CEEPR Working Paper

2024-012, August 2024

Katrin Sievert, Alexandru Stefan Stefanescu, Pauline Oeuvray, and Bjarne Steffen

According to decarbonization pathways, carbon capture and storage (CCS) forms a core part of the mitigation technology portfolio for energy-intensive process industries. One region with high policy attention on CCS as part of the decarbonization portfolio is Europe. After a long period of hibernation since the early 2000s, CCS deployment is gaining momentum, targeting the very sectors where emissions are difficult or expensive to abate. To incentivize CCS investments, commercial-scale CO2 transport infrastructure is needed to connect European industrial CO2 emitters and potential underground storage sites. Developing such infrastructure involves resolving several techno-economic issues that have been addressed in previous literature, such as identifying which CO2 transport modes are feasible, designing optimal transport routes, and estimating transport costs (Oeuvray et al., 2024). The question of how to finance the upfront investment cost, however, is typically out-of-scope. Yet it matters: Developing a transnational CO2 transport network in Europe will require substantial initial investments. Despite its importance, the issue of how to finance CO2 transport infrastructure is hardly addressed in the literature. However, the financing structure of transport assets is an important determinant of transport cost: Financing conditions are critical for capital-intensive assets, where large parts of the life-cycle costs are incurred upfront and need to be financed.

To fill this gap, we assess the impact of financing structures on the total cost of CO2 transport. Given the absence of empirical data on CO2 transport financing, we review the literature on economic ownership to identify the economic rationales that influence the choice of financing structures and to assess the impact of financing structures on the cost of capital and on operational efficiency. Several financing sources are available to provide capital for CO2 transport assets: public finance, private finance, and regulatory asset base (RAB) finance. In terms of financing models, new projects can be financed through corporate finance structures (i.e., “on balance sheet”) or project finance structures (i.e., “off-balance sheet,” in a new legal entity) (Steffen, 2018).

To apply the insights from the broader economic literature on infrastructure financing to the case of CO2 transport, we first assess which financing structures are most suitable for the financing of assets required for each CO2 transport mode by referring to analogous industries with similar asset types and risk profiles. We then estimate the financing structure- and transport mode-specific financing cost, namely, the cost of capital, and calculate the levelized cost of transport, accounting for operational efficiency differences related to the different financing structures.

