CEEPR Working Paper

2025-15

Demis Legrenzi, Emanuele Ciola, Davide Bazzana, Massimiliano C. P. Rizzati, Enrico M. Turco and Sergio Vergalli

The transition towards greener and more environmentally sustainable business models has gained significant traction among companies in recent decades. Green accounting and communication of firms’ environmental values have emerged as critical competitive strategies in the consumer goods market. At the same time, increased environmental awareness, effective marketing campaigns, and improved education on environmental issues have gradually influenced consumers to pay greater attention to the products they purchase and the social implications of their choices. In this sense, when a substantial portion of consumers is committed to sustainability, a new consumption paradigm may emerge, encouraging firms to adopt greener practices. However, the extent to which these social dynamics affect green investments (e.g., emissions abatement) remains a topic of ongoing debate.

This work extends the Multi-Agent model for Transition Risks (MATRIX – Bazzana et al., 2024) calibrated on the Euro Area to investigate how endogenous green preferences for consumption goods interact with firms’ investment decisions in reducing aggregate emissions. Specifically, we explore whether the uncoordinated actions of consumers and firms can (endogenously) reinforce each other, fostering a virtuous cycle toward lower carbon emissions. We assume that a household’s preferences are influenced by its peers and by evolving individual attitudes. Moreover, since green consumption preferences represent just one side of the spectrum, we allow households to develop anti-environmental consumption preferences. Thus, we consider the possibility of lock-in effects that may emerge during this process and avoid the transition to a low-carbon economy. Lastly, we complete our analysis by examining the potential interaction of such behavior with standard climate policy tools, such as carbon taxation.

We find that consumers can prompt large-scale abatement investments, leading to a massive reduction in the emission intensity of firms even without public intervention guiding the effort with climate policy. By redirecting resources towards environment-friendly firms they reward green investments. The environmental benefits are greater when households are more reactive, changing their preferences frequently or quickly.

Nevertheless, while this process can complement carbon taxation in the short term, it becomes conflicting once emissions achieve the target level. At that point, consumers start suffering a loss of income due to carbon taxation without benefiting from a supplementary reduction in emissions, thus making their preferences less green (Bosetti et al., 2025).

Indeed, the distributional consequences of climate policies are proving to be a major obstacle (the so called “green backlash’”) to public support for mitigation, with relevant implications on a political level (Egli et al., 2022; Voeten, 2025). However, parallel compensation schemes may prevent households from moving towards anti-environmental preferences or factions (Colantone et al., 2024). Therefore, managing such a variation in households’ attitudes while keeping a (relatively) high carbon tax rate may become politically unfeasible, thus constraining policy-makers decisions and possibly reverting their past choices.

These dynamics disappear when an imitative (i.e., a social) component is introduced in the model. Indeed, accounting for peers’ preferences reduces the perceived reduction of firms’ emissions intensities by consumers, and only coordinated and economy-wide changes would generate sufficient stimuli for households to modify their behavior. According to our sensitivity analysis, this happens even when imitation has a significantly lower weight in preference formation compared to the internal component, and the size of a household’s neighborhood seems to have a limited impact on this effect.

