Geoffrey Haratyk

Power prices have fallen significantly since 2008, putting commercial nuclear reactors in the United States under substantial financial pressure. These low prices, mostly caused by negative demand growth and cheap natural gas, are expected to persist. Nuclear power plants, accounting for 60% of the carbon-free electricity generated in the country, are retiring or are at risk of retiring before the end of their operating license, despite positive operational records. In the past three years, five nuclear power plants, totaling 4.7 GW of installed capacity, retired from the electrical grid, and eight additional ones have officially announced their retirement in the coming years.

This paper aims to analyze nuclear power plant closures. Although the literature on new nuclear power plant economics and climate benefits is abundant (Joskow and Parsons, 2009), few studies have focused on the prospects for existing reactors. Davis and Hausman (2016) quantified the consequences of the recent closure of the San Onofre Nuclear Generating Station in California using econometric techniques. Here, we provide a detailed valuation of every U.S. reactor. We employ our own wholesale electricity market model to study the mechanics and outcome of market changes. Finally, we re-examine the supposed contradiction between competitive markets and high-level policy objectives, in light of nuclear retirements. Are regulatory changes needed and justified for nuclear to survive in free competitive markets? What are the options offered to policymakers?

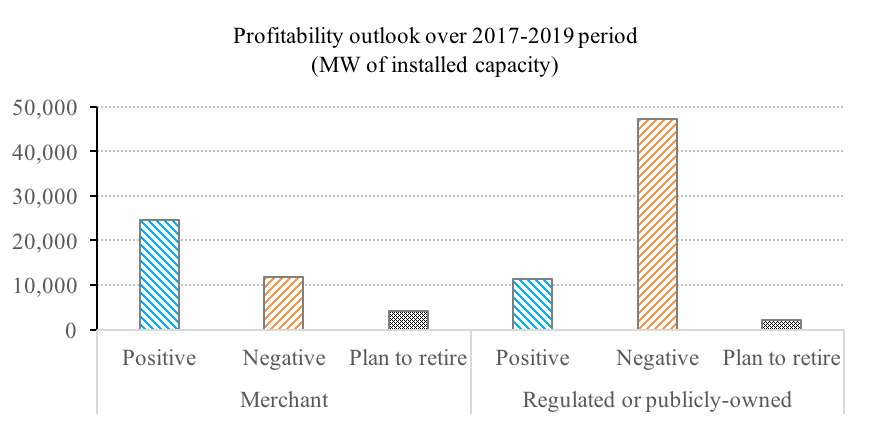

Our study shows that nearly two-thirds of the 102 GW nuclear capacity are uncompetitive in the U.S. over the next few years under the current price trajectory (Figure 1). Among those, 18 GW are retiring or are merchant plants at high risk of retiring prematurely. Nuclear reactors mostly suffer from a revenue problem. Wholesale electricity prices have fallen by 40 to 50% between 2008 and 2015, and neither trends in capacty prices nor nuclear production costs have been able to stop the decline in nuclear profitability.

The potential consequences of a massive nuclear capacity withdrawal depend on the future energy mix. If 20 GW were to be replaced by modern gas-fired combined cycle plants, carbon emissions from the power sector and U.S. gas burn would rise by an estimated 3.2% and 3.7% respectively. Electricity supply would rely even more heavily on natural gas. If replaced by renewables (wind), the withdrawal would be carbon-neutral, but the cost would be greater in most locations.

In a context of uncertainty around future fuel prices, technological progress, and climate policy, avoiding the irreversible shutdown of nuclear assets is deemed preferable. This would minimize cost as well as damage to the environment while ensuring long-term security of supply.

To maintain nuclear power, policymakers could employ several regulatory instruments in deregulated markets. Carbon pricing is a prefered measure that would reconcile climate objectives with competitive markets and benefit nuclear energy. Calculations show that a carbon price as low as $10 / MT CO2 would be sufficient to maintain most U.S. nuclear capacity. Without a carbon price, out-of-the-market payments would be needed to effectively maintain nuclear capacity, though they would create market distortions. Filling the revenue gap would come at a cost of $3.5-5.5/ MWh on average in deregulated markets, which is much lower than the cost of subsidizing equivalent wind power, or the social cost of carbon damage caused by equivalent new gas-fired generation. Policy support could take the form of direct zero-emission credits, renewable portfolio standard expansion, or “clean” capacity market mechanisms. As a last resort, the exercise of a new mothballing status could prevent the premature retirement of the most at-risk nuclear plants.

Figure 1. Market signals indicate that 18 GW of nuclear capacity are retiring or are merchant plants at high risk of retiring prematurely in the U.S.

References:

L. Davis and C. Hausman, 2016. “Market Impacts of a Nuclear Plant Closure”, American Economic Journal: Applied Economics, Vol.2, No. 2, pp. 92-122, 2016.

P. Joskow and J. Parsons, 2009. “The Economic Future of Nuclear Power”, Daedalus, Vol.138, No. 4, 2009.

P. Linares and A. Conchado, 2013. “The Economics of New Nuclear Power Plants in Liberalized Electricity Markets”, Energy Economics, Vol. 40, pp.S119-S125, 2013.

OECD-NEA, 2011. “Carbon Pricing, Power Markets and the Competitiveness of Nuclear Power”, NEA report No. 6982, 2011.

G. Rothwell, 2000. “The Risk of Early Retirement of U.S. Nuclear Power Plants under Electricity Deregulation and COâ‚‚ Emission Reductions.” The Energy Journal, vol. 21, no. 3, pp. 61–87, 2000.

Further Reading: CEEPR WP 2017-009