CEEPR Working Paper

2023-19, November 2023

Emil Dimanchev, Steven A. Gabriel, Lina Reichenberg, and Magnus Korpås

Climate policy goals call for substantial investments in low-carbon generation and storage technologies. Whether such investments materialize will depend in large part on the financial risk that investors face and their ability to manage it.

Firms typically manage risk using financial contracts that insure them against unfavorable realizations of the future. In electricity markets, an important hedging strategy is the use of forward contracts, such as power purchase agreements (PPAs), between investors and consumers. However, markets for such contracts are generally incomplete, leaving investors unable to hedge all of the risk they face. Our research investigates the implications of this missing market problem for societal goals to decarbonize power systems.

The main question we ask is how the problem of missing risk markets impacts future power system emissions. To address this question, we model how investors’ risk exposure influences their investment decisions, and thus the future technology mix.

The common approach to assessing power system investments under uncertainty uses stochastic optimization. This method assumes that investors consider multiple scenarios of the future, but that their objective is to merely maximize their expected future profit, implying that they are neutral toward risk, i.e., the shape of their profit’s uncertainty distribution.

To explore the role of risk, we developed a new model of generation expansion, which has two distinguishing features. First, our model represents investors’ preference to avoid risk (also known as risk aversion). Second, our model captures the incompleteness of risk markets, by taking a game theoretic approach to modeling power system investments.

Our model represents a perfectly competitive energy-only market. In it, risk-averse investors maximize profit under future uncertainty and constraints that describe their preference to avoid risk. A system operator agent dispatches the technologies deployed by investors to meet power system demand at the lowest cost.

The experiments we perform consider a stylized power system featuring four common technologies: gas plants, onshore wind, solar photovoltaic, and Li-ion batteries. We include two sources of uncertainty. First, there is uncertainty in annual electricity demand, which is modeled by scaling overall demand up and down by 25%. This represents, for example, the uncertainty in new demand from electrification and hydrogen electrolysis. Second, we model gas price uncertainty by specifying alternative scenarios that scale the gas price up and down by 25%.

The purpose of our analysis is to indicate the direction in which the missing market problem skews power system behavior. An important caveat is that we assume markets for risk to be missing (rather than merely incomplete). In other words, we assume away the existence of PPA contracts or similar financial contracts. Hence, the magnitude of our numerical results represents an upper bound on the extent to which the missing market problem affects investment decisions.

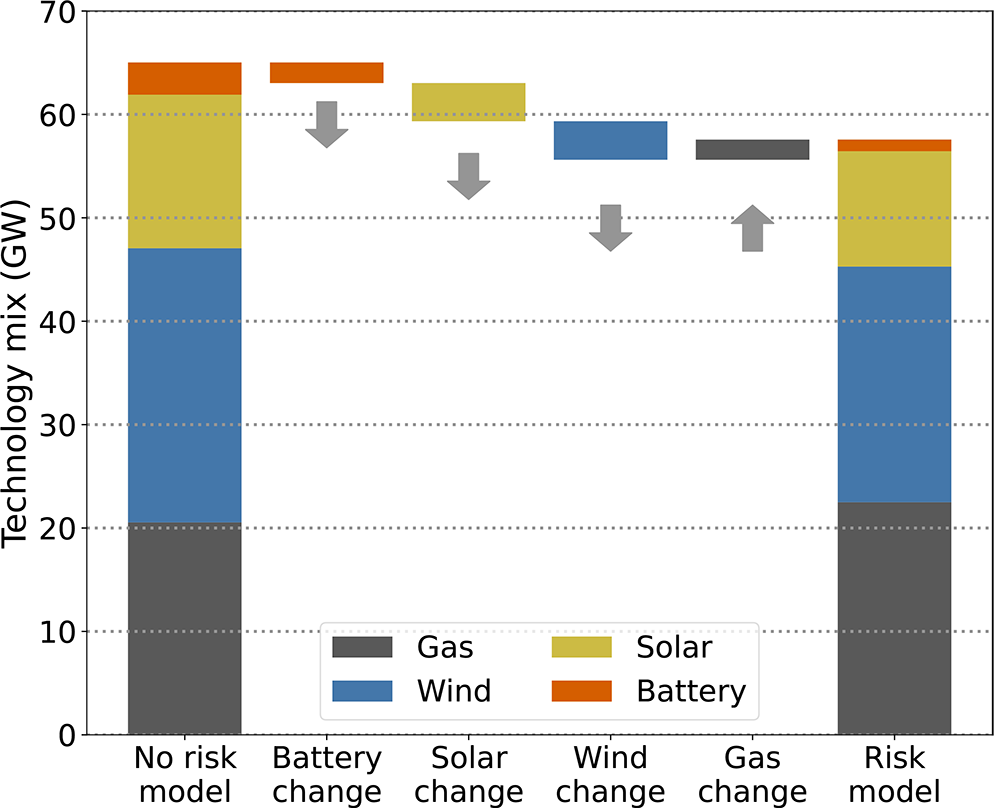

Figure 1. Effects of risk exposure on technology investments.

The figure above illustrates the effects of risk-exposure on technology investments. It displays results from two cases. First, we used the traditional approach to model generation expansion under uncertainty: namely, we assumed investors to be risk-neutral, which makes risk market completeness irrelevant. This is labeled as the “No risk model” in the figure. Second, we model a system with a missing market problem, namely where investors are risk-averse and risk markets are missing (in which case investors are fully exposed to the financial risk stemming from future uncertainty). This case is labeled as “Risk model” in the figure.

As illustrated, we find that the missing market problem skews the capacity mix away from wind, solar, and batteries and toward gas, relative to assuming risk neutrality. These results show that renewable and storage investments are relatively more sensitive to the risks they face compared to gas. As variable renewable and storage capacities decrease, the end result is higher power system emissions.

What explains these results? It is often thought that renewables’ capital intensity is what makes investments particularly dependent on risk exposure. This is because the more capital-intensive a technology, the more a given risk premium increases its overall cost. While we capture this effect, we also model how risk premia differ between technologies. We show that gas plants face more risk than variable renewables, as the former rely on rare events of scarcity pricing. Instead of capital intensity, our analysis shows that the observed investment effects are largely driven by how sensitive technology investments are to changes in their total cost. Wind and solar capacities are adversely affected by the missing market problem because the variability of these technologies make investment relatively sensitive to cost increases.

We also model optimal risk-averse planning, where risk markets are effectively complete. In this case, it is optimal to build more wind, solar, and storage capacity than are deployed in the case of missing markets. Wind and solar provide value by reducing consumers’ exposure to risk stemming from demand and gas price uncertainty.

Overall, our research shows that the missing risk market problem increases power system emissions. While the problem of missing markets is not new, we show that addressing it would also contribute to climate policy objectives. This finding strengthens the case for policy measures that enable investors to efficiently manage risk. Such measures include support for greater use of long-term contracting, instruments such as New York’s index renewable energy credit contracts, or contracts for differences.