CEEPR Working Paper 2020-010, June 2020

Bentley C. Clinton, Christopher R. Knittel, Konstantinos Metaxoglou

The stock of electric vehicles (EVs) worldwide increased by 65 percent between 2017 and 2018 to approximately 5 million total vehicles (IEA, 2019b). An expanding EV fleet represents a potentially large transition in energy demand from the established liquid transportation fuel supply network to the electricity system. The International Energy Agency estimates this transition could reduce oil demand by 2.5 to 4.3 million barrels per day and increase electricity demand by 640 to 1,110 terawatt-hours (IEA, 2019a). Such a transition requires a significant deviation from the status quo for automobile consumers and producers alike. In this chapter we take stock of the global LDV ecosystem and highlight issues and challenges likely to arise as electricity expands its role as a transportation fuel.

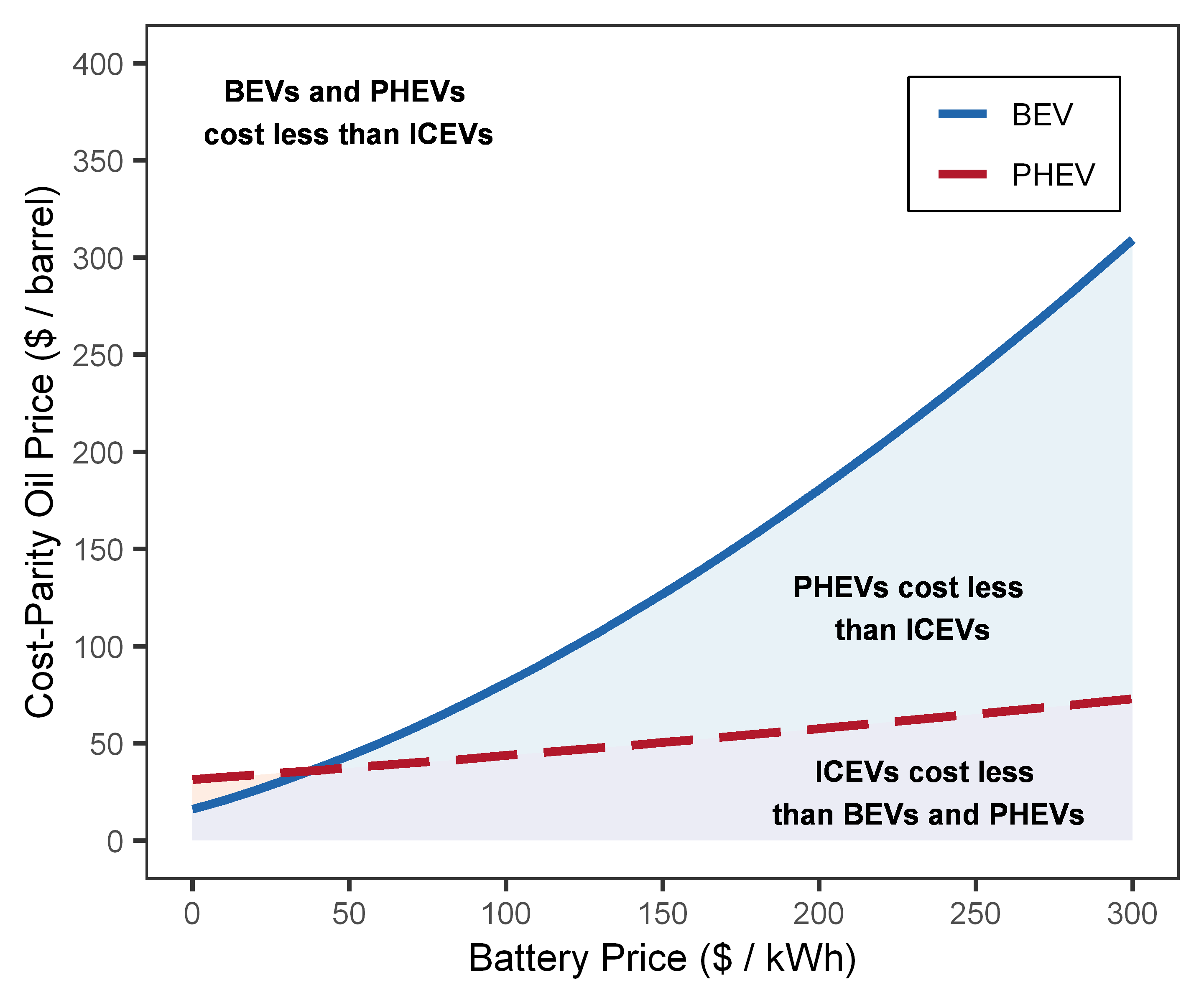

Our assessment pays particular attention to trends in vehicle stock, fuel markets, and refueling infrastructure before turning to a study of market dynamics and an analysis of catalysts and consequences of broad transportation sector electrification. Three such inquiries are: (i) a comparison of vehicle cost factors and investigation of the break-even cost relationship between oil and battery prices; (ii) an approximation of the energy demand effects for a range of LDV electrification scenarios; and, (iii) an estimate of the foregone fuel tax revenue attributable to the current EV fleet. Additionally, we discuss the benefits of EVs in the context of avoided ICEV emissions and conclude with some thoughts on electrification in other transportation sector contexts, namely, medium- and heavy-duty freight transport, and the role EVs may have in ride sharing and autonomous vehicle networks.

