Audun Botterud and Hans Auer

The installed capacity of renewable energy technologies, in particular wind and solar, has increased rapidly in Europe and the United States in the last decade. At the end of 2015, Europe was generating 28.8% of its electricity from renewables, about twice as much as in the United States. Since 2005, most of the growth in renewables in both regions came from increased wind and solar, with hydropower generation remaining roughly constant.

Several factors have led to the rapid development of these renewable technologies. In Europe, the main support mechanism has been feed-in-tariffs, which provides a fixed payment per kWh of generation from selected technologies. However, there has been a recent trend towards governments conducting auctions to achieve renewable generation targets in a more cost-effective manner. In the United States, the main policy instruments have been federal tax credits and state-level renewable portfolio standards. In both the U.S. and Europe, tariff structures such as net metering, where customers with local generation are compensated at the full retail rate, provide indirect support for renewables. Finally, a focus on distributed generation, microgrid solutions, and a growing interest in purchasing wind and solar from different consumer groups (households, communities, corporations) that are willing to pay a premium for green products all have contributed to the demand for wind and solar.

The rapid growth in renewable energy is starting to make an impact on the prices in the electricity markets. Wind and solar energy have very low operating costs, which may even be negative when policy support schemes are considered. Hence, these resources displace generation from technologies with higher operating costs, which tends to reduce electricity market prices, as observed particularly in some European markets. In addition, constraints on the system combined with excess wind and solar generation is leading to a significant increase of negative prices in electricity markets on both continents. Of course, other factors also influence prices in the electricity market. In the United States, several studies show that reductions in the cost of natural gas is the primary reason for the low electricity prices in recent years.

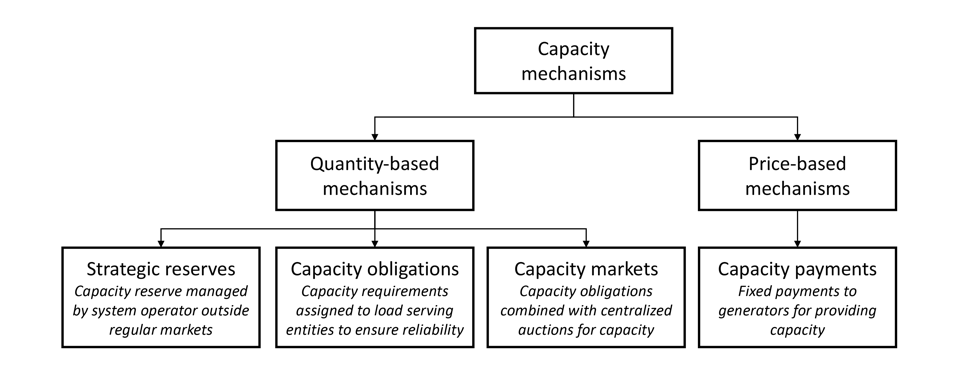

In principle, the revenues from the markets for energy and operating reserves should be sufficient to provide incentives for adequate investments in generation capacity. This is the premise for the so-called energy-only market design. However, the reductions in electricity market prices are making it harder for existing generators to make a profit. This has led to renewed discussions about the need for capacity mechanisms, which are additional compensation schemes designed to provide incentives for generation investments and system reliability. Figure 1 categorizes capacity mechanisms into price-based and quantity-based mechanisms. Both categories exist in Europe, where some countries have relied on capacity payments or strategic reserves for a long time, and other countries have recently introduced capacity markets or obligations. However, many countries in Europe still rely on the “energy-only” market design. In the United States, four electricity markets rely on centralized capacity markets, two on capacity obligations, whereas the market in Texas (ERCOT) is the only energy-only market. The current status clearly illustrates that no consensus exists on the best approach to maintain reliability.

Figure 1: Overview of the main capacity mechanisms.

Independent of the choice of capacity mechanism, we argue that the most important challenge in electricity market design is to achieve a good price formation in the short-term markets. A sharper price formation will provide better incentives for system flexibility from supply, demand, and energy storage resources. This can be obtained through increased demand response to market prices so that they better reflect consumers’ preferences and willingness to pay for electricity. A particularly important issue is what happens to prices when supplies are short, as scarcity rents are critical for capital cost recovery. Improved scarcity pricing can be achieved through demand participation as well as administrative mechanisms, such as using demand curves for operating reserves rather than fixed requirements to calculate the price for operating reserves. It would also be beneficial to move from technology specific incentive schemes for renewable technologies towards adequate pricing of carbon emissions, as it would have the effect of increasing the cost of emitting technologies rather than depressing wholesale electricity prices. We argue that these general recommendations, which apply to Europe as well as the United States, would foster a more market-compatible integration of wind and solar energy, better functioning energy only markets, and less reliance on capacity mechanisms.

We also find that certain market design challenges differ in Europe and the United States. For instance, in Europe there is a need for improved representations of the transmission network in market clearing algorithms to obtain locational prices that better reflect congestion patterns. In addition, substantial benefits would be achieved from moving towards shorter time intervals in real-time balancing markets and from introducing integrated markets for energy and operating reserves, as is already done in some U.S. markets. In the United States, electricity markets should follow the European approach of using intraday markets to enable a more market-based balancing of system deviations between the day-ahead and real-time markets. Overall, as electricity markets continue the transition towards a low-carbon future on both continents, lessons can and should be learned in both directions.

References

Botterud A., H. Auer, 2018, “Resource Adequacy with Increasing Shares of Wind and Solar Power: A Comparison of European and U.S. Electricity Market Designs.” MIT CEEPR Working Paper 2018-008.

Further Reading: CEEPR WP 2018-008