CEEPR Working Paper 2020-018, October 2020

Andrés Inzunza and Christopher R. Knittel

In the face of a widespread penetration of distributed energy resources (DER) in electric grids, such as residential solar PV, batteries, electric heat pumps, etc., an inadequate tariff design may have uneven consequences across different socioeconomic groups. In the U.S., owners of residential solar systems are wealthier than non-owners, given that more than 80% of solar owners belong to the top 3 income quintiles (Barbose et al., 2018). If, for instance, an important portion of utilities costs is collected through the volumetric charge of tariffs, solar adopters, whose electricity consumption from the grid is lower, would contribute less to paying for the electric infrastructure (e.g., networks), and thus, uncollected revenues would have to be obtained from other customer groups (S. Burger et al., 2019). Moreover, other types of DERs, such as behind-the-meter (BTM) batteries, could provide an even greater opportunity to reduce electricity bills paid by adopter clients (Hledik & Greenstein,2016). These resources allow the consumer to manage the amounts of electricity they consume from the system flexibly and could be used to further optimize their consumption.

Adding further complexity to the context, net metering (NEM) schemes are widely adopted in the U.S. and around the world in order to incentivize investment on residential solar PV systems and more recently, on behind-the-meter storage (California Public Utilities Commission, 2019; The Commonwealth of Massachusetts Department of Public Utilities, 2019). Under the simplest definition, these schemes consist of valuing net imports (i.e., consumption) and net exports of power from customers premises to the grid at the full retail tariff. In many jurisdictions in the U.S. and other countries, an important fraction of network costs is recovered through volumetric charges (Brown & Faruqui, 2014). Hence, given that NEM policies help DER adopters avoid some of these costs, we argue that these policies may increase undesirable distributional impacts of DER adoption, under some tariff designs. In this context, the present work aims at answering the following research questions:

- How do different tariff designs combined with NEM schemes interact with different levels of solar PV and BTM storage adoption, in terms of the economic impact on adopters and non-adopters of DER?

- How would the benefits and costs of solar and storage adoption be distributed across different income quintiles?

- How do different tariff designs combined with NEM schemes and solar plus storage adoption interact with other aspects relevant to policy making, such as the economic value that adopters draw from the adoption of BTM storage and potential costs/benefits due to increased/decreased needs regarding network assets?

To address these questions, we use half-hourly data for the year 2016 for ~100,000 customers in Chicago, IL, to which we randomly assign solar or solar plus storage assets, with increasing penetration levels. We calculate the operation of these assets by means of several instances of an optimization model capable of calculating DER operation that would minimize each client’s yearly bills. We test three different NEM regimes (On, Off and the NEM regime currently applicable to BTM storage in California) and several different tariffs designs and calculate cost-shifting effects of DER adoption from adopters and non-adopters due to residual cost avoidance by the former. Additionally, using socioeconomic data from customers we assess how bill impacts differ across different income groups.