Break-even costs

We build on the analysis of Covert, Greenstone and Knittel (2016) to calculate the break-even price of oil for a range of battery costs. Using historical data, we map monthly crude oil prices to gasoline prices in the US and apply the resulting parameters to a model of operating costs for ICEVs and EVs. The result of this calculation is included as Figure 1. Points below the solid line represent oil price and battery price pairs where ICEVs are less expensive to operate than EVs. The opposite relationship holds for points above the line. To a first order, the relationship is close to a 1:1 mapping between oil prices and battery costs; this does not bode well for EVs. At current battery prices (approximately $160/kWh), oil prices would need to exceed $135/bbl for EVs to be cost competitive. We repeat this calculation for a number of scenarios ranging from imposition of a carbon tax to incorporation of avoided maintenance costs realized by EV owners. While these do lead to more favorable break-even cost levels, the comparison remains unfavorable to EVs at current battery and oil prices. We next modify our analysis to include assumptions unique to PHEVs (dashed line, Figure 1) and find a more favorable break-even scenario for these vehicles, though we caution this result is sensitive to baseline PHEV assumptions (see Interactive Tool Link)

Energy demand effects

We apply existing simulations of intra-day EV charging patterns from the National Renewable Energy Laboratory’s EVI-Pro tool to publicly available data on EV ownership and electricity generation infrastructure to illustrate the potential effect of LDV electrification on a select group of power systems (Wood et al., 2017, EVI-Pro data available at: https://maps.nrel.gov/cec.). Our assessment of energy and power requirements of these fleets indicates current adoption levels of EVs pose limited challenges on a grid-level scale, but the projected increases in EV adoption—and any long-term push for high-level or full electrification—will require long-range planning actions by key electricity market participants. These actions are likely to include a mixture of capacity additions, infrastructure expansion, and the introduction of load-shifting options (e.g., smart charging) and compatible incentives (e.g., time of use rates) for EV owners.

Foregone fuel tax revenues

A decline in reliance on liquid transportation fuels necessarily decreases tax revenues derived from fuel sales, all else equal. In scenarios with high levels of EV ownership, revenue shortfalls must be recouped from other sources. We explore these issues in a number of national markets and quantify the required scale of alternative revenue-generating mechanisms. Expanding on the methods of Davis and Sallee (2019) and accounting for cross-sectional variation in fuel excise tax levels, EV fleet sizes, annual miles traveled, and ICEV fleet efficiency, we determine foregone tax revenues. Our calculations indicate electricity excise taxes or annual fees for EV owners would significantly increase current cost burdens on EV owners. While such a move has the potential to depress EV adoption rates, more information is needed to evaluate these tradeoffs; we are actively pursuing such an assessment with ongoing work.

The push toward a fully electrified vehicle fleet is is one of opportunity, but also faces many challenges. This chapter examines a number of these in the global context. Results of our work demonstrate that electricity’s place in the future portfolio of transportation fuel options depends crucially on EV cost competitiveness, model availability, and forward-looking actions by the electricity supply network. In preparing for next steps toward an electrified LDV sector, stakeholders and policymakers alike will need to consider these aspects of the market along with implications for emissions and tax revenues for transportation infrastructure investment.

Figure 1. BEV and PHEV cost parity frontier

Curves represent cost-parity oil price and battery price pairs. Points along the curve are computed by setting ICEV and BEV (or PHEV) operation costs equal and incorporating battery price considerations for EV models. The oil-to-gasoline price relationship is estimated by linear regression in log form.

Further Reading: CEEPR WP 2020-010

An interactive tool based on this research can be found here:

http://ceepr.mit.edu/research/projects/WP-2020-010-tool

References

Covert, Thomas, Michael Greenstone, and Christopher R. Knittel. 2016. “Will We Ever Stop Using Fossil Fuels?” Journal of Economic Perspectives, 30(1): 117–138, DOI: http://dx.doi.org/10.1257/jep.30.1.117.

Davis, Lucas W, and James M Sallee. 2019. “Should Electric Vehicle Drivers Pay a Mileage Tax?” National Bureau of Economic ResearchWorking Paper No. 26072, DOI: http://dx.doi.org/10.3386/w26072.

IEA. 2019a. “Global EV Outlook 2019: Scaling-up the transition to electric mobility.” DOI: http://dx.doi.org/10.1787/35fb60bd-en.

IEA. 2019b. “World Energy Outlook 2019.” DOI: http://dx.doi.org/10.1787/caf32f3b-en.

Wood, Eric, Clément Rames, Matteo Muratori, Sesha Raghavan, and Marc Melaina. 2017. “National Plug-In Electric Vehicle Infrastructure Analysis.” US DOE Office of Energy Efficiency and Renewable Energy.