CEEPR Working Paper

2023-012, July 2023

Gunther Glenk, Anton Kelnhofer, Rebecca Meier, and Stefan Reichelstein

In the discussion surrounding the timely transition to a net-zero economy, commentators frequently point to the obstacles of reducing the carbon dioxide (CO2) emissions in hard-to-decarbonize industries, such as steel, cement, and chemicals. These industries deliver products that are essential to a modern economy, yet a major share of their emissions are intrinsic process emissions that will not be avoided by phasing out the use of fossil fuels. By itself, the cement industry, in particular, is responsible for about 8% of global annual CO2 emissions. Like their counterparts in other heavy manufacturing industries, major cement producers have recently embraced net-zero emission goals by the year 2050. The achievement of these goals will require the adoption of abatement levers that drastically reduce the emissions associated with current production processes.

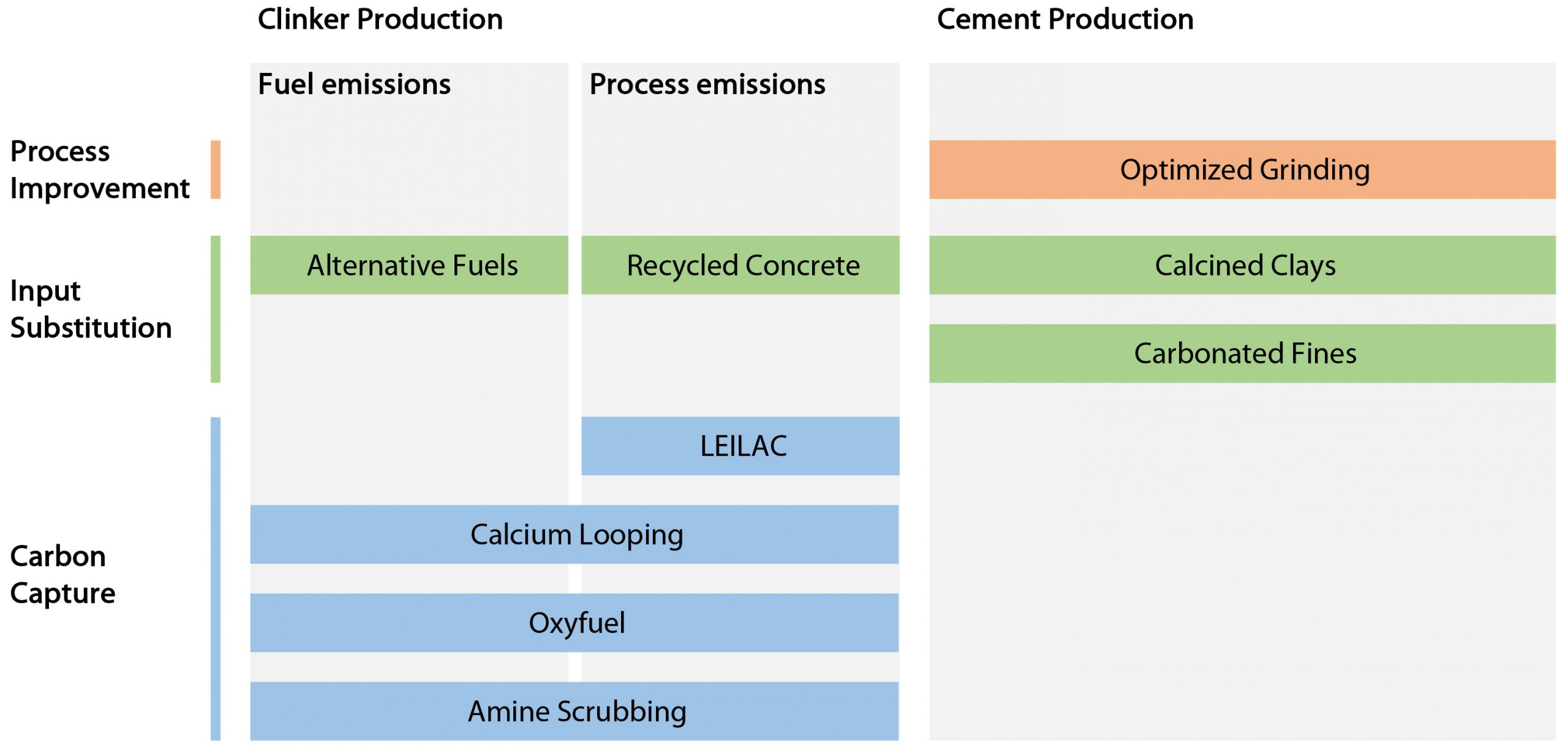

This paper first develops a generic economic framework for identifying cost-efficient combinations of abatement levers a firm would need to implement to achieve substantial emission reductions. We then calibrate our model to new industry data in the context of European cement plants. Our numerical analysis considers nine elementary abatement levers that are technologically ready for deployment (Figure 1). They include process improvements, input substitutions, such as the use of supplementary cementitious materials (SCMs), and the installation of carbon capture technologies. Since most of these elementary levers can be combined freely, there are potentially up to 512 combined abatement levers. Importantly, the resulting abatement and cost analysis is not separable across the constituent elementary levers. For instance, the abatement impact of SCMs varies depending on whether the use of these materials is combined with a carbon capture installation.

Figure 1: Elementary abatement levers. This figure illustrates the nine elementary abatement levers considered in our calculations.

The central economic concept introduced in this paper is the Incremental Abatement Cost curve. Conceptualized as the life-cycle cost of reducing emissions incrementally by certain target levels, this cost curve is a variant of the Marginal Abatement Cost curve, as popularized by McKinsey and studied in numerous contexts. A central assumption of marginal abatement cost curves is that the abatement impact of different levers is separable, allowing for levers to be ordered according to their marginal costs. In contrast, incremental abatement cost curves are generally not monotonically increasing in the level of abatement, precisely because the joint costs and emission levels corresponding to different combined levers are not separable across the constituent elementary levers.