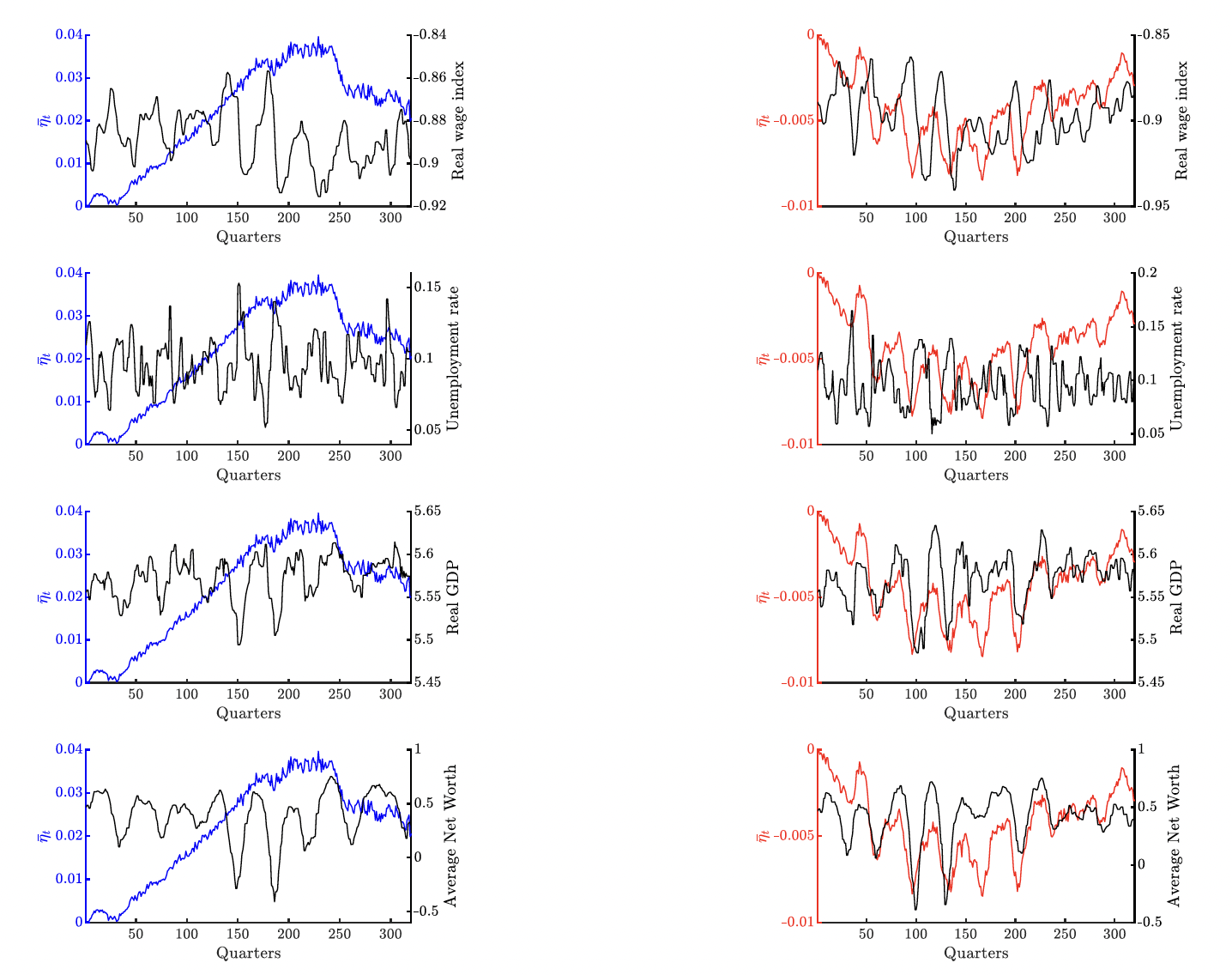

Figure 1 shows how green preferences behave over time along with the main macro-series (i.e., the unemployment rate, average net worth, real GDP, wage index growth rates). Without peer imitation (left side panels, blue line), the dynamics of green preferences are disconnected from the main macro-series, at least until carbon abatement objectives are reached in the long term. In this case green preferences are more dependent on observed abatement progress. However, when peer effects are active (right side panels, red line), green preferences mirror the macro-series, implying the dominance of income effects on green consumption choices.

Figure 1. Plots of macro-variables and average green preferences for a randomly sampled simulation.

The GP scenario (personal green preferences) is shown on the left, in blue, while the SN scenario (introduction of social dynamics) is on the right, in red. The first quarter corresponds to 2020Q1.

Concerning the interaction of green preferences with climate policy, internal green preferences make the government’s task easier and faster in the short term by reducing the need for carbon taxation. Then again, these advantages vanish once social dynamics are included. Thus, the government may be able to exploit green consumers to attain its emission reduction objectives. However, encouraging firms to jump-start abatement investments is necessary to allow consumers to find the green path. Some form of short-term financial assistance (such as subsidies or guarantees) to private investments in carbon capture and storage or strengthening the emission permits trading system are just a few options for the government to provide the momentum needed.

