CEEPR Working Paper

2025-18

Andrea Bastianin, Ilenia Gaia Romani, Luca Rossini, and Marco Zoso

The global transition to clean energy depends heavily on lithium-ion batteries, which power electric vehicles, renewable energy storage, and consumer electronics. Stable battery prices are therefore crucial for making clean technologies competitive with fossil fuels. If battery prices swing unpredictably, the costs of electric vehicles, renewable energy storage, and other green technologies may rise, slowing adoption.

One of the main drivers of instability in lithium-ion battery prices is the complex structure of their supply chain. In particular, the raw materials needed for their production are mined in only a few countries. For example, the Democratic Republic of Congo produces over three-quarters of the world’s cobalt, Indonesia dominates nickel production, and China refines the majority of processed battery materials. This concentration means that disruptions — from geopolitical tensions, trade restrictions, or even local unrest — can spread quickly through the supply chain and impact global battery markets.

Our research explores an often-overlooked issue: how a country’s position in the global trade network of critical raw materials (such as cobalt, lithium, nickel, and manganese), their processed derivatives, and finished batteries affects its vulnerability to supply chain–driven price swings. By combining trade and price data with advanced network analysis, we shed light on why the risks from battery price volatility are not the same for all countries; instead, they depend on trade network characteristics.

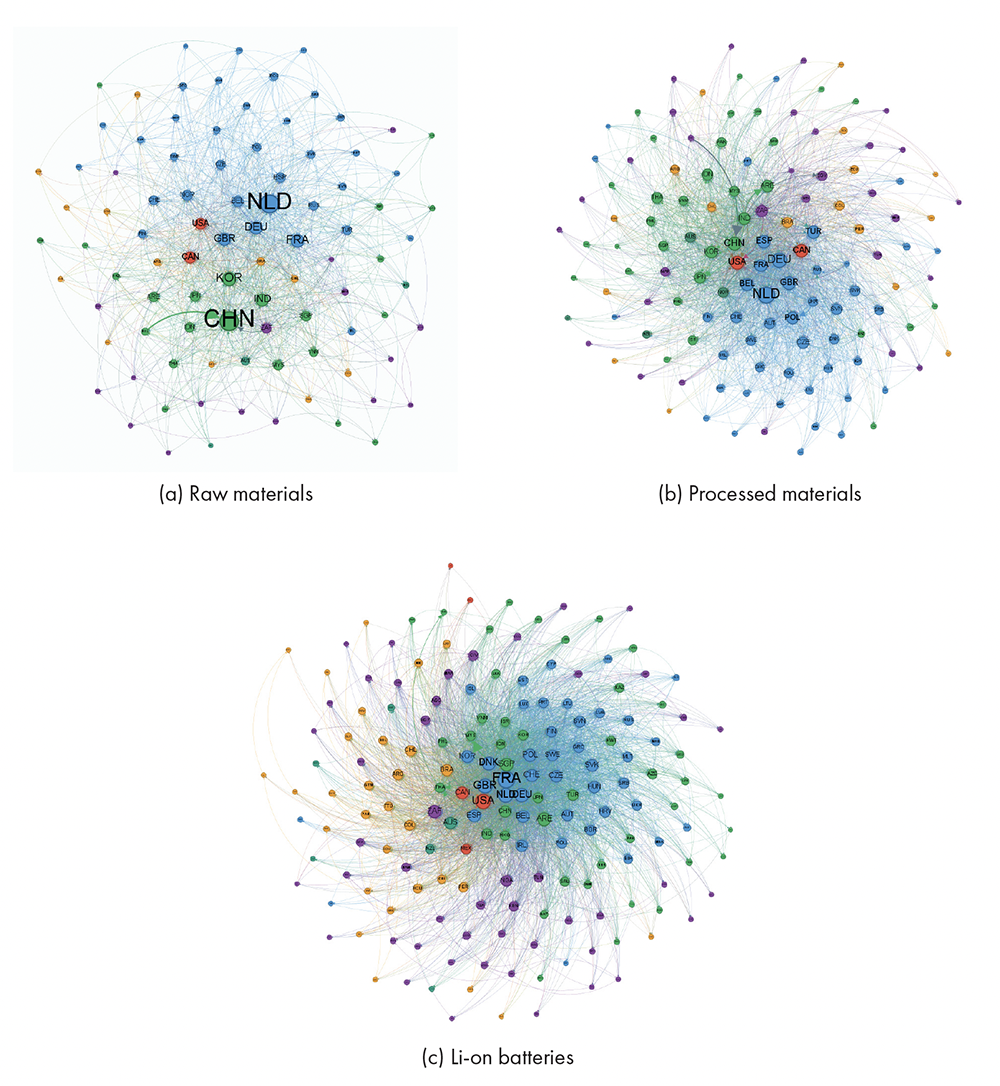

Specifically, we map the supply chain into three layers: raw minerals, processed materials, and finished lithium-ion batteries. Figure 1 shows a graphical representation of these networks for 2022,highlighting the main actors at each stage.

Figure 1. Trade networks of raw (a), processed materials (b), and batteries (c), in 2022. Each node represents a country, with node size proportional to the number of importing partners and node color indicating geographical region.

We then regress indicators of these networks on a newly constructed country-level index of exposure to battery price fluctuations.

In theory, it is not clear whether being more connected in these trade networks makes countries safer or more vulnerable. On the one hand, greater connectivity might provide stability, since a country with many partners and a central position could spread risk and benefit from its influence. On the other hand, those same links might amplify exposure, leaving countries more vulnerable to shocks that spread quickly across the network.

We employ statistical models that account for differences across countries and over time to examine how trade network positions affect exposure to battery price swings. Our analysis shows that being central in the trade network or exporting to many partners does not seem to have an impact on vulnerability. Instead, what matters most is imports. Countries that rely on a larger number of import partners for processed materials and finished batteries are actually more vulnerable to price volatility, not less. In other words, the second hypothesis prevails — greater connectivity through imports tends to amplify, rather than mitigate, exposure to battery price shocks.

These findings have important policy implications. First, reducing vulnerability requires strategic import concentration rather than simple diversification. Mineral-dependent countries may reduce their exposure to battery price volatility by lowering the number of origin countries from which they import processed materials and batteries. This runs counter to the conventional diversification logic that more trading partners reduce risk, highlighting instead the asymmetry between exporting and importing positions in the trade network. For mineral-importing economies, resilience lies in building more stable, possibly long-term contractual relationships with fewer suppliers, or in developing domestic midstream and downstream capacities. In addition, fostering research, innovation, and industrial policies that encourage the substitution of scarce or complementary critical minerals with more abundant alternatives could further mitigate vulnerability by reducing the risk of joint supply disruptions. Taken together, such strategies can help ensure that battery prices remain stable enough to support the rapid adoption of clean energy technologies worldwide.