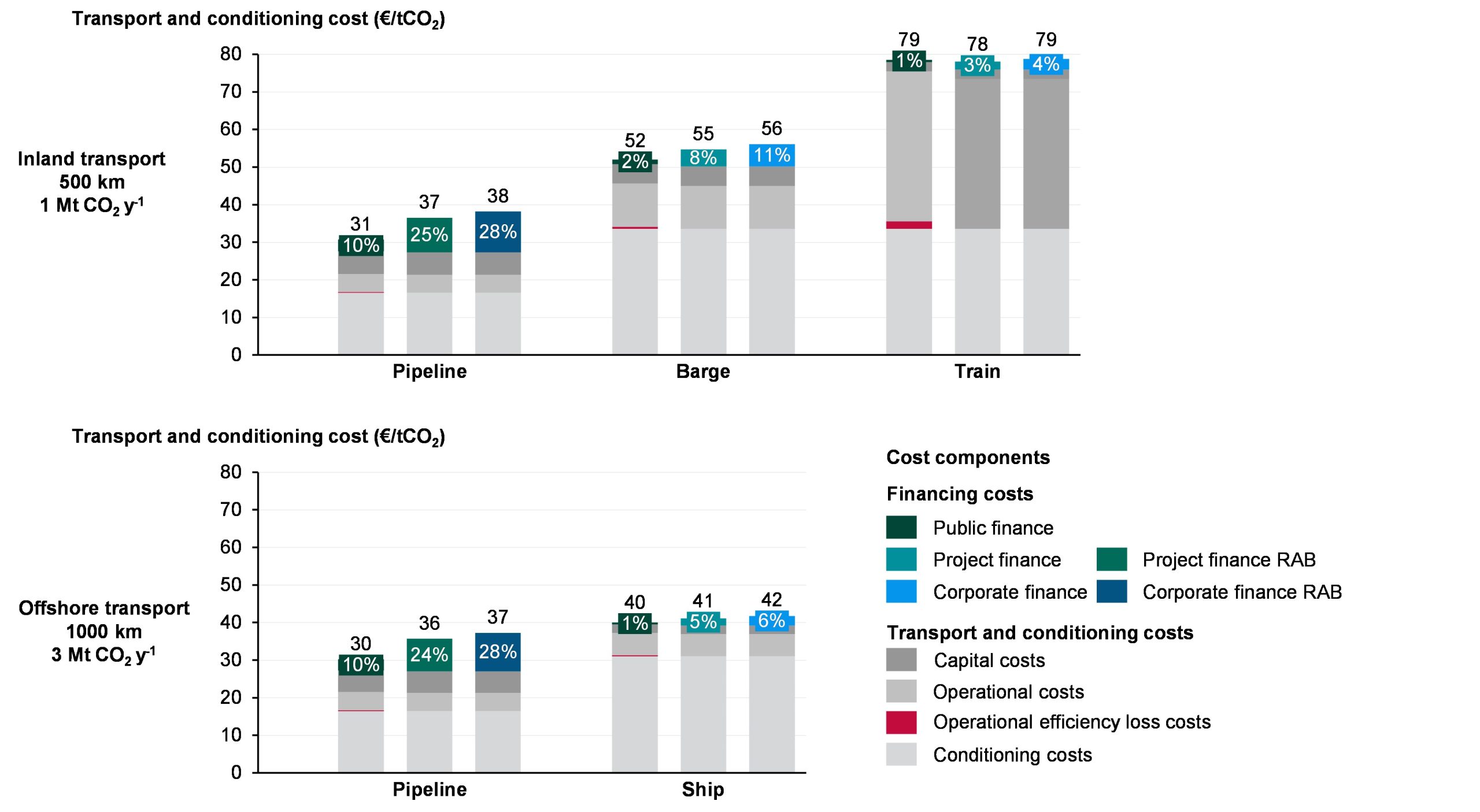

We find that the impact of financing structures on the cost of capital and, thus, the cost of CO2 transport, varies notably by transport mode but also by financing structure. Overall, our results show that onshore and offshore pipelines are the lowest-cost transport modes regardless of the financing structure, as illustrated in Figure 1. Pipelines, which require high upfront capital investments, are highly sensitive to the financing structure chosen. With a cost of capital of 8.5% or above, financing costs could account for more than half the total transport costs for onshore pipelines. In contrast, for the other CO2 transport modes, including barges, trains and ships, we find a relatively small impact of different financing structures.

Our findings are relevant for policymakers, as the cost of financing is an important factor in the choice of a financing structure for CO2 transport infrastructure. Generally, our results suggest that in the context studied, public finance appears to be the most cost-effective financing structure for CO2 transport infrastructure, if the government cost of capital sets the discount rate, because the benefits of a lower cost of capital under public finance, compared to RAB and private finance, outweigh the operational efficiency losses associated with it. However, the results are contingent upon our assumptions, and, specifically, the understanding of efficiency differences both between public and private financing structures and among various types of public delivery remains limited.

Given the need to develop CO2 transport infrastructure to meet CCS policy targets in Europe, we hope that studying the impact of financing structures on cost will expand policymakers’ attention beyond the question of the total investment required toward the issue of how the financing should be structured. The analysis can inform policymakers aiming to design regulations that attract both public and private investment in CO2 transport infrastructure, CO2 emitters evaluating their CO2 transport options, and project financiers and financial intermediaries considering becoming involved in CO2 transport finance.

Figure 1. Levelized cost assessment of CO2 transport and conditioning in €2022/tCO2 under different financing structures.