and learning-by-using,” Resource and Energy Economics, 25, 1, pp. 105–126.

Stevenson, B. and J. Wolfers (2006) “Bargaining in the shadow of the law: Divorce laws and family distress,” Quarterly Journal of Economics, 121 (1), pp. 267–288.

Further Reading: CEEPR WP 2020-004