CEEPR Working Paper

2023-14, August 2023

John Bistline, Neil Mehrotra, and Catherine Wolfram

The Inflation Reduction Act (IRA) represents the largest federal response to climate change to date. The problem IRA confronts is massive – re-orienting the way the U.S. and global economies produce and consume energy. IRA’s incentives span the entire energy sector, from producers of raw materials to end-use consumers, and will set considerable new forces in motion.

This paper offers several initial perspectives on what IRA’s climate-related provisions could imply for energy transitions and key macroeconomic indicators using detailed energy systems modeling and general equilibrium modeling of the U.S. economy. The paper focuses on several major themes.

The first theme is the fiscal implications of the Act. There is a wide range of uncertainty in the extent to which firms and households will take up the different tax credits. To evaluate the Act’s fiscal impacts, the authors summarize evidence from the Electric Power Research Institute’s U.S. Regional Economy, Greenhouse Gas, and Energy (EPRI’s US-REGEN) model. Analysis using this model suggests that IRA, along with other policies and market trends, shifts baseline expectations of firms, households, and policymakers concerning the pace and extent of future decarbonization. Particularly, under IRA, clean electricity investments span 34-116 gigawatts of nameplate capacity added annually through 2035, compared with 18 GW/year on average in the previous decade and 36 GW/yr in 2021. In addition, IRA is expected to increase the electric vehicle share of new vehicle sales by 12 percentage points in 2030 – from 32% without IRA to 44% with IRA credits.

However, the projected pace and extent of these changes depend on assumptions about future policies, technologies, and markets. The uncertainty associated with these projections reflects IRA implementation details and unknown responses to siting and permitting challenges, workforce changes, global supply chain shifts, and non-cost barriers to deployment.

The acceleration in the deployment of clean supply- and demand-side technologies in the paper’s modeling implies greater uptake of IRA incentives than initial estimates indicated. These projections indicate that fiscal costs of IRA tax credits for clean electricity, carbon capture, and electric vehicles may be $780B by 2031 in our central case – nearly three times the Congressional Budget Office (CBO) and Joint Committee on Taxation’s (JCT) score for comparable credits, thus suggesting that initial estimates of the fiscal costs may be understated.