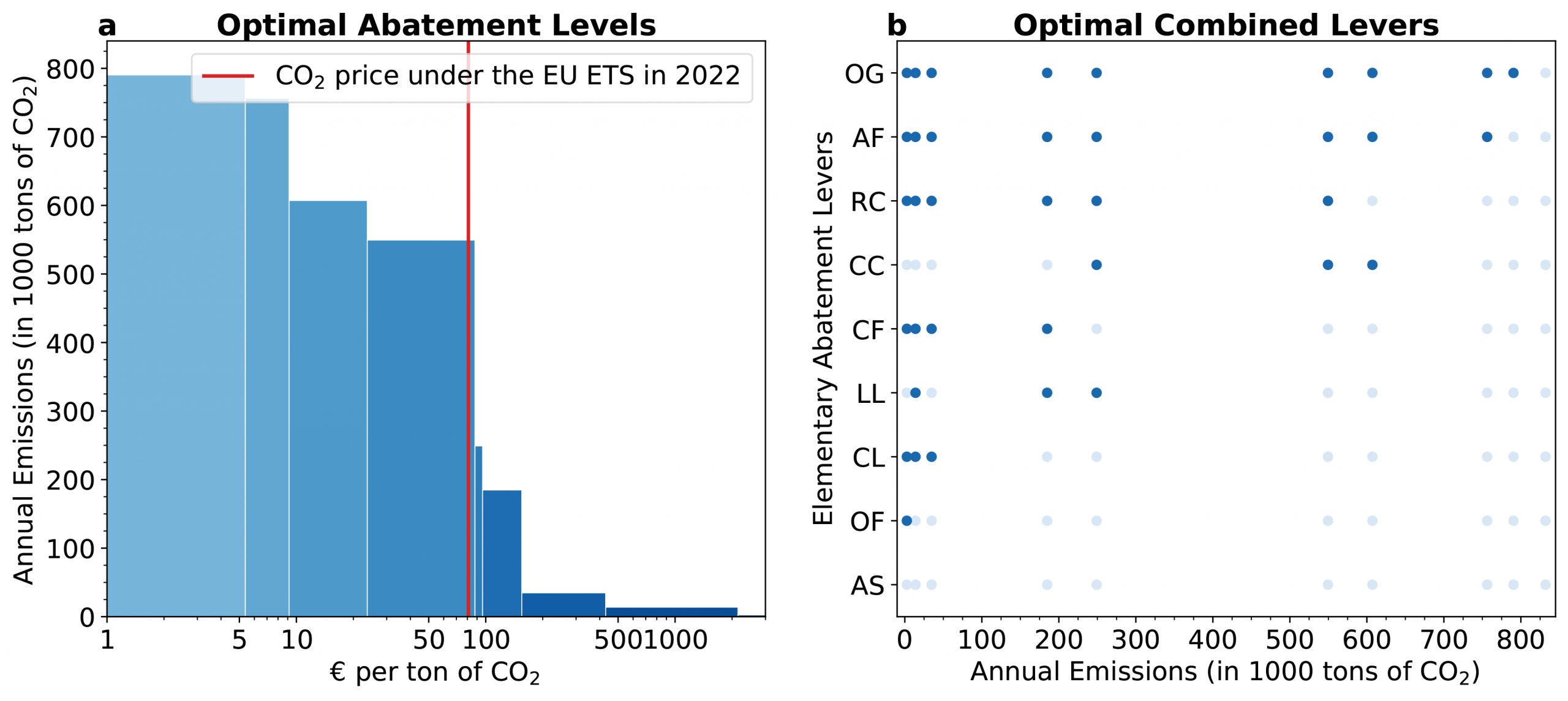

Our numerical analysis examines the willingness of European cement producers to adopt combinations of elementary abatement levers in response to alternative carbon prices that might prevail under the European Emission Trading System. We find that if prices were to continue at their 2022 average value of €81 per ton of CO2 in future years, firms would have incentives to abate their annual direct (Scope 1) CO2 emissions by 34% relative to the status quo (Figure 2). At the same time, our analysis demonstrates that optimal abatement levels are highly sensitive to carbon prices in the range of €80-150 per ton. Specifically, cement producers would optimally reduce their emissions by 78% at a carbon price of €100 per ton of CO2, while €155 per ton would provide incentives sufficient for near-full decarbonization.

Our findings are generally more favorable than those reported in earlier studies regarding the cost of decarbonizing cement production. These differences partly reflect that our calculations are based on new industry data showing advances in the cost and emission profiles of different abatement technologies. Our more favorable results also reflect that our cost calculations rely on an embedded optimization algorithm that selects for each abatement target the unique cost-efficient combined lever from a large set of elementary levers.

Current climate policy discussions have yet to arrive at a consensus on how far carbon pricing regulations or subsidies for decarbonization efforts need to be expanded in order to ensure a timely transition to a net-zero economy. In this regard, our analysis provides several relevant elasticity estimates. For instance, we conclude that, relative to the 2022 average, a 25% increase in the market price of emissions allowances on the EU ETS would reduce the annual demand for emission permits from representative Portland cement plants by approximately 66%.