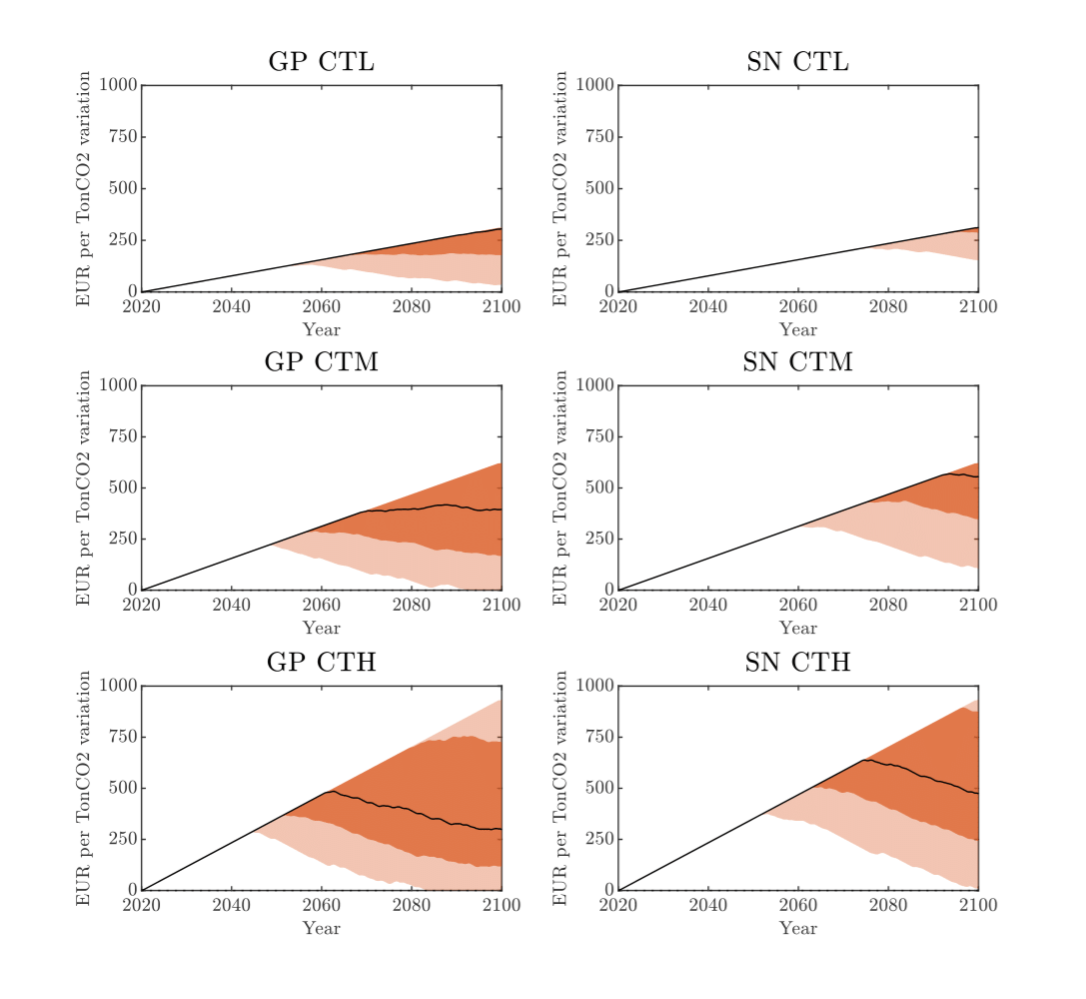

Figure 2 highlights the difference in carbon tax level between the cases without (left panels) and with peer effects (right panels). When peer imitation is active, the median carbon tax rate fixed by the government to achieve its environmental goals is consistently higher than in the case where it is inactive, especially when the carbon tax is more reactive (i.e., sharper adjustments in the carbon tax rate – middle and bottom panels).

Figure 2. Sensitivity analysis for increasing carbon tax adjustment speed (low to high going down the figure).

Adjustment speed is lowest for the top figures and highest for the bottom figures. The figures on the left show the results for personal green preferences, while the figures on the right include the social component.

To summarize, our results support the capability of pro-environmental preferences to facilitate the green transition. However, when firms display a limited initial commitment to abate, the diffusion process can be slowed down or even reversed if consumers give importance (no matter how little) to the green preferences exhibited by their peers. The positive signals from a few virtuous firms can drown among the contrasting opinions of one’s network. Thus, we highlight the importance of massive, coordinated abatement efforts in the short term if policymakers intend to exploit pro-environmental preferences to their advantage. Slow and uncertain signals to consumers may be counterproductive.