Katherine Rittenhouse and Matthew Zaragoza-Watkins

Vintage-differentiated emission standards are widely used to regulate pollution from mobile and stationary sources. When a new emission standard is expected to discontinuously change the purchase price or lifetime cost of a new piece of equipment, forward-looking agents may pre-buy equipment, i.e., shift the timing of purchases forward, in order to avoid compliance costs. To investigate the incentives created by vintage-differentiated standards, the impact of those incentives on the new-equipment sales cycle, and the implications for the effectiveness of new-equipment standards, we analyze the market for new Class-8 heavy-duty vehicles (HDVs or trucks). In the context of new-vehicle emissions standards, prior analyses have not considered anticipation as an adjustment margin. In this paper, we address four specific questions: How does the anticipation of regulation affect the pattern of new-truck sales? How does the pattern of new-truck sales affect the pattern of used-truck retirements? How do purchasing and retirement patterns affect the environmental benefits of standards? Empirically, have recent regulations caused firms to pre-buy trucks? To answer these questions, we first develop a theoretical model, which incorporates the effects of anticipation on new-vehicle sales and the used-vehicle fleet, and differentiates those impacts from previously identified effects of regulation on the flow and stock of vehicles. We test our predictions using a data set of monthly U.S. sales of new freight trucks around the time of EPA’s 2007 implementation of HDV criteria pollutant standards, widely regarded as the most significant action taken by EPA (i.e., with respect to trucks) during the 25-year span of our data. Consistent with our predictions, we find evidence that anticipation caused a sales spike in the months before the policy took effect and a sales slump after implementation. For analysts using time-series variation to study the effects of standards, failing to account for anticipation likely results in significantly biased estimates of the direct effect of the policy on sales. More broadly, our findings have important implications for the analysis of markets in which agents can shift the timing of purchases in anticipation of new regulation.

We begin by specifying a dynamic model of a competitive freight truck market, where firms incorporate new-truck prices, operating costs and freight rates (i.e., operating revenue) into their purchasing and retirement decisions, and calculate comparative statics for changes in upfront and operating costs. We find that an increase in the upfront cost of new trucks causes an increase in the equilibrium freight rate and vehicle lifetime, while an increase in the operating cost of new vehicles causes an increase in the equilibrium freight rate, but has an ambiguous effect on vehicle lifetime. We then analyze how incorporating anticipation (i.e., beliefs about future new-truck prices) affects investment and retirement patterns. We find that, if firms are given the opportunity to buy trucks ahead of costly regulation, they will shift purchases forward, increasing demand for new trucks before regulation is implemented, symmetrically decreasing demand after implementation, and pushing out the oldest (highest-emitting) vehicles in the fleet. The net environmental effect of anticipation depends on how gains from accelerated turnover compare with losses from more-modest emission-rate improvements.

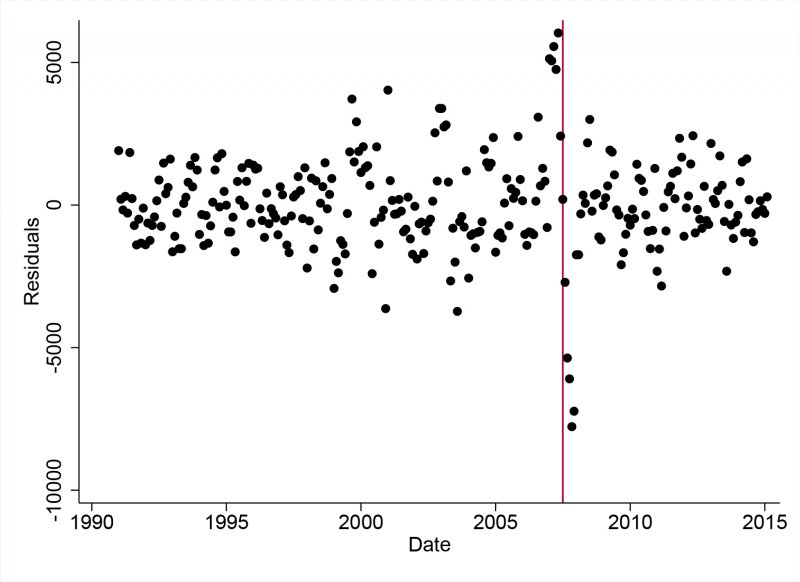

We test our predictions by estimating an econometric model of new-truck sales, using monthly HDV sales in the U.S. over the period 1991-2015. We investigate whether anticipation affected sales by examining residual variation in sales around the month the standards took effect. Consistent with our theory model, we find evidence of anticipation of the 2007 criteria pollutant standards (Figure 1). We estimate anticipation of the standards caused several thousand more trucks to be sold in each of the months prior to, and approximately the same number fewer trucks to be sold in each of the months after, the introduction of the standards.

Figure 1: Plot of monthly sales residuals*

*NOTE: In this figure the y–axis reports the difference between actual monthly Class–8 HDV sales and monthly Class–8 HDV sales predicted by our regression of sales on real oil price, GDP, year and month–of–year fixed effects. The x–axis reports the date. Each (black) dot is a monthly observation. The (red) reference line corresponds to the month the regulation took effect.

Our results are relatively stable across various specifications. Our results have important implications for policy design and program evaluation. Confounding the effects of anticipation with the direct effects of policy would, under a variety of identification strategies, result in significantly biased estimates. Ex ante, policy-makers should account for the effects of anticipation, and minimize the costs associated with it. For example, they may choose to phase in new standards (or award credits for early compliance), eliminating the discontinuous price change which induces a pre-buy. Ex post, analysis that does not account for anticipation risks mischaracterizing the effects of policy. Anticipation is not unique to emissions standards in the HDV industry; similar behavior has recently received increasing attention in the tax avoidance literature. Going forward, it will be important to consider and identify the effects of anticipation across a wide range of policy areas. Whenever regulation is expected to result in a discontinuous change, and agents affected by the regulation are able to adjust the timing of their behavior, we should expect to see some form of anticipation.

Further Reading: CEEPR WP 2017-004