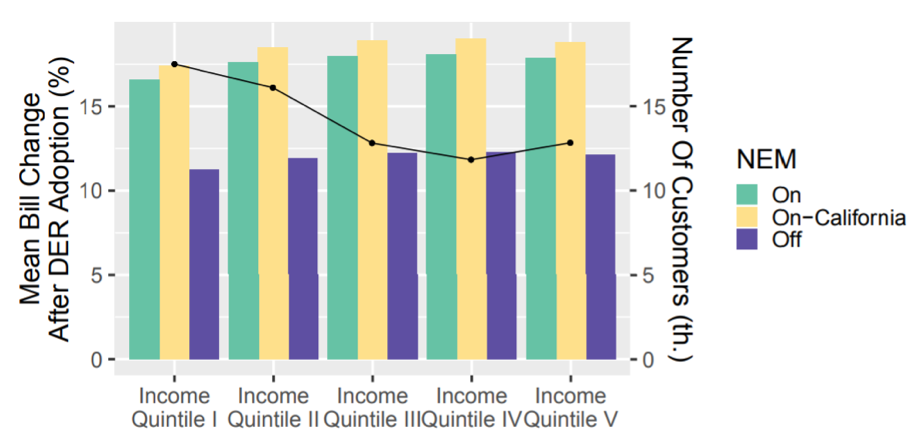

Overall, results show that the combination of NEM schemes and recovery of residual costs through volumetric charges may cause important cost shifting effects from adopter onto non-adopter customers, raising equity and fairness concerns. Firstly, under NEM schemes, we calculate that adopter customers may, on average, obtain bill reductions of 71% when installing solar plus storage, whereas non-adopters can see their bills increase around 18% in high DER penetration scenarios (i.e., 45% penetration). Moreover, under the same NEM schemes, 45% adoption and considering solar plus storage adoption alone, we calculate that customers from the two lowest income quintiles may suffer bill increases in the 16-19% range on average, while removing NEM schemes reduces these increases to the 11-12% range.

We also set out to investigate potential effects on power management for grid operators. Although we did not model grid operation, we calculated the aggregated change on load patterns after DER operation and used the pre-DER adoption condition as a proxy for the design condition of the grid. Overall, we see that in 3 out of 4 tariff designs considered, NEM schemes provide incentives to use the grid more intensively, which could be a cause for concern by grid operators, due to potential higher network investment costs.

While the analysis performed here used data from Chicago, Illinois in the U.S., fundamental causes for the cost-shifting effects of DER adoption and inadequate tariff designs can be tested using our methods in any other jurisdictions where similar tariff and billing practices are present (e.g., other states in the U.S., Chile, Australia, U.K., etc.).

Finally, it is important to note that in this study we have focused our efforts on identifying and quantifying specific potential effects of NEM schemes without intending to perform a comprehensive analysis of the benefits and costs of these policies. Many aspects not considered in this study matter when performing such an assessment, such as benefits on reduced environmental footprint of the energy supply, job creation and potential incentives for grid-defection. Consequently, results here should be considered in combination with an assessment of these other effects in order to provide quality recommendations on the societal desirability of NEM schemes.

Figure 1 Bill impacts of DER adoption on non-adopters by income quintile and NEM regime, calculated under time-of-use tariff and

45% of solar plus storage adoption.

References

Barbose, G., Darghouth, N., Hoen, B., & Wiser, R. (2018). Income Trends of Residential PV Adopters: An analysis of household-level income estimates, 1–6. https://doi.org/10.1016/j. neuroimage.2004.02.031

Brown, T., & Faruqui, A. (2014). Structure of electricity distribution network tariffs: recovery of residual costs. Prepared for the Australian Energy Market . . ., (August). http://www.ksg. harvard.edu/hepg/Papers/2014/Brattle%20report%20on%20structure%20of%20DNSP% 20tariffs%20and%20residual%20cost.pdf

Burger, S., Schneider, I., Botterud, A., & Pérez-Arriaga, I. (2019). Fair, Equitable, and Efficient Tariffs in the Presence of Distributed Energy Resources, In Consumer, Prosumer, Prosumager. Elsevier. https://doi.org/10.1016/B978-0-12-816835-6.00008-5

California Public Utilities Commission. (2019). Decision 19-01-030 – Decision granting petition for modification of decision 14-05-033 regarding storage devices paired with net energy metering generating facilities. https://static1.squarespace.com/static/54c1a3f9e4b04884b35cfef6/t/ 5c5a02ff104c7b5f073745dc / 1549402881064 / STORAGE+ DEVICES+PAIRED+WITH+ NET+ENERGY+METERING+GENERATING+FACILITIES.PDF

Hledik, R., & Greenstein, G. (2016). The distributional impacts of residential demand charges. Electricity Journal, 29 (6), 33–41. https://doi.org/10.1016/j.tej.2016.07.002

The Commonwealth of Massachusetts Department of Public Utilities. (2019). D.P.U. 17-146-A – Net metering and energy storage systems.

Further Reading: CEEPR WP 2020-018