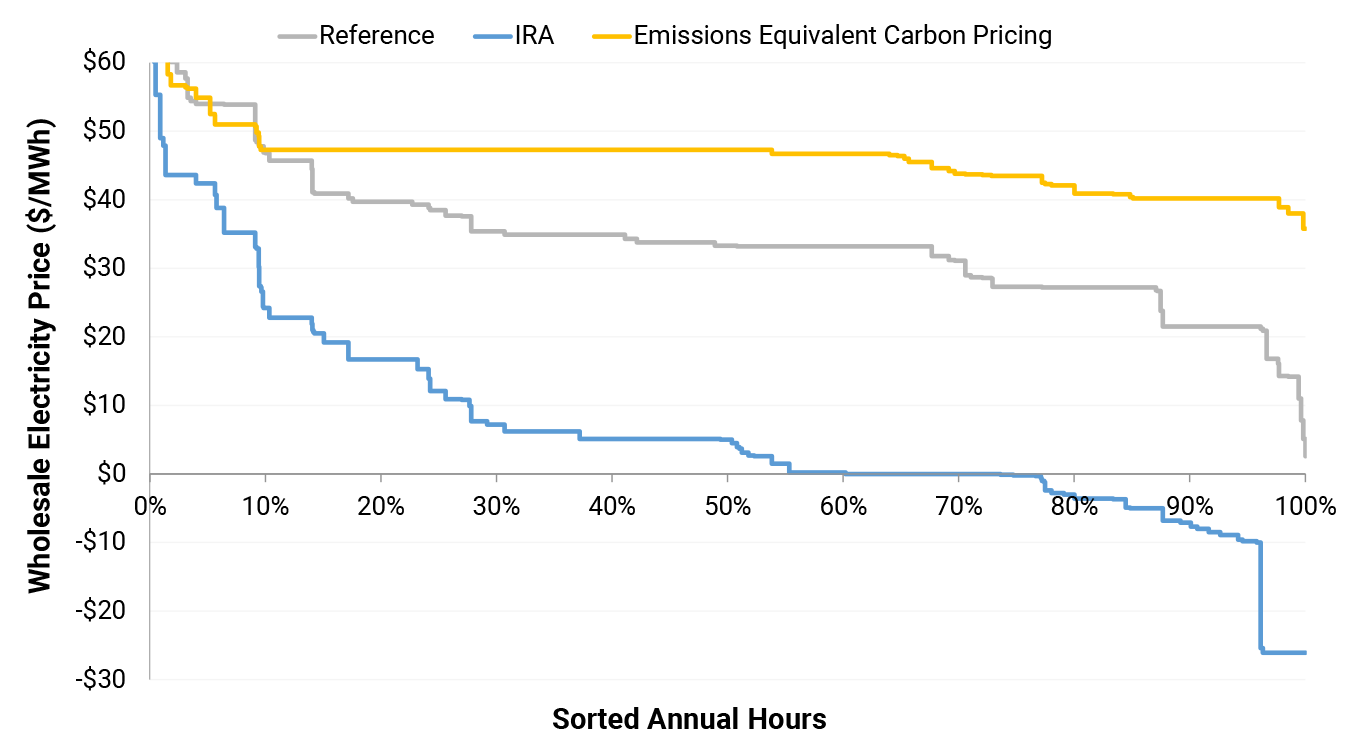

The paper’s second theme is the market impacts of IRA incentives, particularly negative prices in wholesale electricity markets. Electricity generation technologies that collect production-based tax credits will have strong incentives to operate even when wholesale prices are low or even negative to receive IRA credits. Some areas of the country are already seeing negative prices, but their prevalence will likely increase with IRA. These negative prices can alter economic signals for market entry and exit of generators, shift incentives for locational decisions and balancing resources (e.g., energy storage, transmission), and change the economics of end-use electrification and new loads (e.g., hydrogen production, cryptocurrency mining).

Figure 1: Wholesale electricity price duration curves for the reference, IRA, and carbon price scenarios.

Curves are shown for the Southwest Power Pool (SPP) region in 2050, which includes South Dakota, Nebraska, Kansas, and Oklahoma.

The third theme is the distributional impacts and the possible incidence of the different subsidies in IRA. This paper notes the extent to which IRA may drive down retail prices for energy due to subsidies for electricity generation and investment, reflecting transfers from the federal government (and ultimately taxpayers) to consumers and clean electricity providers. In addition to potentially decreasing retail electricity prices, IRA could lower expenditures on fossil fuels due to its incentives for end-use electrification, especially petroleum for transportation. The authors describe patterns in energy expenditures by income, as well as results from US-REGEN under a counterfactual scenario without IRA subsidies to inform the extent of inframarginal transfers to firms and households that would have adopted these technologies anyway.

The fourth theme is the relationship between IRA and the macroeconomy. To elucidate the potential macroeconomic impacts of IRA, this paper presents a representative agent model of the economy which features subsidized clean energy as an input. The model demonstrates how clean energy subsidies function as a supply-side policy that boosts output, investment, wages, and labor productivity while reducing the price of electricity. These dynamic effects work to partially offset the static fiscal cost of the policy. Along the transition path, increased investment demand raises interest rates and lowers private consumption. Bottlenecks lower real clean energy investment, but may raise investment expenditures and the fiscal cost of the investment tax credit as the relative price of investment in clean energy capital rises. However, the slower pace of investment under bottlenecks mitigates the rise in the real interest rate. Elastic labor supply and learning-by-doing externalities can increase the clean energy capital stock in steady state under a subsidy policy. Even labor and domestic sourcing requirements as structured in IRA would increase the steady state clean energy capital stock. Clean energy investment may crowd out non-energy investment in the short-run but increase non-energy capital in the long run.

The fifth theme is a comparative analysis of the subsidies approach in the IRA to carbon pricing. This paper presents a comparison that is both conceptual and quantitative, using a carbon price that would yield comparable emissions reductions over a similar timeframe. Conceptually, while both policies lower the relative price of clean to fossil fuel power generation, a carbon tax raises energy prices, encouraging energy conservation but carrying negative supply-side implications for output, investment, and wages. The conservation margin means that a carbon tax results in a larger decline in emissions. In the context of the model, despite its positive supply-side effects, optimal climate policy generically involves a positive carbon tax and a zero clean-energy subsidy. Therefore, the case for an approach centered on clean energy subsidies relies heavily on strong learning-by-doing externalities.

The paper describes further dimensions along which carbon taxes and subsidies differ that are not captured in the model, including fuel switching, differential carbon intensity, and impacts from usage along the intensive margin. Subsidies and carbon pricing are also compared in terms of the incentives created for innovation. Within this section, w the economics of some of the industrial policy aspects of IRA, which offers higher tax credits for firms that adopt certain labor practices and buy inputs manufactured in the U.S. is discussed. These provisions may be addressing market failures, but if not, they may raise costs.

The sixth and final theme focuses on quantifying the IRA’s possible macroeconomic impacts, using inputs from the US-REGEN model in the Federal Reserve’s FRBUS model. The new investment under IRA, while large relative to the current level of investment in the energy sector, is comparatively small as both a share of overall investment and overall economic activity. Increases in clean power investment and transfers to households to subsidize electric vehicles and other household equipment initially increases demand before raising the capital stock and output. The movements in interest rates and unemployment are very small owing to the small size of electric power investment relative to the overall economy. Although this paper finds that IRA investments in the baseline case are likely not large enough to meaningfully influence macroeconomic aggregates, it quantifies how the macroeconomic environment – including higher interest rates and rising costs of labor and materials – could have meaningful negative impacts on clean energy investment.

This paper’s review of potential IRA impacts points to several areas for additional research. Notably, assessing interactions between IRA incentives and changes in federal regulations, state policies, and company targets will be important. Future work should also quantify the aggregate macroeconomic impacts of IRA, Infrastructure Investment and Jobs Act, and CHIPS and Science Act, as all three are expected to increase investments across a similar timeframe and have impacts on manufacturing, construction, and raw materials. Finally, understanding the economic incidence of subsidies and the distributional implications of IRA will be valuable to policymakers and other stakeholders, especially since many IRA provisions target energy equity, environmental justice, and disadvantaged communities.