The Intergovernmental Panel on Climate Change and other research organizations have issued a variety of forecasts for the amount of CO2 that will continue to be emitted in the year 2050. Such residual emissions would then have to be compensated by carbon removals in order to achieve a net-zero position. Our findings on the mirror S-shape of firms’ willingness to abate suggest that unless carbon prices were to reach a range of several hundred Euro per ton of CO2 emitted, Portland cement manufacturers would continue to emit at least 4% of their current emissions. Such projections must, of course, be qualified by their reference to contemporary manufacturing and abatement technologies.

In countries like Germany, governments seek to accelerate corporate decarbonization efforts by providing targeted subsidies to companies to reduce their emissions beyond the levels that current carbon prices incentivize. Such contractual arrangements are frequently referred to as “carbon contracts for difference” (“Klimaschutzverträge”). The abatement cost concept developed in this paper provides estimates for the minimum subsidy required for cement manufacturers to be willing to reduce their annual emissions to some target if the prevailing carbon price only incentivizes a higher level of emissions. For a company to be willing to enter into a contractual agreement that imposes maximal annual emissions of 184,823 tons of CO2 (22% of the status quo emissions) at a representative plant, we find that the subsidy would need to be at least €8 per ton of CO2, which is equivalent to an annual lump sum of about €3.0 million per plant. This calculation assumes that the prevailing carbon price is €81 per ton and, therefore, absent any contractual agreement, the company’s optimal abatement response would be to emit 549,502 tons of CO2 (66% of the status quo emissions) annually, as established in Figure 2.

Figure 2: Optimal abatement for Portland Cement.

This figure shows (a) the optimal abatement at different CO2 prices and (b) the optimal combined levers. Abbreviations are OG (Optimized Grinding), AF (Alternative Fuels), RC (Recycled Concrete), CC (Calcined Clays), LL (LEILAC), CL (Calcium Looping), OF (Oxyfuel), and AS (Amine Scrubbing).